6 of Top 10 Loan Companies

Q1 Turns to Deficit as Feared

Corporate Loans in April Surge Over 4 Times

'Signs of Distress' Delinquency Rate Also Rises

[Asia Economy Reporters Haeyoung Kwon and Minyoung Kim] As the spread of the novel coronavirus infection (COVID-19) has rapidly deteriorated corporate earnings, banks are facing an emergency in managing their soundness. The delinquency rate, a sign of loan defaults, has also begun to rise. Due to the financial sector’s characteristic of lagging behind the real economy, it is expected that as early as the end of the year, the financial sector will be rapidly drawn into the impact zone of the COVID-19 shock. Although proactive risk management is urgent, banks are caught in a dilemma, pushed by the government and public opinion demanding shared pain, unable to take decisive action.

According to the financial sector on the 1st, among the top 10 companies with the largest loan asset size borrowing from Bank A, six turned to deficits in the first quarter of this year.

The president of Bank A said, "The real economy shock caused by COVID-19 is much greater than we feared, and the situation will also be prolonged," adding, "Through industry and corporate outlooks, we need to actively support those temporarily facing difficulties and reduce exposure for companies that are not, thereby managing soundness." He added, "Banks need to consider a major restructuring of their loan portfolios to respond after COVID-19." In particular, this bank has many corporate loans in the manufacturing sector, and after the spread of COVID-19, the sales and profits of its client companies have declined more noticeably compared to other banks. Manufacturing industries such as auto parts, electronic components, and textile products have been directly hit by COVID-19.

In fact, the financial conditions of banks are operating very urgently. As of the end of April, corporate loans increased by 51.7 trillion won compared to the end of January. This is more than four times the amount compared to the same period last year. During this period, loans to large corporations also increased by 21.7 trillion won. In the same period last year, loans to large corporations by banks decreased by 1 trillion won. This is due to the tightening of the corporate bond and commercial paper (CP) markets caused by the spread of COVID-19.

The funding difficulties felt by small and medium-sized enterprises (SMEs) and self-employed individuals at bank branches are also severe. The head of the sales division at Bank B said, "For a client company exporting men's clothing to Europe, sales have shrunk to a quarter of last year's level," lamenting, "Export volumes have sharply declined, overseas sales have been blocked, and they are not even receiving payments for previously exported goods." Except for some industries such as corrugated cardboard and mask manufacturers that have gained from increased demand for delivery and quarantine supplies, most are experiencing liquidity difficulties. He added, "Besides export manufacturers, loan demand has surged among companies facing severe funding difficulties such as entertainment agencies, event planning companies, and venue rental businesses," and "Among the self-employed, demand in the food service sector has recovered, but sales have sharply declined in pubs and lodging businesses that mainly operate in the evening, causing significant damage."

Banks are prioritizing soundness management to prevent the risk of the real economy shock spreading to financial insolvency. Although a slowdown in corporate earnings does not immediately lead to loan defaults, unprecedented demand cliffs and sharp profit declines are worsening corporate cash flows. The delinquency rate, considered a sign of bank distress, is also on the rise. The average delinquency rate on SME loans at four major commercial banks?KB Kookmin, Shinhan, Hana, and Woori?rose from 0.43% in March to 0.47% in April. An executive in charge of loans at Bank C sighed, "It is expected that a flood of companies will be downgraded in the internal credit evaluation conducted by the end of next month," adding, "It is difficult to even estimate how much more this will increase next year."

The head of the sales division at Bank D said, "Even though our client companies have been less affected, their sales this year have decreased by an average of 20% compared to last year," expressing concern that "If the COVID-19 situation prolongs, many companies and self-employed individuals will go bankrupt within the next two years." According to the Supreme Court, the number of companies filing for bankruptcy in courts nationwide was 252 in the first quarter of this year, a 26% increase compared to 200 cases a year earlier. This is the largest scale in the past five years.

Although the likelihood of increasing financial sector insolvencies lagging the real economy is high, additional demands for shared pain from banks are pouring in. The government has decided to provide a special guarantee of 500 billion won to auto parts companies immediately. Based on guarantees from the Korea Credit Guarantee Fund and the Korea Technology Finance Corporation, banks are expected to supply additional funds. It is practically difficult to reduce existing loans. On the 29th of last month, Prime Minister Chung Sye-kyun hinted at additional financial support targeting not only the auto industry but also sectors facing severe management difficulties. Follow-up financial support for other industries is also expected to fall on banks. Banks are unable to manage risks comfortably due to scrutiny from financial authorities and public opinion. A financial sector official pointed out, "The government is ordering banks to expand funding to companies and the self-employed even by easing regulations, making it difficult to strengthen soundness management," adding, "It is time to gradually raise the loan threshold to prevent bank insolvencies from spreading to the real economy."

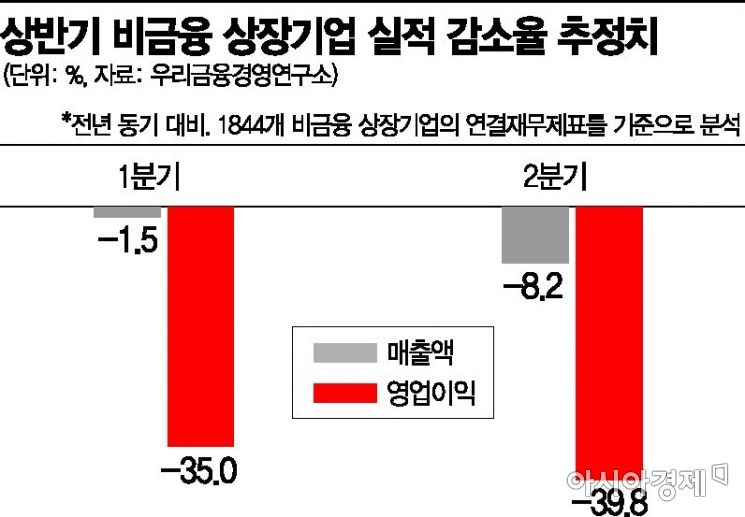

Sujin Kim, senior researcher at Woori Financial Management Research Institute, expressed concern, saying, "With corporate fundamentals weakened by cumulative performance deterioration since 2018, if economic activity normalization is delayed, the poor performance of some industries is highly likely to translate into credit risk," and added, "Banks need to strengthen monitoring and risk management considering the differential impact of COVID-19 on industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.