Reduced Inventory Revaluation Losses Due to Rising International Oil Prices

Full Reflection of Middle East OSP Reduction Effect

Declining Oil Product Inventories in the US and China

[Asia Economy Reporter Hwang Yoon-joo] The Singapore complex refining margin, an indicator used to gauge the profitability of oil refiners, has recorded negative values for 11 consecutive weeks. Although the refining industry is unlikely to escape losses in the second quarter due to negative margins, they expect performance improvements from the second half of the year, considering the recovery in petroleum product demand.

According to the refining industry on the 1st, the Singapore complex refining margin for the last week of May was '-$1.3', marking 11 consecutive weeks in the negative. This is the first time that the weekly average margin has been negative for two consecutive months, April and May. The average refining margin was -$0.8 in April and -$1.32 in May, with the negative margin widening.

Although the refining margin figures declined, the refining industry expects performance to improve from the second half of the year. Key indicators affecting refiners' profits, such as ▲rising international oil prices ▲reduced Middle East crude oil procurement costs (OSP) ▲decreased petroleum product inventories, are showing positive signs.

The international oil price, which had plunged sharply, has stabilized since April. The price of unleaded gasoline rose by $11.38 from an average of $19.45 in April to $30.83 in May. Diesel and kerosene increased to $36.07 (+$4.65) and $28.89 (+$7.63), respectively. With the rise in international oil prices, refiners were able to reduce inventory valuation losses in the second quarter.

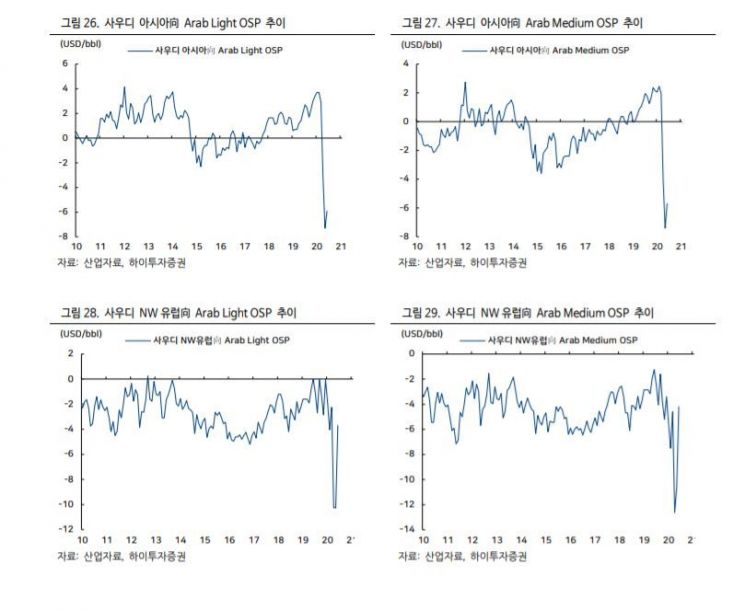

The easing of the Middle East OSP burden has also provided considerable help to the refining industry. Saudi Arabia applies a premium when supplying crude oil to the Asian region, but with the sharp drop in international oil prices, it significantly lowered the OSP applied from June onwards. As a result, the actual refining margin is expected to improve by up to $5.3 per barrel.

An industry insider said, "S-Oil, which has the highest proportion of Middle Eastern crude oil imports, will benefit the most," adding, "Due to the OSP decline, S-Oil and SK Innovation are expected to see performance improvements of approximately 200 billion KRW and 400 billion KRW, respectively, in the second quarter."

Most importantly, petroleum product inventories in China and the United States are showing signs of normalization.

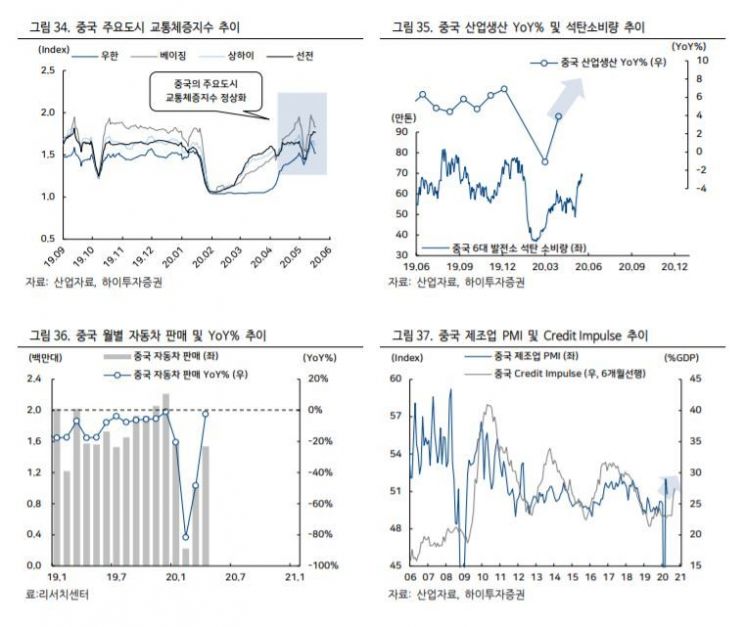

China, the origin of COVID-19 and the first to recover, is already showing signs of economic activity recovery. Since the end of March, China has implemented lockdown lifting measures in major regions. According to the traffic congestion index in major Chinese cities, the weekly average dropped to 1.05 during lockdown but recovered to the normal level of 1.65 in May. Coal consumption at six major Chinese power plants decreased to 370,000 tons but recently recovered to 680,000 tons, and automobile sales in April were 1,536,000 units, only a 2.5% decrease compared to the same period last year.

Won Min-seok, researcher at Hi Investment & Securities, said, "In the U.S., the average daily nominal gasoline consumption dropped from 10 million barrels to 5.82 million barrels during the COVID-19 outbreak but has recently recovered to over 7.1 million barrels," adding, "Despite global refiners, including those in the U.S., advancing scheduled maintenance and increasing operating rates due to the downturn, petroleum product demand recovery has led to a shift toward decreasing inventories."

However, there are concerns that the recovery of the aviation industry, a key upstream sector, is crucial for the domestic refining industry to achieve clear performance improvements. Jet fuel is a major export product for refiners and ranks among the top three products sold domestically.

Kang Dong-jin, a researcher at Hyundai Motor Securities, said, "Due to large-scale refinery capacity expansions and weak demand this year, refining margins are expected to remain weak," adding, "The recovery of jet fuel demand will play an important role in improving refining margins for domestic refiners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)