May SME Loans Increase by 7.4329 Trillion Won

Credit Loans Surge by 1.0689 Trillion Won

Savings and Deposits Decrease by 8.2 Trillion Won in April-May

[Asia Economy Reporter Kangwook Cho] As the Bank of Korea continues to cut its benchmark interest rate, interest payments have decreased, leading to a decline in customers depositing money in banks, while the number of borrowers is increasing. In particular, the risk management of commercial banks has been put on high alert as the trend of increasing loans to small and medium-sized enterprises (SMEs) and personal credit loans, which have been affected by the novel coronavirus disease (COVID-19) crisis, continues.

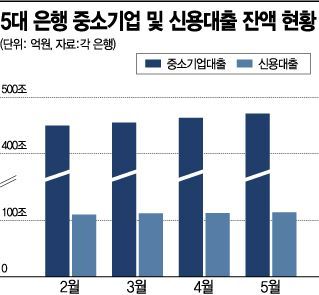

According to the banking sector on the 3rd, the outstanding SME loans at the five major domestic commercial banks?KB Kookmin, Shinhan, Woori, Hana, and NongHyup?amounted to 471.362 trillion won at the end of May, an increase of 7.4329 trillion won compared to the end of April. This is the second-largest increase since September 2015. The largest increase occurred in April, when full-scale financial support for small business owners began amid the COVID-19 crisis, with an increase of 8.4379 trillion won. The continued rise in SME loans is analyzed as reflecting the worsening business conditions of small business owners and SMEs.

In particular, the government’s directive to expand financial support for small business owners and SMEs has influenced banks to actively increase related loans. According to the Financial Services Commission, since the implementation of the Livelihood and Financial Stability Package Program announced on March 24, a total of 528,000 cases amounting to 54.1 trillion won have been supported through commercial banks as of the 29th of last month.

Personal credit loans have increased significantly. At the end of May, the outstanding personal credit loans reached 114.6858 trillion won, up 1.0689 trillion won from the end of April. This is more than twice the increase in April (497.5 billion won). It is analyzed that due to the COVID-19 impact, household financial conditions have worsened, leading to increased borrowing through overdraft accounts and other loans. Credit loans increased by 1.1925 trillion won in February and 2.2408 trillion won in March.

On the other hand, as deposit interest rates at major commercial banks have been steadily lowered, the outflow of deposit customers is accelerating. Over the two months from April to May, the balance of deposits and savings at major commercial banks decreased by about 8.2 trillion won. Limiting to time deposits excluding installment savings, a massive 8.5578 trillion won was withdrawn during this period. With deposit interest rates falling to the 0% range in the ultra-low interest rate era, more customers have judged that there is no reason to keep their money in banks.

As SME and personal credit loans increase while deposit customers withdraw funds, concerns about the profitability and risk management of commercial banks are growing. Due to the economic recession and intensified competition among banks, the net interest margin (NIM), a profitability indicator for banks, is already on a downward trend.

Experts particularly point out that risk management should be prioritized as an increase in non-performing loans is a concern. With the spread of COVID-19, policy authorities have temporarily relaxed bank soundness regulations and encouraged credit expansion to low-credit rating companies, making an increase in non-performing loans inevitable.

The International Finance Center warned in its report "Challenges for the Banking Industry in the Post-COVID Era" that if soundness regulations are strengthened again after the crisis ends, bank restructuring may be necessary, which could lead to deteriorating profitability. It pointed out that loan growth may slow due to increased awareness of risk management and decreased demand, net interest margins may shrink due to low interest rates, and there is a possibility of increased non-performing loans and operational losses.

Kim Widae, a senior researcher at the International Finance Center, said, "Due to the high sensitivity of the banking industry to economic conditions, a decline in profits is expected from the second quarter of this year, so proactive management to reduce costs is necessary," adding, "Due to the inevitable low interest rate situation, as bank deposits move to stock and real estate markets, there is also a need to be cautious about the possibility of asset price overheating."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.