[Asia Economy Reporter Changhwan Lee] As the conflict between the United States and China, reignited after the outbreak of the novel coronavirus disease (COVID-19), is expected to prolong beyond the U.S. presidential election, the need to seek countermeasures to minimize the impact on the Korean economy has been raised.

The Federation of Korean Industries (FKI) announced on the 16th that it held an expert roundtable titled "Reignition of the U.S.-China Trade War and Response Strategies for Korean Companies" at the FKI Conference Center in Yeouido, Seoul.

At the roundtable, the impact of the deepening U.S.-China hegemonic conflict on the Korean economy was analyzed, and response strategies for Korean companies were explored.

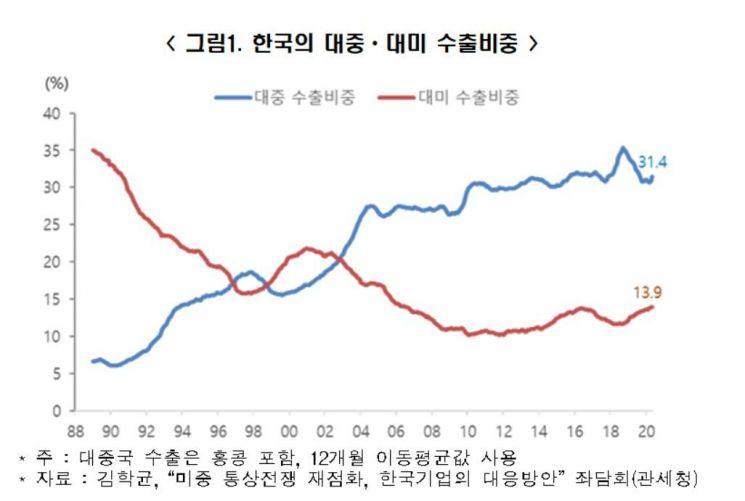

Experts predicted that the U.S.-China trade dispute will not end within a few years regardless of the U.S. presidential election results and is expected to intensify most in the third quarter ahead of the election. In this situation, the Korean economy, which is highly dependent on exports to both countries, faces both risks and opportunities, but with the added impact of COVID-19, the economic damage is expected to increase significantly.

Kwon Tae-shin, Vice Chairman of the FKI, explained, "Last year, Korean exports decreased by 10.3% compared to the previous year, marking the largest decline since the financial crisis. In particular, exports to China fell by 16% year-on-year due to the U.S.-China trade dispute."

Vice Chairman Kwon diagnosed, "In addition, with COVID-19 prompting countries worldwide to protect their domestic industries and reorganize global supply chains, signaling a widespread rise in protectionism, and the renewed U.S.-China conflict amid debates over responsibility for the pandemic, the Korean economy is facing a difficult situation."

Kim Hak-kyun, Head of the Research Center at Shin Young Securities, stated in his keynote presentation, "As the implementation of the first phase of the U.S.-China trade agreement from January is not progressing smoothly, the U.S.-China conflict is expected to be prolonged," and analyzed, "Along with the U.S.-China conflict, reshoring, which has been strengthened since the outbreak of COVID-19, is creating an unfavorable environment for Korea, which was a model country in the era of globalization."

He emphasized that Korean companies must find opportunities amid the U.S.-China conflict and forecasted, "Some industries may benefit from the restructuring of the global competitive landscape."

Lee Joo-wan, Research Fellow at the POSCO Research Institute and a panelist at the event, commented on the impact of the U.S.-China conflict on the semiconductor industry, saying, "The revocation of Hong Kong's special status is not expected to significantly affect semiconductor exports, but sanctions against Huawei are likely to have visible impacts."

Research Fellow Lee argued, "If Huawei requests Korean companies to produce semiconductors instead of Taiwan's TSMC, which has aligned with the U.S., actively responding could be burdensome considering relations with the U.S. Moreover, if reckless expansion of transactions leads to memory chips also becoming subject to sanctions, it could result in a case of losing more than gaining."

Jo Yong-jun, Head of the Research Center at Hana Financial Investment, stated, "The second round of the U.S.-China dispute is a war for IT technological supremacy, presenting both opportunities and threats to Korean industries and companies."

He analyzed, "As an opportunity, Korean companies may directly benefit by supplying Korean IT equipment and materials to China and building semiconductor factories in the U.S. On the other hand, as a threat, if companies become closely tied to either the U.S. or China, they may face political pressure from the rival country."

In the subsequent panel discussion, Jeon Byung-seo, Director of the China Economy and Finance Research Institute, described the U.S.-China conflict as "essentially about money and power not being shared," and diagnosed, "The direction of U.S.-China relations will likely be determined by Trump's approval ratings and China's stance, but there is a risk of further intensification in the third quarter, so caution is necessary." He also emphasized, "From Korea's perspective, it is time to pursue de-Chinaization in traditional manufacturing and accelerate entry into China in consumer goods and services."

Center Head Kim Hak-kyun pointed out Korea's difficult balancing act between the U.S. and China, citing the sharp decline in Korean cosmetics and entertainment stocks after China's THAAD-related boycott, while emphasizing that Korea's memory semiconductors could become the global leader thanks to the collapse of Japanese semiconductor companies following the 1986 U.S.-Japan semiconductor agreement.

He forecasted, "As competition between Korean and Chinese companies intensifies in the global market, if unfair practices such as subsidies to Chinese companies are eliminated, Korean companies in semiconductors and shipbuilding will benefit."

Chaired by former Geneva Representative Choi Seok-young, the panel concluded that "The confrontation between the U.S. and China is expanding beyond economic, trade, and technology fields into strategic and hegemonic competition, maximizing uncertainty in the global economic order and continuing as a long-term internal conflict." He stressed, "Korea, which must stake its trade fate between its ally the U.S. and economically dependent China, must respond with highly strategic measures based on the fundamental principles of liberal democracy and market economy."

To this end, he added, "The government and companies should promote diversification of trade markets to disperse risks and comprehensively review trade and investment strategies considering reshoring and local production methods."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.