As the novel coronavirus disease (COVID-19) has grounded travelers, passenger airplanes have become almost useless. Naturally, the workload for global aircraft manufacturers has sharply declined. This sense of crisis has extended to domestic aircraft parts companies. Although the defense industry serves as a pillar, it is obvious that prolonged circumstances will bring significant difficulties. How long can domestic parts companies endure with their current strength? We examined the management status of aircraft parts manufacturers such as Korea Aerospace Industries (KAI) and Astr.

[Asia Economy Reporter Yoo Hyun-seok] The growth of Astr, a company specializing in aircraft parts manufacturing, has come to a halt. Due to COVID-19, factories of complete aircraft manufacturers like Boeing have stopped, causing a slump in performance. However, Astr holds an order backlog worth 3.6 trillion KRW and expects performance to improve again once the aviation industry normalizes.

Astr was established in 2001. Initially, it mainly manufactured 'stringers,' structural components of aircraft. Starting with large cargo doors on the central fuselage section of large aircraft, it has recently expanded beyond parts manufacturing to produce Section 48, an aircraft fuselage assembly. Its main customers are major global complete aircraft manufacturers such as Boeing, Stais (STAIS), and Spirit (SPIRIT). Over 90% of its sales come from exports.

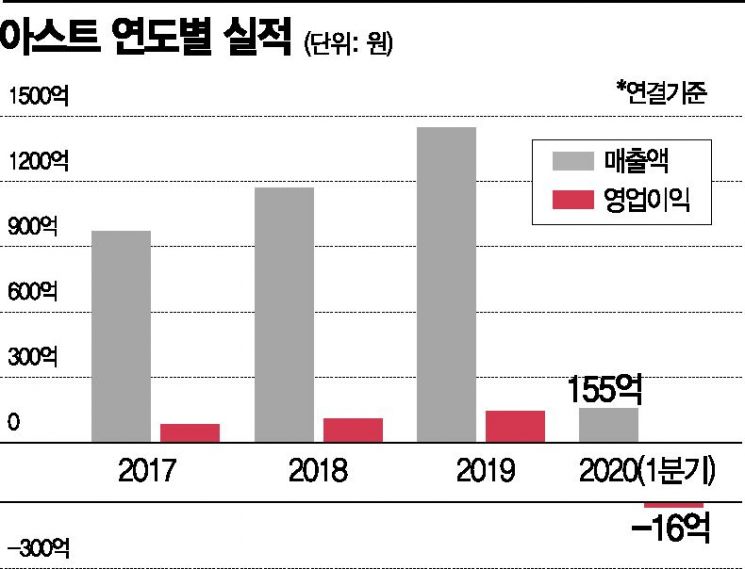

Since its listing on KOSDAQ in 2014, Astr has steadily grown. In 2015, Astr recorded consolidated sales of 80.8 billion KRW and operating profit of 3.3 billion KRW. By 2017, sales and operating profit increased to 97.2 billion KRW and 8.1 billion KRW, respectively. Notably, last year, it achieved sales of 144.6 billion KRW and operating profit of 14.3 billion KRW.

However, performance began to decline from the first quarter. This was due to Boeing and Airbus halting factory operations amid COVID-19. In the first quarter of this year, Astr posted sales of 15.4 billion KRW and an operating loss of 1.7 billion KRW. Sales dropped to less than half compared to the same period last year, and operating profit turned negative. An Astr official said, "Major overseas clients closed factories due to COVID-19 cases and social distancing measures, reducing production volume. This negatively impacted Astr’s sales of aircraft parts and fuselage manufacturing and delivery."

The financial situation also worsened. The debt ratio decreased from 227.7% in 2018 to 165.4% last year but rose again to 168.9% in the first quarter. The reliance on short-term borrowings increased from 19.2% in the first quarter of last year to 20.4%. Retained earnings of 2.8 billion KRW in the first quarter of last year turned into an 800 million KRW deficit. A company representative explained, "Debt increased due to facility investments related to the expansion of production facilities and acquisition of business rights following increased orders for Boeing’s 737 Max model and new orders for Brazil’s Embraer E jet2."

However, the order backlog Astr has received so far is ample. As of the first quarter, Astr’s order backlog totaled 3.6 trillion KRW, including 2.0815 trillion KRW from Embraer and 962 billion KRW from Spirit. The order backlog was 2.9 trillion KRW in the first quarter of last year. In April, its subsidiary ASTG signed an aircraft parts supply contract worth approximately 149.4 billion KRW, showing steady order intake. Especially since the parts they mainly produce are entering the phase where sales begin in earnest, the company believes there is no long-term problem.

A company official said, "Due to the nature of the aircraft parts industry, a single model generates sales for decades. Although production volume decreased somewhat due to the grounding of Boeing’s 737 Max following two accidents in 2018 and 2019, the increased production of the E jet 2, which will be in full production this year, will drive sales."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.