Q1 Growth Rate -1.3%... Gross National Income (GNI) Down 2.0%

Per Capita GNI $30,000 at Risk if Exchange Rate Surges in Second Half

Total Savings Rate Declines... Government Supports Economy with Consumption Amid Downturn

Labor Income Share Hits Record Low Due to Sojusung Policy

[Asia Economy Reporter Kim Eunbyeol] The income that citizens hold in their hands (GNI) in the first quarter of this year shrank at the largest rate since the foreign exchange crisis, as the economy contracted due to the novel coronavirus infection (COVID-19) and low inflation also had an impact. The gross domestic product (GDP), adjusted for inflation, also declined at the largest rate since the financial crisis. This trend is expected to continue into the second quarter. The Bank of Korea forecasted that the growth rate for the second quarter would record around -2% in the mid-range.

The preliminary real GDP for the first quarter was revised upward by 0.1 percentage points from the flash estimate (-1.4%). This was due to a downward revision in the service sector (-0.4 percentage points) and an upward revision in manufacturing (+0.8 percentage points), among others. By expenditure items, exports (+0.6 percentage points) and imports (+0.5 percentage points) were revised upward. Private consumption decreased by 6.5% due to the impact of COVID-19, while government consumption increased by 1.4% due to increased government support. Exports decreased by 1.4% as semiconductors increased but automobiles and machinery declined. Imports decreased by 3.6% due to factors such as the drop in international oil prices.

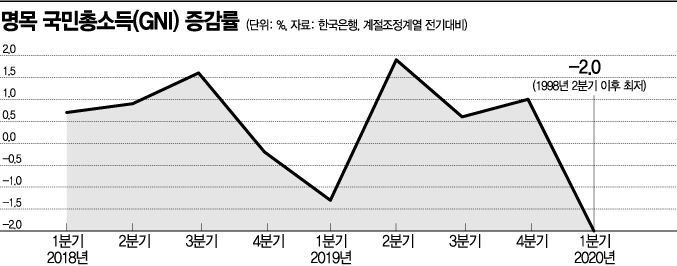

◆Gross National Income Shrinks at Largest Rate Since Foreign Exchange Crisis... Can Per Capita $30,000 Be Maintained?= On the 2nd, the Bank of Korea announced in the 'Preliminary Gross National Income for Q1 2020' that the nominal GDP growth rate for the first quarter, reflecting price changes, recorded -1.6% compared to the previous quarter. This is the lowest since the fourth quarter of 2008 (-2.2%) during the global financial crisis. As a result, the 'GDP deflator,' which is nominal GDP divided by real GDP, recorded -0.6%, marking five consecutive quarters of negative values. The GDP deflator is an indicator representing the overall price level of the national economy and is at its longest period of negativity in history.

The first quarter GNI, which is the income earned by citizens, also decreased by 2.0% compared to the previous quarter, recording 481.3973 trillion won. This is the largest decline since the second quarter of 1998 (-3.6%) during the foreign exchange crisis. Since the money available for citizens to spend has decreased, it could eventually lead to reduced consumption and other effects.

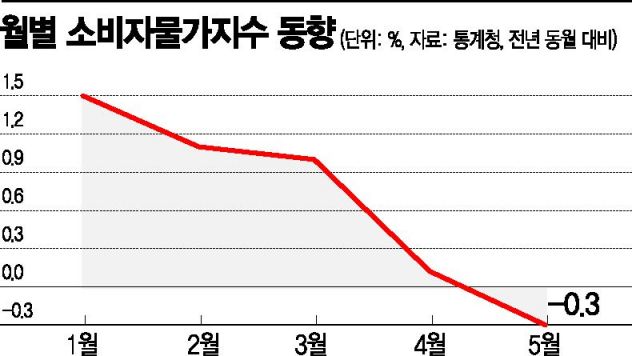

Due to the low growth and low inflation trend, some voices express concerns about deflation (price decline amid economic recession). Park Yang-su, head of the Economic Statistics Bureau at the Bank of Korea, said, "Policy authorities should be alert to the possibility of deflation." However, he added, "The recent reduction in the decline of the GDP deflator is a positive factor." The Bank of Korea and the government consider the domestic consumer price trend more important than the GDP deflator, which includes semiconductor export prices. The consumer price inflation rate announced by Statistics Korea for May recorded -0.3%, marking a negative value for the first time in eight months. The Bank of Korea issued a reference explaining that the negative consumer price inflation rate was mainly due to the weakening demand-side price pressure caused by the spread of COVID-19, the sharp drop in international oil prices acting as a significant factor for price decline, and increased downward price pressure from government policies such as welfare policy expansion.

With the sharp decline in first quarter GNI, there is interest in whether the annual per capita GNI for this year can maintain the $30,000 level. Last year, the per capita GNI in dollar terms was $32,115, a 4.3% decrease from the previous year. This decline was the largest in 10 years. Park explained, "Assuming nominal GDP is -1% and the GDP deflator remains at a similar level to last year, the won-dollar exchange rate would need to stay around 1,250 to 1,260 won from June through the end of the year for the per capita GNI to fall below $30,000." This means that if the exchange rate does not surge sharply due to external factors, the per capita GNI of $30,000 will be maintained.

The Bank of Korea expects the second quarter growth rate to hit bottom considering the impact of COVID-19. Last week, the Bank of Korea forecasted the growth rate for the first half of this year at -0.5%. Considering this, the second quarter growth rate is expected to be lower than -2%. Factors that could influence future growth rates include ▲ the visibility of effects from the first supplementary budget and disaster relief funds ▲ export trends due to the US-China trade dispute ▲ the degree of COVID-19 resurgence.

◆Government Total Savings Decline for the First Time... Labor Income Share Hits Record High Amid Income-Led Growth Policy= Meanwhile, the total savings rate compiled by the Bank of Korea last year was 34.7%, down from 35.9% the previous year. This was because consumption exceeded income earned by the private sector and government. Last year, the government's total savings amount was 132.91 trillion won, marking the first decrease in savings. While the private savings rate maintained its previous level, the government's savings rate sharply dropped from 8.2% in 2018 to 6.9%.

The share of workers and households in total income of corporations, government, and citizens increased. The 'labor income share,' which is the proportion of labor income (employee compensation) in workers' and national income, recorded 65.5% last year, the highest since statistics began in 1953. Operating surplus, representing corporate profits, decreased by -6.9%, marking the first two consecutive years of decline since statistics began, while the growth rate of employee compensation (3.4%) exceeded that of GNI (1.6%). Park said, "It is true that some income-led growth (Eoljuka) related policies influenced the rise in labor income share, but it is difficult to say to what extent."

Although corporate profits (operating surplus) declined, when viewed by institutional sectors such as households, corporations, and government, corporate distribution turned positive (1.8%) from negative (-3.2%) in 2018. Park explained, "Corporations withheld dividend payments, and tax expenditures decreased due to lower corporate taxes and other taxes. Also, last year the government executed a large budget for jobs, and there was an effect of income transfer from the government to corporations through subsidies when corporations increased employment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)