Maximum Life Imprisonment Penalty Strengthened for School Zone Traffic Accidents

Driver Insurance Contracts Surpass 1 Million Since Law Enforcement

[Asia Economy Reporter Ki Ha-young] Office worker Kim Hye-in (36, female) signed up for driver insurance alongside her younger sibling last month. This was because she heard that under the Minsik Law, if a traffic accident occurs in a school zone, the penalty can be as severe as life imprisonment. Kim said, "I initially had no intention of subscribing to driver insurance since it is not mandatory, unlike car insurance," but added, "Even my father, who has over 30 years of driving experience, mentioned the Minsik Law and expressed concerns about driving in school zones, so I decided to get driver insurance."

Since the enforcement of the so-called Minsik Law (Amendment to the Act on the Aggravated Punishment of Specific Crimes), which significantly strengthens penalties for drivers involved in traffic accidents in school zones, the number of driver insurance subscribers has skyrocketed. As legal penalties for drivers have increased, consumer interest has grown due to concerns about accident occurrences. However, caution is required as insurance payouts related to fines are not duplicated even if multiple driver insurance policies are purchased.

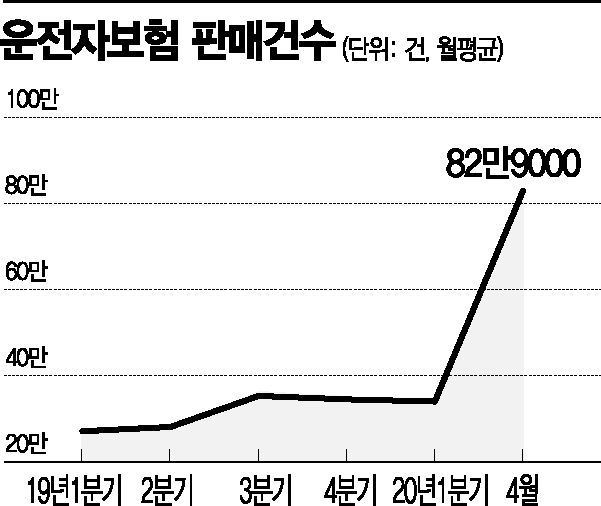

According to the Financial Supervisory Service and the insurance industry on the 5th, it is estimated that the number of new driver insurance contracts has approached approximately 1.5 million from March 25, when the Minsik Law was enforced, until last month. In April alone, immediately after the law's enforcement, 829,000 new driver insurance contracts were signed. This is about 2.4 times the average monthly figure from January to March. The initial premiums paid by April contract holders reached 17.8 billion KRW.

A representative from Insurance Company A explained, "Inquiries about driver insurance surged right after the Minsik Law was enforced, and from April, the number of new contracts exploded," adding, "Compared to the same period last year, this is an increase of about two to three times." A representative from Insurance Company B said, "Although the rapid increase slowed somewhat in May, the number of driver insurance subscribers still doubled compared to the previous year, showing that interest in driver insurance remains strong."

Driver insurance is a product that covers criminal liabilities such as fines imposed in the event of a traffic accident, settlement payments, and attorney fees. However, unlike car insurance, which covers civil liabilities such as bodily injury and property damage compensation, it is not mandatory.

Despite not being mandatory, the explosive growth is attributed decisively to the enforcement of the Minsik Law. According to the Minsik Law, if a child dies due to driver negligence in a school zone, the driver faces life imprisonment or imprisonment of three years or more; if a child is injured, the penalty ranges from one to fifteen years imprisonment or a fine between 5 million and 30 million KRW. This naturally increases the burden on consumers in the event of an accident.

In response to consumer needs, insurance companies have expanded coverage and introduced various special contracts to attract customers.

DB Insurance introduced a special contract that pays 3 million KRW in traffic accident support funds even for injuries requiring less than six weeks of treatment. KB Insurance became the first in the industry to introduce a 'payback' feature that exempts future insurance premiums and refunds previously paid premiums if the insured suffers injuries classified between grades 1 and 7 due to a car accident. Earlier, Meritz Fire & Marine Insurance raised the coverage limit for fines within traffic accident support funds from 20 million KRW to 30 million KRW starting in April. Samsung Fire & Marine Insurance and Hyundai Marine & Fire Insurance also plan to increase the coverage limit for legal cost support special contracts from 20 million KRW to 30 million KRW starting next month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.