Market Cap Ranks 9th as of Closing on 22nd with Record Highs

Sales 35 Times Higher, 'Goliath' Hyundai Motor Surpassed

ICT-Centered Industrial Map Reshaped by 4th Industrial Revolution

Rapid Change Patterns Confirmed Amid COVID-19 Spread

[Asia Economy Reporter Song Hwajeong] "Kakao surpassing Hyundai Motor, which has 35 times the sales and 17 times the operating profit, to rise to the 9th largest market capitalization is a symbolic phenomenon representing the current shift in market leadership."

On the 22nd, based on the closing price, Samsung Securities analyst Shin Seungjin evaluated Kakao's market capitalization surpassing Hyundai Motor for the first time in this way. As the 4th Industrial Revolution rapidly grows ICT, internet, and healthcare sectors, the industrial map was expected to be reorganized, and the novel coronavirus infection (COVID-19) accelerated this change. In particular, the change in the top market capitalization stocks on the KOSPI reflects this trend exactly.

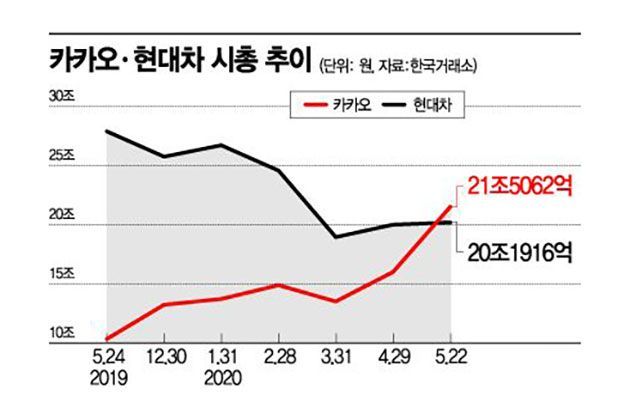

As of 10:41 AM on the 25th, Kakao recorded 260,000 KRW, up 5.26% (13,000 KRW) from the previous day. Kakao, which has been hitting record highs day after day, surpassed 250,000 KRW at the opening and rose to 265,500 KRW during the session, setting a new all-time high again in just one day. This marks the fourth consecutive day of strong gains. With this momentum, Kakao's market capitalization surpassed Hyundai Motor based on the closing price on the 22nd. On the 22nd, Kakao's market cap was 21.5062 trillion KRW, while Hyundai Motor's was 20.1916 trillion KRW. Continuing this momentum, Kakao also overtook LG Household & Health Care during the session on the 25th to rise to 8th place.

◆ Declining Cha-Hwa-Jeong, Rising Internet and Healthcare = The KOSPI market capitalization landscape is rapidly changing. Traditional leading industries in the domestic stock market such as automobiles, chemicals, steel, and finance are being pushed out of the top ranks, replaced by internet, healthcare, and secondary battery sectors. One year ago, on May 24 last year, the top 10 by market cap included Samsung Electronics, SK Hynix, Hyundai Motor, Celltrion, LG Chem, Shinhan Financial Group, SK Telecom, Hyundai Mobis, POSCO, and LG Household & Health Care. However, as of the closing price on the 22nd, the top 10 were Samsung Electronics and SK Hynix holding 1st and 2nd, followed by Samsung Biologics, NAVER, Celltrion, LG Chem, Samsung SDI, LG Household & Health Care, Kakao, and Hyundai Motor. Traditionally strong leaders in finance, steel, and telecommunications have all been pushed out of the top 10, and only Hyundai Motor remains barely within the top 10 among automobile stocks. Instead, Samsung Biologics, NAVER, Samsung SDI, and Kakao have taken their places. Semiconductor, healthcare, internet, and secondary batteries each occupy two spots. LG Chem, which has maintained its position, is now driven more by secondary batteries than traditional chemicals.

Since the second half of last year, these growth stocks have rapidly surged, causing a sharp change in market cap rankings. NAVER, which was 14th a year ago in May, rose significantly in the second half and ended last year ranked 3rd by market cap. Samsung Biologics, which was 11th and outside the top 10 in May last year, has recorded new highs daily this year and currently ranks 3rd. Samsung SDI, which was 21st and outside the top 20 a year ago, surged from the end of last year and entered the top 10 this year, settling at 7th place.

The rapid growth of these stocks recalls the 'Cha-Hwa-Jeong (automobile, chemical, refining stocks)' that led the KOSPI's recovery after the financial crisis. Cha-Hwa-Jeong rapidly rose from 2009 to 2011, leading the KOSPI's recovery from the financial crisis. Due to Cha-Hwa-Jeong's strength, the KOSPI reached the 2200 level in May 2011. Nine years later, the role of Cha-Hwa-Jeong is now played by internet and healthcare sectors. The KOSPI, which experienced a sharp drop in March due to COVID-19, quickly recovered to touch the 2000 level within two months, largely thanks to new growth stocks such as internet, healthcare, and secondary batteries. Analyst Shin said, "The rally centered on these growth stocks is due to massive liquidity inflows driven by a low interest rate environment," adding, "Despite inevitable short-term shocks to real economic indicators caused by COVID-19, investor preference continues for companies related to non-face-to-face (untact) sectors that can achieve differentiated growth."

On the other hand, the once dominant Cha-Hwa-Jeong is gradually declining. The automobile industry has been hit by poor sales due to COVID-19, and refining stocks posted large losses in the first quarter due to the sharp drop in international oil prices.

◆ Industrial Reorganization Accelerated by COVID-19 = With the arrival of the 4th Industrial Revolution era, significant changes in leading industries were already anticipated. However, the sudden emergence of COVID-19 has rapidly accelerated the pace of these changes. As non-face-to-face culture spreads due to COVID-19, people's lifestyles have changed significantly, and industries have responded with faster changes. Park Soyeon, a researcher at Korea Investment & Securities, said, "As untact becomes common and normalized due to COVID-19, people feel no need to forcefully return to the old ways," adding, "Although only partially, people's lifestyle and consumption patterns may permanently change after COVID-19, which is a significant burden for traditional economic sectors and means some restructuring is inevitable."

Biotech stocks, which had been sluggish for a while due to COVID-19, have regained momentum. Hong Gahye, a researcher at Daishin Securities, said, "Even after COVID-19, this epidemic will remain a kind of trauma, sustaining interest in health and preference for over-the-counter drugs," and forecasted, "The spread of untact and activation of online consumption due to COVID-19 will further increase consumer accessibility to consumer health products, promoting market growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.