International Oil Prices Rise... Goldman Sachs "June Unemployment Rate Will Fall Further"

China and European Economic Recovery Still Weak, U-Shaped Caution Prevails

Concerns Over COVID-19 Resurgence Raise Double-Dip Worries... W-Shaped Recession Concerns

[Asia Economy New York=Correspondents Baek Jong-min and Lee Hyun-woo] Attention is focused on whether the surprise rebound in U.S. employment indicators will lead to a global economic recovery. The debate among macroeconomists since the COVID-19 outbreak over whether the recovery will be a V-shaped (sharp rebound) or U-shaped (slow recovery) is resurfacing. In the U.S., optimism supporting a V-shaped recovery is growing, while cautious voices advocating a U-shaped recovery argue that the recovery in Europe and China, excluding the U.S., remains weak. Some even warn that a W-shaped double-dip recession remains a possibility due to the resurgence of COVID-19.

According to CNBC on the 7th (local time), Jan Hatzius, Chief Economist at Goldman Sachs, stated, "We see that the labor market recovery has begun, and we expect the unemployment rate to fall further in June." Ryan Detrick, Senior Market Strategist at LPL Financial, also emphasized the V-shaped rebound, saying, "Jobs have shown a strong recovery in just two months, making it difficult to call this a recession based on only two months of data." Earlier, the U.S. Department of Labor announced that nonfarm payroll employment increased by 2.5 million last month, and the unemployment rate fell to 13.3% from 14.7% the previous month.

The price of West Texas Intermediate (WTI) crude oil also strengthened optimism by recovering above $40 for the first time in three months. On that day, the July WTI contract traded at $40.37 in the over-the-counter market, surpassing the $40 mark for the first time since March 5.

However, criticism that the optimism is premature remains strong. The rebound last month may be temporary, largely driven by government fiscal support, so caution is advised. Rishina Guha, Global Policy and Central Bank Strategist at Evercore ISI, a U.S. investment advisory firm, explained, "Current employment figures are based on government wage subsidies. If this support is cut off within a few months due to fiscal deterioration, employment indicators risk plummeting again."

The U.S. Federal Reserve (Fed) is also expected not to assume economic recovery based solely on employment improvements at the upcoming Federal Open Market Committee (FOMC) meeting on the 9th. Earlier, Fed Chair Jerome Powell had indicated that due to the severe recession caused by COVID-19, near-zero interest rates would be maintained for an extended period. According to MarketWatch, most Wall Street experts do not expect any changes in monetary policy at this FOMC. Sal Guatieri, Senior Economist at BMO Capital Markets, stated, "The May employment data does not mean the economy has emerged from the (recession) forest."

Instead, more proactive recovery measures such as yield caps may be introduced. A yield cap is a policy where if a specific bond yield rises above a predetermined ceiling, the Fed buys unlimited amounts to keep it below that level. The Wall Street Journal (WSJ) predicted that discussions on yield caps will expand at this FOMC. According to the April FOMC minutes, members mentioned the introduction of yield caps and plan to discuss it more seriously at this month's meeting.

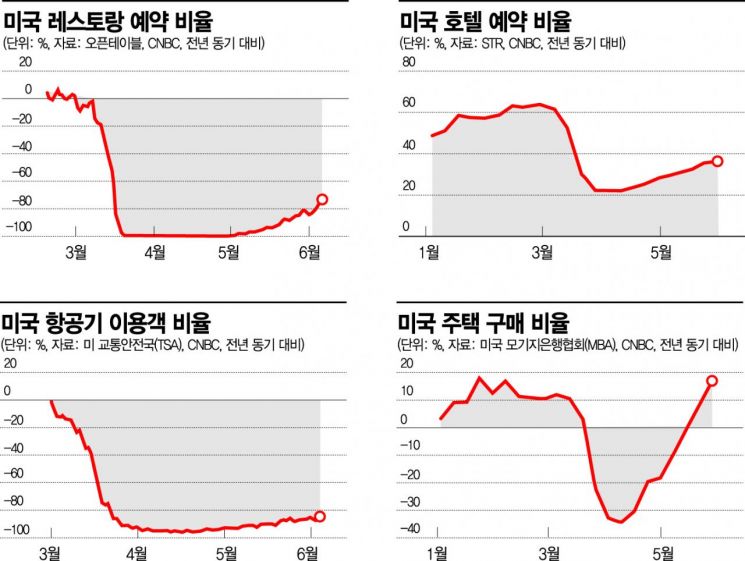

Major U.S. economic indicators also resemble a Nike swoosh curve, indicating a gradual rise rather than a V-shaped recovery. According to OpenTable, an online reservation service, U.S. restaurant reservations in June were still 80% lower compared to the same period last year. Hotel occupancy rates in the U.S., compiled by STR, remain below 40%. Although the U.S. Mortgage Bankers Association (MBA) reported that home purchases rebounded nearly 20% year-over-year after a 30% decline in April, this is attributed to demand for homes in suburban areas as people avoid city centers due to COVID-19.

Economic recovery outside the U.S. is also progressing slowly. Bloomberg pointed out that China's May consumer price inflation forecast is 2.6%, lower than April's 3.3% and below the 3.5% target set at the recent Two Sessions. This is attributed to concerns over COVID-19 and rising food prices following African Swine Fever (ASF). The European Central Bank (ECB) also announced at its monetary policy meeting on the 4th that the recession caused by COVID-19 remains severe and that it will significantly increase the size of its pandemic emergency purchase program (PEPP) from the existing 750 billion euros to 1.35 trillion euros as a stimulus measure.

Concerns remain over a W-shaped double-dip recession due to the resurgence of COVID-19 in the fall and winter. The U.S. economic media Forbes reported, "After the Middle East oil shock in 1979, the U.S. economy rebounded in 1980 but experienced a double-dip recession in 1981. The current recovery still carries the risk of leading to a deeper recession."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.