Tax Audit Conducted Upon Detection of Undeclared Income... Strict Response According to Tax Law

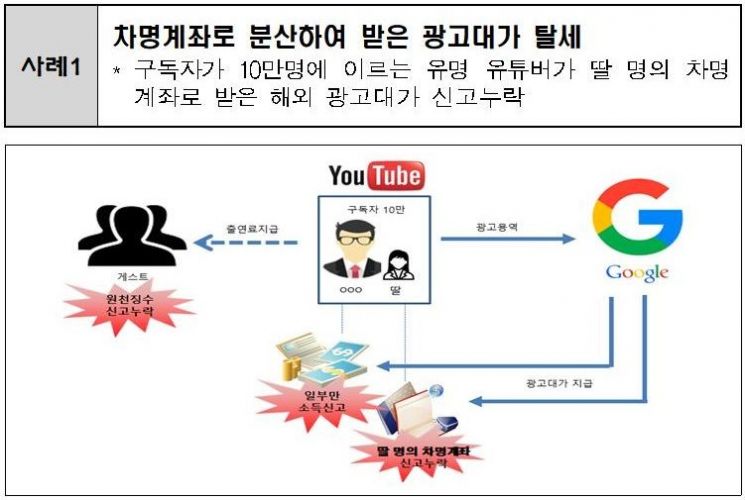

[Asia Economy Reporter Kwangho Lee] #Case 1= ○○○○ operates a YouTube channel that provides various content such as current affairs, culture, and politics, with over 100,000 subscribers. However, in the process of receiving advertising fees related to YouTube operations from the overseas platform operator Google, they registered an account under their daughter's name with Google and dispersed a significant portion of the fees to that account to conceal income. They also reported only a part of the fees received in their own account as comprehensive income tax. Furthermore, after featuring multiple guests on their YouTube channel and paying appearance fees, they failed to fulfill withholding tax obligations. Accordingly, the National Tax Service imposed additional taxes of ○ billion KRW, including income tax, on the omitted YouTube advertising income received through the nominee account.

#Case 2= ○○○○ is a BJ (Broadcasting Jockey) who has been conducting internet broadcasts for a long time, providing various content on platforms such as AfreecaTV and YouTube. They are a well-known social network service (SNS) celebrity with 200,000 followers, and their YouTube subscriber count reaches 170,000. While reporting viewer charging (star balloon) payments and advertising income received from Google and others, they failed to report income tax on small overseas advertising fees under $10,000. They also disguised personal expenses unrelated to the business as business expenses to evade income tax and failed to fulfill withholding tax obligations on payments made to coordinators and managers related to YouTube operations. The National Tax Service imposed additional taxes of ○ billion KRW, including income tax, on the omitted YouTube advertising income received in small amounts from Google and others.

The National Tax Service is strengthening verification of overseas income generated by high-income creators. As the number of creators earning high incomes, such as YouTubers and one-person agencies, is rapidly increasing, the methods of tax evasion are also diversifying. As of May, the number of YouTubers with over 100,000 subscribers reached 4,379, a sharp increase of 11.9% compared to 367 in 2015.

A National Tax Service official stated on the 24th, "There are concerns that some high-income creators receive large advertising fees from overseas platform operators such as Google and evade taxes by using nominee accounts or splitting small remittance amounts to disperse and conceal income, thereby avoiding the tax authorities' surveillance," explaining the background for strengthening verification.

Starting this year, the National Tax Service plans to conduct detailed analyses of foreign exchange transaction data exceeding $1,000 per transaction and $10,000 per individual annually, and to utilize tax infrastructure such as cross-country financial information exchange data to focus on verifying high-income creators who attempt intelligent tax avoidance by dispersing and concealing overseas income through nominee accounts or splitting remittance amounts.

If omitted income is confirmed as a result of the verification, strict measures will be taken according to tax laws, including conducting tax audits.

Last year, the National Tax Service also initiated tax audits on 176 high-income business operators engaged in new and booming industries such as YouTubers and one-person agencies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.