Terrestrial Broadcasters' 'Monopoly' Broken... Decline After 25 Years

Big 5 Choose 'Acquisition' by Telecoms to Survive

Complacent with 'No.1 Paid Broadcasting' Status, No Change Sought

IPTV Growth Stagnates Amid Netflix OTT Onslaught

Expanding Market Only Through 'Bundled' Price Competitiveness

Must Build Competitiveness to Avoid Becoming 'Second Cable TV'

[Asia Economy Reporters Kim Heung-soon, Goo Chae-eun] "A wider world, a brighter future, 30 channels, clear picture, 24-hour broadcasting."

The promotional slogan for the official launch of cable TV broadcasting on March 1, 1995, was spectacular. After about two months of test broadcasts involving 21 program providers (PP) and 39 comprehensive wired broadcasting operators (SO), it boldly announced the birth of new media that would change the existing broadcasting landscape centered on terrestrial broadcasting. At the time, President Kim Young-sam congratulated, "With the launch of comprehensive wired broadcasting, our country has entered the full-fledged multi-channel era, and as a result, the public will be able to enjoy a higher level of cultural life."

Now, 25 years later, the cable TV industry is effectively on the decline. This is because it has lost its place to 21st-century new media such as IPTV and online video services (OTT). The industry leader HelloVision and second-ranked T-broad were sold to LG Uplus and SK Telecom respectively, and recently, the fourth-ranked company CMB has entered mergers and acquisitions (M&A) on the premise of sale. As of the 12th, the top five cable TV operators, which accounted for 88% of the market, are either sold to mobile carriers or up for sale, seeking survival.

Cable TV that opened the multi-channel era... Why has it declined after 25 years?

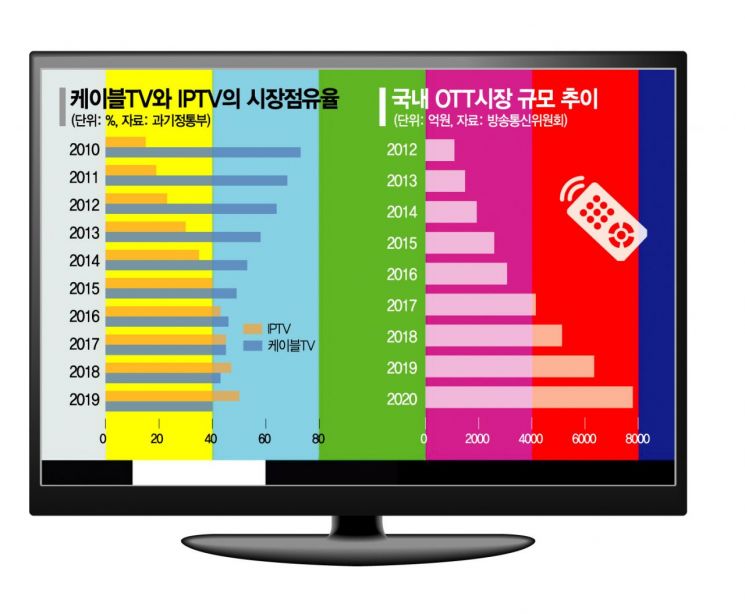

The biggest reason cable TV lost market share to IPTV is price competitiveness. While IPTV offered bundled products combining set-top boxes, wired internet, and IPTV services, cable TV had no strategy in place. Professor Choi Sung-jin of Seoul National University of Science and Technology pointed out, "Unlike IPTV, which bundles multiple products at low prices, cable TV has no bundled services, so it could not win the price war against IPTV." Because of this, cable TV peaked at 15.14 million subscribers in 2009 after IPTV launched at the end of 2008, then declined. Subscribers rapidly decreased as cable TV was outcompeted by IPTV in service, content, and product competitiveness. In 2018, IPTV subscribers (47%, 14.33 million) surpassed cable TV subscribers (43%, 14.04 million), a market share reversal known as the 'Golden Cross,' marking the beginning of a shift in dominance.

Although there were constant warnings that the market could be encroached upon after IPTV was introduced, cable TV's complacency without significant response is also considered a fatal mistake. An Jung-sang, senior expert at the Democratic Party, said, "There were voices advocating for strengthening cable TV's self-sustainability like HBO in the U.S. and enhancing price competitiveness through bundling with MVNOs, but in the mid-2000s, cable TV operators, who ranked first or second in pay TV, were complacent and did not seek new paths." Dividing the country into 78 regions where cable TV operators held monopolies turned out to be a 'poison.' There is also analysis that the cable TV industry itself fulfilled its role according to the times. A content industry official noted, "The cable TV infrastructure formed around regions has limitations in keeping up with the hyper-connected era where the internet instantly connects to the other side of the globe."

Netflix-driven overseas OTT 'capital power' offensive... IPTV also faces fears of becoming 'the second cable TV'

The problem is that IPTV, which defeated cable TV, is also facing challenges. This is due to the offensive by OTTs such as Netflix and Disney Plus. OTTs offer a wide variety of domestic and international video content accessible on multiple devices for a monthly subscription fee of around 10,000 KRW, providing high price competitiveness and convenience. They also attract customers by expanding the proportion of exclusive content. Although domestic OTTs holding IPTV channels like Wavve (SK Telecom) and Seezn (KT) have emerged, they are insufficient in terms of original content investment. This is why there is concern that IPTV will be eliminated from the market like 'the second cable TV' without content competitiveness.

An Jung-sang, senior expert, diagnosed, "OTT, with strong capital and original content production capabilities, is expanding its influence, while IPTV's subscriber growth is stagnating. IPTV must have a sense of crisis and seek content investment or differentiation." A media industry official said, "Platforms have a 'winner-takes-all' structure, so to surpass strong competitors, they must deliver more than twice the customer value," adding, "Differentiation in price or content is necessary to avoid facing extinction." Professor Choi Sung-jin said, "For now, a complementary relationship between fixed TV (IPTV) and mobile TV (OTT) will be maintained for a long time, but IPTV must also develop competitiveness to counter OTT through its own content production capabilities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.