Thai Corporation Records Three Consecutive Years of Profit... Strengthening Competitiveness of Sales Organization

Chinese Joint Venture's Premium Income Exceeds 1.5 Trillion Won

[Asia Economy Reporter Oh Hyung-gil] Samsung Life Insurance, which entered the Southeast Asian insurance market over 20 years ago but failed to achieve significant results, is now expanding its local business operations.

The joint venture operating in China has also surpassed 1.5 trillion KRW in premium income, showing steady progress. Compared to its outstanding domestic sales performance, the overseas business, once considered a "sore spot," is gradually entering a growth trajectory.

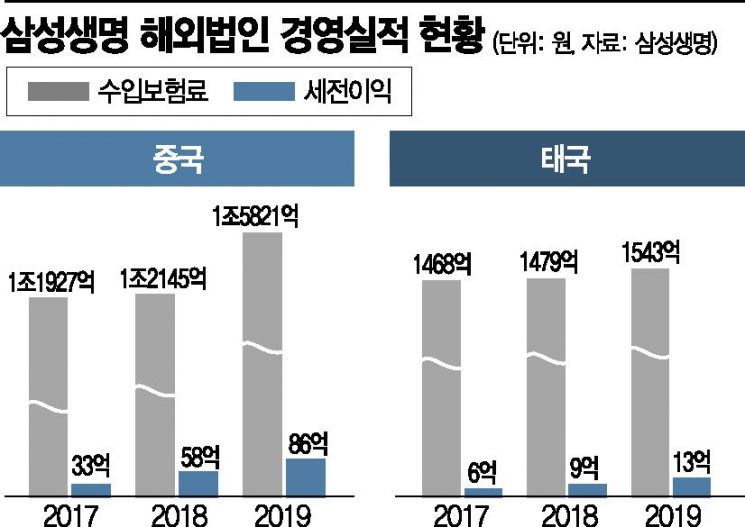

According to the insurance industry on the 10th, Samsung Life Insurance's subsidiaries in China and Thailand collected 1.7364 trillion KRW in premium income from local customers last year. This represents a 27.4% increase from 1.3624 trillion KRW in the same period the previous year. The Chinese subsidiary recorded 1.5821 trillion KRW, and the Thai subsidiary 154.3 billion KRW.

Pre-tax profits were 8.6 billion KRW for the Chinese subsidiary and 1.3 billion KRW for the Thai subsidiary, marking growth of 48.2% and 44.4%, respectively, compared to the same period last year.

Thai Samsung Life Insurance, established in Bangkok in 1997, succeeded in turning a profit in 2017. Since then, it has maintained a profit trend for three consecutive years. The Thai insurance market has been growing, with an average annual premium income increase of 4% over the past five years. There are 22 life insurance companies operating, of which 12 are foreign. Foreign companies hold a market share of 71%.

Thai Samsung has secured about 7,800 agents and operates three branches in Bangkok, with one branch each in the eastern, southern, northern, and northeastern regions. There are 114 sales offices throughout Thailand. The company is focusing on strengthening the competitiveness of its sales organization through agent training using five development centers.

In particular, Thai Samsung is expanding its sales network through partnerships with major banks and bancassurance (selling insurance through bank counters) channels and plans to pursue mergers and acquisitions (M&A) of small and medium-sized companies in the mid-to-long term.

Last year, through a strategic investment fund (CVC) aimed at venture and new industry investments, it also invested in 'Rabbit Finance,' Thailand's number one financial product sales platform. Rabbit Finance is a fintech company that intermediates financial products and insurance online. Samsung Life plans to use Thai Samsung's product sales platform and partnership channels.

It is also making swift moves in the Chinese market. The Chinese subsidiary, Zhongyin Samsung Life Insurance, established in 2005 with China Airlines, has continued its growth since the Bank of China became a new shareholder in 2015. As of the end of last year, total assets amounted to 3.7369 trillion KRW, with Samsung Life holding a 25% stake.

Recently, it has been focusing on securing profitability by expanding the sales proportion of high-yield products such as long-term pensions and protection products. It is also investing in healthcare service companies in China using CVC. Zhongyin Samsung aims to become a mid-sized life insurer based on the Bank of China's bancassurance channel.

Beijing Samsung Dental, a joint venture established with Samsung C&T Corporation in China, is currently constructing a building in Beijing's central business district. After completion, it plans to engage in office leasing business.

A Samsung Life Insurance official said, "Results are gradually appearing in overseas subsidiaries," adding, "We plan to expand our business focusing on Southeast Asia, which has high growth potential, in addition to China and Thailand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)