FKI's 10-Year Market Analysis

Leader US Maintains 45% Market Share

Massive Support from Chinese Government

Aggressive Overseas M&A Impact

Chasing by Expanding from 2% to 5%

[Asia Economy Reporter Dongwoo Lee] Last year, South Korea's share of the global semiconductor market decreased for the first time in 10 years. Meanwhile, as the power struggle between the U.S. and China intensified in the global semiconductor market, Chinese companies, backed by massive government support, significantly increased their market share, and leading U.S. semiconductor companies also received substantial support, widening the gap with South Korea.

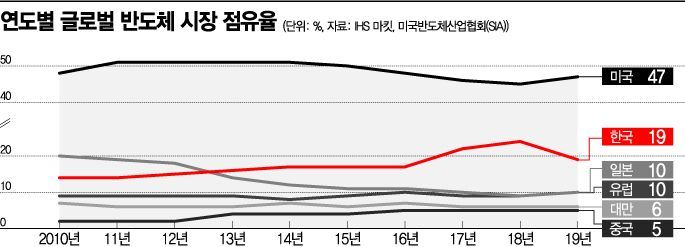

The Federation of Korean Industries (FKI) announced on the 15th that an analysis of global semiconductor market indicators over the past decade (2010?2019) from IHS Markit, the Semiconductor Industry Association (SIA), and others showed that South Korea's market share in the global semiconductor market steadily increased from 14% in 2010 to 24% in 2018 but fell to 19% last year. This marks the first decline in South Korea's semiconductor market share in the past 10 years. In contrast, during the same period, the U.S. consistently maintained a market share above 45%, and China's share, which was less than 2% in 2010, rose to 5% last year.

The number of accepted papers published annually by the International Solid-State Circuits Conference (ISSCC) in the semiconductor field showed a similar trend. While the U.S. maintained overwhelming dominance, the number of papers from China surged more than fivefold from 4 in 2011 to 23 this year. As China rapidly accumulated research achievements, the gap between South Korea and China narrowed, with the technology gap in the system semiconductor field being only 0.6 years as of 2017. However, the technology gap in the system sector between South Korea and the U.S. remained stagnant at 1.9 years in 2013 and 1.8 years in 2017.

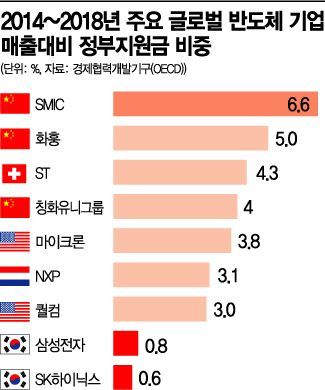

The FKI analyzed that China's rapid rise in the global semiconductor market is the result of massive central government support, including the 'Semiconductor Rise' plan. According to data received from the Organisation for Economic Co-operation and Development (OECD), among the top five global semiconductor companies with the highest ratio of government support to sales from 2014 to 2018, three were Chinese companies. The proportion of government support relative to sales received from the Chinese government was 6.6% for SMIC, 5% for Hua Hong, and 4% for Tsinghua Unigroup. In Europe, companies such as Switzerland's ST and the Netherlands' NXP had high proportions of government support.

The U.S., leading the global market, also provides various supports to semiconductor companies. The ratio of government support to sales for U.S. semiconductor companies was 3.8% for Micron, 3.0% for Qualcomm, and 2.2% for Intel. In contrast, the proportion of government support in the sales of domestic semiconductor companies such as Samsung Electronics and SK Hynix was only 0.8% and 0.6%, respectively.

Chinese semiconductor companies, empowered by government support, have aggressively pursued overseas mergers and acquisitions (M&A) since 2015, entering the global market in a short period. According to the OECD, China increased its cumulative number of acquired companies from 4 in 2014 to 29 between 2015 and 2018. This contributed to the total transaction value of the global semiconductor M&A market soaring from $10 billion (12 trillion KRW) in 2012?2014 to $59.6 billion (72 trillion KRW) in 2016.

The OECD pointed out that the active M&A by Chinese companies was largely due to the contribution of China's 'National Integrated Circuit Industry Investment Fund' established in 2014. In fact, when China's packaging and testing (OSAT) company JCET Group acquired Singapore's STATS-ChipPAC in 2015, the fund played a certain role. After the acquisition, JCET grew into one of the world's top three OSAT companies.

The U.S. is preparing legislation (Endless Frontier Act) to expand spending on advanced industries, including semiconductor research, by more than $100 billion (120 trillion KRW), following efforts to attract the Taiwan semiconductor company TSMC's factory.

Kim Bong-man, head of international cooperation at the FKI, said, "So far, semiconductors, our top export product, have largely succeeded on their own in establishing a global presence," adding, "To maintain our position in the global market, our government also needs to prepare policy support such as R&D and tax incentives."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.