Sold a total of 14 trillion won this month

Profit-taking as recovery surpasses pre-COVID levels

Sell orders swept by institutions and foreigners

Also buying other stocks like Hyundai Motor

Betting on index rise with 'leverage'

Individuals invest in index decline 'inverse'

Untact stocks Naver and Kakao

Buying steadily despite high price concerns

[Asia Economy Reporter Minji Lee] The investment landscape of the so-called 'Donghak Ants,' who have a huge influence on the domestic stock market, is changing. Since the COVID-19 pandemic, they have been concentrating on buying Samsung Electronics and SK Hynix, but now they are handing these stocks over to institutions and foreigners, betting on index declines, or switching to non-face-to-face (untact) related stocks.

According to the Korea Exchange on the 9th, the stocks most sold by individual investors up to the previous day this month were Samsung Electronics and SK Hynix, the top two stocks by market capitalization in Korea. Individual investors sold stocks worth 960 billion KRW and 444.6 billion KRW respectively during this period, putting a total of 1.4 trillion KRW worth of shares on the market.

The large-scale selling of these stocks by individuals is interpreted as profit-taking as stock prices have recovered to pre-COVID-19 levels. Since January 20, when the first COVID-19 case was confirmed in Korea, individuals have purchased a total of 7.6899 trillion KRW worth of Samsung Electronics shares, with an average purchase price of about 51,000 KRW during this period. Currently, Samsung Electronics has steadily risen (29%) to near 55,000 KRW after falling to 42,500 KRW based on the closing price in March. SK Hynix also dropped to 69,000 KRW on the same day but has now risen about 32% to 91,000 KRW.

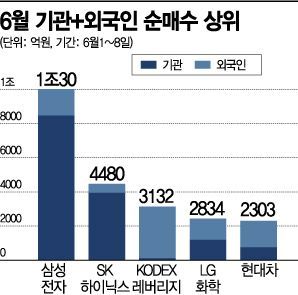

The selling volume from individuals was fully absorbed by institutions and foreigners. This month, Samsung Electronics and SK Hynix were the stocks most purchased by institutions and foreigners. Institutions and foreigners bought Samsung Electronics shares worth 848 billion KRW and 155 billion KRW respectively, totaling 1.03 trillion KRW. SK Hynix was purchased for 395 billion KRW and 53 billion KRW respectively. Over the past month, institutions and foreigners bought secondary battery and biosimilar-related stocks such as Samsung Biologics (162.4 billion KRW), Samsung Electro-Mechanics (128.9 billion KRW), Celltrion Pharm (106 billion KRW), Hyundai Mobis (73.5 billion KRW), and LG Innotek (63 billion KRW), but this month they have focused on semiconductor stocks, the leaders of the domestic stock market.

Institutions and foreigners also bought all other stocks sold by individuals. This month, individuals sold KODEX Leverage, which tracks twice the daily return of the KOSPI 200 index, worth 318.9 billion KRW, as well as LG Chem (250 billion KRW), Hyundai Motor (217 billion KRW), and Celltrion (190 billion KRW). Conversely, institutions and foreigners added LG Chem (283.4 billion KRW), Hyundai Motor (230.3 billion KRW), and Celltrion (210.3 billion KRW) to their portfolios. They also purchased KODEX Leverage worth 313.2 billion KRW, betting on further index gains.

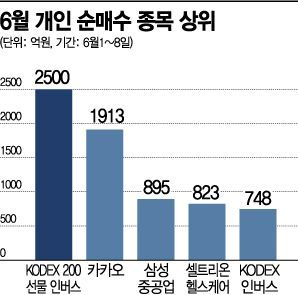

On the other hand, individuals chose to bet on index declines rather than rises. Since June, individuals have bought KODEX 200 Futures Inverse, which inversely tracks the daily return of the KOSPI 200 futures index, worth 250 billion KRW, and also ordered 74.8 billion KRW worth of KODEX Inverse. They have also increased interest in untact-related stocks, which have emerged as essential services since COVID-19. Yoon Young-gyo, a researcher at Cape Investment & Securities, said, "Untact stocks have established themselves as market-leading sectors during the rapid declines and surges of the stock index," adding, "The combined market capitalization of Korea's untact leaders Naver, Kakao, and NCSoft has increased by nearly 40% since the beginning of the year."

Despite concerns that untact leaders Kakao and Naver have reached their peaks by hitting 52-week highs, individuals bought Kakao and Naver stocks worth 191.3 billion KRW and 23.7 billion KRW respectively. They also purchased untact-related stocks such as Douzone Bizon (34 billion KRW) and E-Mart (31.1 billion KRW).

Han Dae-hoon, a researcher at SK Securities, diagnosed, "Due to the long-term low interest rate environment and the increase of smart ants, the proportion of individuals in trading volume in the domestic stock market has exceeded 60%. Individuals are increasing their returns by approaching blue-chip and leading stocks rather than oversold stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.