Plastic Surgery and Beauty App Babitok Gains More Attention

As confirmed cases of the novel coronavirus infection (COVID-19) surge, social demand for non-face-to-face medical consultations is growing. President Moon Jae-in stated in his third anniversary speech on the 10th of last month, “We will focus on fostering non-face-to-face industries such as healthcare, education, and distribution.” Although the Korean Medical Association and the Korean Pharmaceutical Association oppose it, public opinion generally favors the introduction of non-face-to-face medical consultations. While it may not be easy to fully implement non-face-to-face medical consultations, the possibility of regulatory relaxation has increased. The non-face-to-face medical consultation industry based on existing online platforms is expected to grow. Asia Economy reviews the current status of companies promoting non-face-to-face medical consultation and related businesses.

[Asia Economy Reporter Jang Hyowon] Recently, as remote medical consultations became temporarily possible due to COVID-19, the stock price of CareLabs, which operates the medical information platform ‘Goodoc,’ showed strength. However, market opinions on Goodoc’s business growth prospects are divided.

On a consolidated basis, CareLabs’ sales and operating profit for the first quarter of this year were 18.9 billion KRW and 1.8 billion KRW, respectively, up 13.8% and 114.3% compared to the same period last year. Net profit surged 836% to 800 million KRW compared to the same period last year.

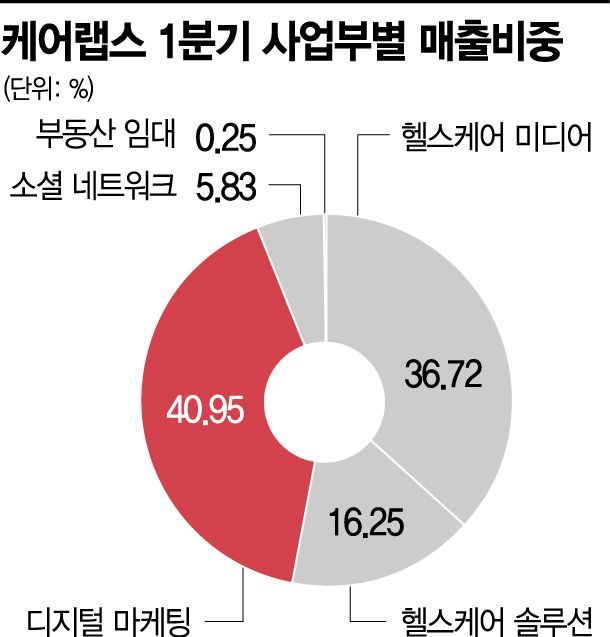

CareLabs is a healthcare platform company. As of the end of the first quarter, the sales composition ratio was Healthcare Media (36.72%), Healthcare Solutions (16.25%), Digital Marketing (40.95%), Social Network (5.83%), and Real Estate Leasing (0.25%). Although known as a healthcare company, the digital marketing segment actually accounts for the largest share of sales.

Sales in the digital marketing segment, which acts as a media rep, grew 26% year-on-year. The healthcare solutions segment, which provides prescription security systems and pharmacy billing programs, and the healthcare media business segment operating Goodoc and ‘Babytalk’ each grew by 25% and 30%, respectively.

On the other hand, the social network business segment, which operates dating applications such as ‘Dangyeonsi’ and ‘Sarangae,’ shrank by 57%.

Goodoc, a medical information platform that gained attention due to COVID-19, is an app for finding hospitals and pharmacies nationwide. Last year, Goodoc’s monthly average users (MAU) were around 1.3 million, but recently, after providing the ‘Mask Scanner’ service, the number increased to 3 million.

As Goodoc’s user base grew, CareLabs recently executed a physical division to make Goodoc a 100% subsidiary. The plan is to make Goodoc independent to facilitate government support and investment.

However, some critics argue that Goodoc’s value is overestimated. Other remote medical consultation-related companies like Ubicare and Bit Computer provide systems necessary for medical institutions such as EMR (Electronic Medical Records), making it easier to expand business-to-consumer (B2C) services. In contrast, CareLabs does not directly provide systems like EMR but offers services through partnerships with other companies’ EMR systems, resulting in relatively lower competitiveness. In fact, Goodoc’s main revenue comes from advertising, whereas ‘Ddokdok,’ operated by Ubicare, has no advertising.

Lee Sangheon, a researcher at Hi Investment & Securities, analyzed, “For hospital reception services to be possible, the EMR system and app must be linked. Since Ubicare has a high market share in the EMR market, the entry barrier is low, and it is easier to expand hospital reception services.”

In the investment banking (IB) industry, it is known that when evaluating CareLabs’ value, more attention is paid to the growth potential of Babytalk than Goodoc. The beauty and plastic surgery information app Babytalk is popular among women in their 20s and 30s as a platform where they share direct plastic surgery reviews and hospital cost information. In April, Babytalk’s competitor startup ‘Gangnam Unnie’ successfully raised 18.5 billion KRW in Series B funding.

Meanwhile, Daily Blockchain, the largest shareholder of CareLabs, selected Maple Investment Partners as the preferred negotiation partner in March for the sale of its 29% stake and convertible bonds (BW) and convertible bonds (CB), and negotiations are underway. Both parties plan to conclude negotiations by the end of this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.