Bank of Korea Economic Outlook

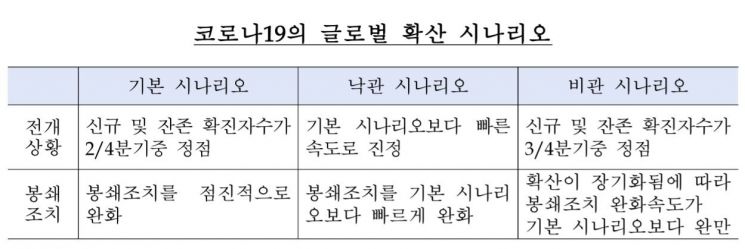

[Asia Economy Reporter Kim Eun-byeol] The Bank of Korea projected that the annual economic growth rate for this year could fall to as low as -1.8% in the worst-case scenario. This forecast assumes a scenario where the number of confirmed COVID-19 cases peaks in the third quarter and the easing of lockdown measures proceeds more slowly than expected.

On the 28th, the Bank of Korea stated in its economic outlook that under the basic scenario, which assumes the number of COVID-19 cases peaks in the second quarter, the growth rate is expected to be -0.2%. The growth rate for the first half of the year is estimated at -0.5%, and for the second half, 0.1%. If COVID-19 subsides faster than expected and countries ease lockdown measures quickly, positive growth (0.5%) is also possible. This is the first time the Bank of Korea has disclosed economic growth forecasts based on different scenarios.

However, if the situation turns out to be more pessimistic than expected, the economic growth rate could fall to -1.8%. In the worst case, the growth rate could decline more sharply than the -1.2% forecast for Korea by the International Monetary Fund (IMF).

Assuming the basic scenario, the Bank of Korea expects private consumption this year to decrease by 1.4% compared to the same period last year, with construction investment (-2.2%) and goods exports (-2.1%) also declining. Looking at the contribution by expenditure components, the contribution of domestic demand is expected to decrease from 1.4 percentage points last year to 0.7 percentage points, while the contribution of exports is expected to turn negative from 0.6 percentage points last year to -0.9 percentage points.

The Bank of Korea noted high uncertainty in the future growth path, citing prolonged COVID-19 crisis, re-emergence of US-China trade conflicts, and delayed recovery in the semiconductor industry as downside risks. On the other hand, if COVID-19 is contained early and the Chinese economy normalizes rapidly, the economy could rebound.

This year, the global economic growth rate is assumed to be -3.4%, reflecting the development of COVID-19 and recent economic conditions in major countries. The growth rate of global trade is expected to record -11.8%, and the average crude oil import price is assumed to be $38 per barrel.

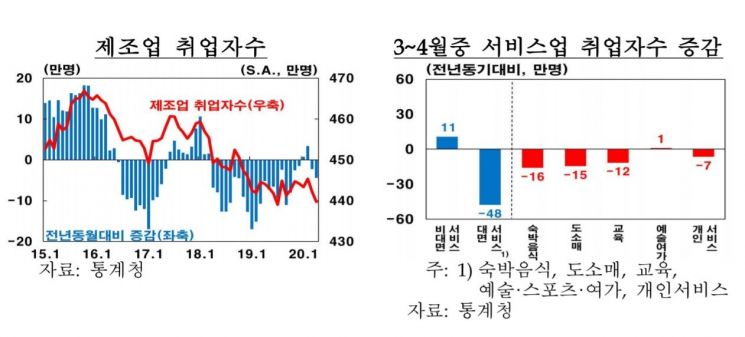

Employment shocks are also anticipated. The Bank of Korea forecasts that the number of employed persons will increase by only 30,000 this year. Last year, the annual increase in employment was 300,000, so this represents a reduction to one-tenth of that level. A Bank of Korea official said, "Although recovery is expected in the second half centered on the service sector, sluggish conditions in manufacturing and construction industries will act as constraints."

The low inflation trend is expected to continue. The Bank of Korea projected this year's consumer price inflation rate at 0.3%, and the core inflation rate excluding food and energy at 0.4%. This is due to the combined effects of economic slowdown and falling international oil prices, which increase downward pressure on prices. Amid the government's ongoing welfare policy stance, reductions in some indirect taxes and public utility charges are also seen as factors pulling prices down. However, next year, the consumer price inflation rate is expected to be 1.1%, and the core inflation rate 0.9%.

The current account surplus, which was around $60 billion last year, is expected to decrease to $57 billion this year and $55 billion next year. The Bank of Korea explained, "Due to the contraction in global trade, exports will sharply decline, reducing the surplus in the goods balance. The service balance will continue to run a deficit in processing and business services, but the deficit will narrow due to a significant reduction in overseas travel by domestic residents, improving the travel balance."

Lee Hwan-seok, Deputy Governor of the Bank of Korea, said, "In April, the current account is expected to record a deficit due to seasonal factors such as dividend payments, but the likelihood of a deficit in May is low. In the short term, whether the monthly current account is in surplus or deficit is less important than the overall trend." He added, "Although the annual current account surplus is slightly smaller than last year, it is still a large surplus compared to other countries, so it is appropriate to emphasize that aspect."

Meanwhile, the Bank of Korea's current economic outlook does not reflect the effects of the third supplementary budget. Deputy Governor Lee said, "It is very difficult to calculate and reflect the numbers while the timing of the supplementary budget's passage through the National Assembly and execution is uncertain. Once the specific size of the supplementary budget is announced, we will be able to calculate its impact."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.