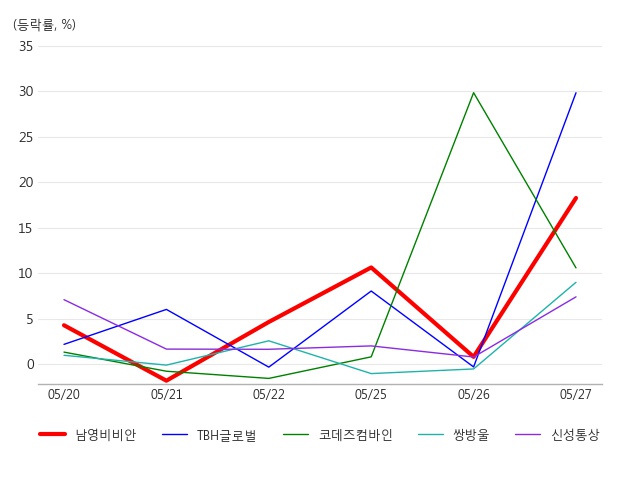

[Graph] Major stock price changes in the boycott of Japanese products (beneficiary) theme

According to the analysis by Thinkpool Robo Algorithm RASSI, Namyoung Vivian's quant financial score was 14.79 points, ranking 15th in the quant financial ranking within the boycott of Japanese products (beneficiary) theme. This can be interpreted as Namyoung Vivian having relatively low investment attractiveness from a financial perspective. On the other hand, Barrel ranked first in the quant financial ranking with higher growth, stability, and profitability scores compared to the average of other stocks.

[Table] Top stocks by financial score within the theme

※ The quant financial score is the result of the robo algorithm analyzing each company's sales growth rate, equity growth rate, debt ratio, current ratio, ROA, ROE, etc.

※ This article was generated in real-time by an article automatic generation algorithm jointly developed by Asia Economy and the financial AI specialist company Thinkpool.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.