Netflix Invests 20 Trillion Won

Carefully Crafting Content to Secure Advantage

[Asia Economy Reporter Kim Heung-soon] 46 trillion won.

This is the scale of investment expected to be poured into content production this year by major overseas online video services (OTT), including Netflix. Due to the impact of the novel coronavirus disease (COVID-19), video content consumption has shifted from theaters and television to OTT platforms, igniting a 'money game' aiming for OTT dominance. Compared to global companies, the domestic OTT industry, which is severely lacking in investment scale, is struggling to produce differentiated content.

Securing Global Subscribers

Original Series as a Winning Strategy

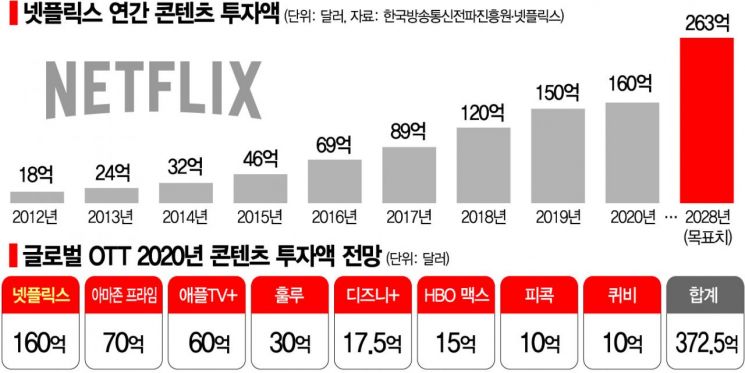

According to foreign media such as the US economic outlet Forbes on the 25th, Netflix, the world's number one OTT operator, plans to invest $16 billion (approximately 20 trillion won) solely in content production this year. This amounts to about 75% of last year's revenue of $20.2 billion (approximately 24 trillion won) being fully invested in production costs. Netflix's content investment has increased nearly tenfold in eight years, from $1.8 billion in 2012 when it first introduced original (self-produced) series. Earlier, global market research firm BMO Capital projected that if Netflix maintains this investment trend, it will pour $26.3 billion (approximately 30 trillion won) into content investment by 2028.

The reason for this intensive production is interpreted as an attempt to gain an advantage amid the emergence of successive OTT competitors. Already, in November last year, Apple TV Plus and Disney Plus debuted in the US and began attracting global subscribers. In July, NBCUniversal's new streaming service Peacock will launch. These platforms are expected to target the market with their own original series, making this year likely the inaugural year of the OTT content money game.

A Netflix representative explained, "Given the nature of OTT services targeting global subscribers, resolving complex licensing issues related to content investment and distribution is important," adding, "The ultimate goal is to fill all Netflix content with original series, which are free from such burdens and useful for increasing subscriber interest." According to the book 'Content is Everything' published by Mirae's Chang in January, Netflix's original content accounted for about 8% of the total in 2018 but influenced 37% of the viewing time by subscribers.

Based on Netflix's investment amount, latecomers are also expected to make bold bets on content production this year. Amazon Prime is reported to have allocated $7 billion, Apple TV Plus $6 billion, and Hulu, which streams US broadcast content, $3 billion. Additionally, Disney Plus $1.75 billion, HBO Max $1.5 billion, Peacock $1 billion, and mobile-focused streaming service Quibi $1 billion, combined, bring the total investment of major OTT companies this year to $37.25 billion (approximately 46.27 trillion won).

Global OTT Market Expected to Grow from 17 Trillion Won in 2014 to 86 Trillion Won in 2023

Concerns over Overseas Operators' Offensive, Domestic Companies Also Actively Investing in Content

According to the Ministry of Science and ICT, the global OTT market, which was worth 17 trillion won in 2014, is expected to grow more than fivefold to 86 trillion won by 2023. It is evaluated that there is sufficient momentum to secure subscribers by investing huge budgets in content within the related market. A domestic OTT industry official said, "In the existing wired broadcasting market, competition was fierce over a limited number of subscribers with uniform content provided by comprehensive wired broadcasting operators (SO), but OTT can attract multiple subscribers with differentiated content selectively invested by each operator using various devices, so growth potential is high."

Netflix's dominance of content has also grown in South Korea. According to the Korea Media Rating Board, which reviews and classifies films, videos, performances, advertisements, and promotional materials, Netflix, which started service in Korea in 2016, requested classification for 5,553 foreign videos over the past four years, nearly half of the total 11,414 foreign videos classified during the same period. Classification is a mandatory procedure that domestic and foreign videos must undergo before distribution in Korea, providing a basis for comparing which company's content has a higher share.

Although smaller in scale compared to overseas operators, domestic OTT companies are also focusing on providing exclusive content to attract new subscribers and secure competitiveness. 'Wavve,' a collaboration between SK Telecom and the three terrestrial broadcasters, is a representative example. It plans to invest 60 billion won in producing up to eight original contents, including terrestrial and comprehensive programming dramas and idol variety shows, by the end of this year, with a total investment of 300 billion won planned through 2023.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)