'Post-COVID-19 Issues and Prospects for the Korean Economy'

Korean Economic Association, Korean International Economic Association, Korean Public Finance Association Academic Conference

[Asia Economy Reporter Eunbyeol Kim] Economists have collectively voiced concerns over the rapid increase in the national debt ratio due to expansionary fiscal policies such as the third supplementary budget (추경). They argued that the global value chain (GVC) could split into pro-US and pro-China blocs amid the COVID-19 pandemic, and since South Korea's long-term growth rate continues to decline, the country needs to restructure its economic framework.

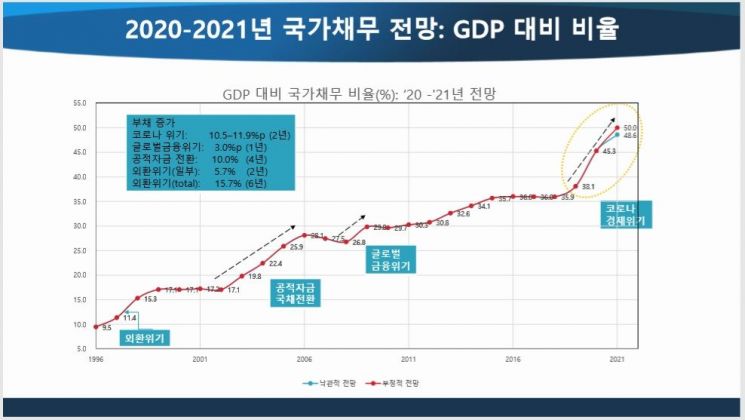

At a joint economic policy academic conference held on the 3rd by the Korean Economic Association, the Korean International Economic Association, and the Korean Fiscal Association under the theme "Issues and Prospects of the Korean Economy After COVID-19," Professor Woochul Kim of the Department of Taxation at the University of Seoul stated, "If the 10 percentage point increase in the national debt ratio during the COVID-19 crisis recovery process is reflected in the National Assembly Budget Office's medium- to long-term fiscal outlook, the national debt ratio will rise to 67% by 2028 even by simple calculation methods," adding, "If the COVID-19 deficit debt accumulates, it could rise to around 80%."

He continued, "Right after the COVID-19 crisis, the fiscal deficit ratio relative to GDP will soar to 5%, and to reduce the fiscal deficit ratio to 3%, an annual 60 trillion won must be secured through tax increases or spending cuts," he explained. He also warned that if the fiscal deficit ratio is not reduced, South Korea's national debt could increase to an unsustainable level, causing serious problems for its external creditworthiness.

Professor Kim noted that large-scale tax increases or spending cuts are nearly impossible under the current confrontational parliamentary structure or presidential system, and suggested considering the use of politically neutral and independent fiscal institutions. He further advised, "As a realistic measure, it is worth considering utilizing a fiscal council (or fiscal committee) within the parliament or an independent fiscal institution located in the intermediate zone between the executive and the legislature."

Professor Euiyoung Song of Sogang University's Department of Economics said, "The GVC has split into pro-US and pro-China blocs, increasing industrial inefficiency and confusion," and added, "The government should assist small and medium-sized enterprises in participating in supply chain formation and strengthen support policies for certain strategic industries."

He emphasized, "The countries most affected by the retreat of globalization are small open economies like South Korea," and stressed, "Efforts must be made to maintain an open system as much as possible." He also stated that South Korea should actively participate in strengthening industrial policies in some strategic industries and establishing a new multilateralism system.

Professor Sejik Kim of Seoul National University's Department of Economics and Professor Jaebin Ahn of Seoul National University's Graduate School of International Studies pointed out that South Korea's long-term growth rate has been declining by 1 percentage point every five years. When including last year's growth rate, South Korea's long-term growth rate (2014?2019) is around 2%, and if the trend continues, it could fall to 1% in five years and to the 0% range in ten years.

Therefore, they emphasized that to prevent the decline in growth rate, focus should be placed on improving productivity in the service sector. South Korea's long-term growth rate has fallen due to declining labor productivity and a decrease in employment rates caused by changes in the industrial structure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.