President Trump: "Buffett's Sale of Airline Stocks Was a Mistake"

US Allows Chinese Airlines to Operate Passenger Flights Twice

Previous Day: Korean Air Up 7%, Asiana Airlines Up 5%

Financial Sector: "COVID-19 Is Not Over... Caution in Investment"

[Asia Economy Reporter Minji Lee] Global airline stocks, which had experienced a sharp decline due to the impact of the novel coronavirus infection (COVID-19), soared vertically. This is interpreted as being influenced by major countries resuming international flights from this month and the easing of tensions between the United States and China over air routes.

According to the securities industry on the 6th, airline-related stocks on the New York Stock Exchange in the United States showed a sharp rise for two consecutive days on the 5th (local time). American Airlines, which rose 41% the previous day, increased by 11.8%, while United Airlines (8.45%), Delta Air Lines (5.50%), and Spirit Airlines (7.61%) also rose.

The unexpectedly strong U.S. employment data for May and the alleviation of concerns over clashes between the U.S. and China regarding air routes had a significant impact. On the same day, the U.S. Department of Transportation announced that it would allow Chinese airlines to operate two round-trip flights per week to the United States. This followed the announcement by the Civil Aviation Administration of China, the Chinese aviation regulatory authority, that starting from the 8th, foreign airlines would be permitted to operate international flights to China once a week.

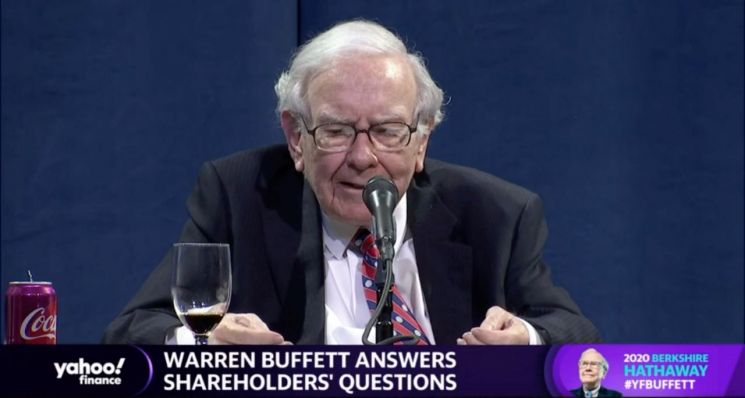

On that day, President Donald Trump stated at a press conference, "Buffett should have continued to hold airline stocks," adding, "Airline stocks broke through the roof today." Earlier, Warren Buffett, chairman of Berkshire Hathaway, sold all shares of the four major U.S. airlines?American, Delta, Southwest, and United Airlines?citing uncertainty about the future of the airline industry following the COVID-19 crisis.

As the spread of COVID-19 slows down, countries worldwide are preparing to resume international flights. Starting from the 15th, countries including the United States, Germany, Belgium, and Norway plan to lift travel restrictions and accept limited entry from European Union (EU) member states. Next month, tourist destinations such as Spain and Greece, as well as Southeast Asian routes, are expected to reopen.

Accordingly, airline and travel-related stocks also showed an upward trend in the domestic stock market the previous day. Korean Air closed trading at 20,600 KRW, up 7.57%, while T'way Air rose 5.75%, Asiana Airlines 4.87%, Jin Air 3.82%, and Jeju Air 1.78%, all rising together.

In the Chinese stock market, the airline and airport sectors rose 3.94% in one day, recording the highest increase among all sectors. Among individual stocks, China Express Airlines, headquartered in Chongqing, rose 9.98%, China Southern Airlines, the top airline, increased by 6.85%, followed by China Southern Airlines (6.84%), Shanghai Airport (2.98%), Guangzhou Airport (2.20%), and Xiamen Airport (1.90%). As COVID-19 subsides in China, domestic flights have recovered to about half the usual passenger volume as of the end of May.

However, the securities industry advised caution when investing, noting that the COVID-19 situation has not yet ended. Ki-hyun Park, a researcher at SK Securities, said, "Chinese airlines recorded the largest net loss in the first quarter when combining the Shanghai and Shenzhen stock markets," adding, "While market recovery is expected in the long term, attention should be paid to the fact that the COVID-19 phase has not yet ended."

Sungbong Park, a researcher at Hana Financial Investment, forecasted, "The International Air Transport Association (IATA) expects global passenger numbers to recover to last year's levels by 2023," adding, "The recovery of passenger demand remains uncertain at this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.