Alcohol OEM Production Allowed... PB Beer to Appear in Food Service Brands and Convenience Stores

Expectations for Korean Guinness Debut... Meeting Consumer Needs with Various Product Attempts

Abolition of Usage Labels for Home and Large Store Products... Cost Reduction Expected

[Asia Economy Reporter Lee Seon-ae] Now, when ordering chicken from Kyochon Chicken, you can order 'Kyochon Beer' together, and when ordering food from Baedal Minjok, you can order 'Baemin Beer' as well. You can also conveniently enjoy craft beers from breweries lined up in areas like Gyeongridan-gil and Yeonnam-dong in canned form.

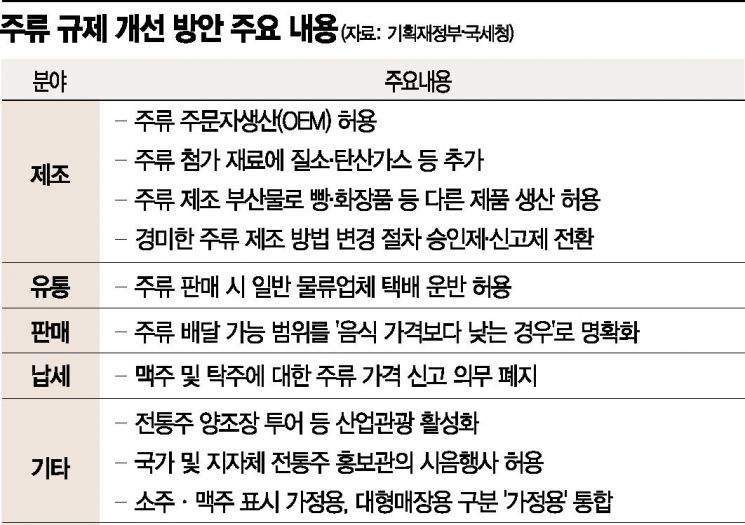

On the 20th, the liquor industry welcomed the announcement of liquor regulation improvement measures by the Ministry of Economy and Finance and the National Tax Service. Although the reactions varied by type of liquor, a total of 18 regulations across manufacturing, distribution, sales, and taxation sectors will be eased. An executive from a leading domestic liquor company said, "We expect craft beer and traditional liquor to benefit the most from the deregulation," adding, "There were many regulatory relaxations that the entire industry welcomed."

◆ Era of Liquor OEM = The biggest change is the emergence of a new industry of 'contract manufacturing (OEM) specialized production' in the liquor market. With the full legalization of liquor contract manufacturing, everyone can now have their own liquor brand. This means that dining brands, convenience stores, and restaurants can have and distribute their own private brand (PB) beer. By setting up minimal brewing facilities and obtaining a liquor manufacturing license, they can distribute 'PB beer' simply by placing OEM orders.

A representative from the dining industry predicted, "Since Kyochon Beer and Baemin Beer can be launched, various liquor brand wars will break out," and added, "Especially dining brands are expected to quickly start selling PB beer."

The craft beer industry expects the OEM production to lower the entry barriers for liquor production, expanding the market size and vitality. A craft beer industry insider explained, "For companies that completed craft beer recipes but could not mass-produce due to the burden of equipment investment costs, it is positive that they can increase production by utilizing other beer manufacturers' facilities," and added, "Also, existing breweries with equipment now have opportunities to generate profits through OEM production."

However, there are also concerns. If major clients of breweries request OEM beer production and prioritize selling these PB beers, fierce competition is inevitable. A person operating a brewery emphasized, "The identity unique to craft beer will disappear due to brand proliferation and wars," and warned, "Typical problems arising from OEM production systems could also occur in the liquor industry."

There is also concern about the entry of large companies. An industry insider pointed out, "Foreign large beer companies could dominate the domestic market with aggressive OEM strategies," and added, "Moreover, large corporations in distribution and food sectors that have not been involved in the liquor business might leverage their strong distribution networks to enter OEM product sales."

◆ Craft Beer and Traditional Liquor Smile, Wine and Whiskey Frown = The reactions vary by liquor type. The beer and soju industries welcomed the abolition of the large store usage label on soju and beer bottles. Previously, labels distinguished between household use, large store use, and entertainment food service use. Although the contents were the same, separate labels had to be produced depending on the distribution channel. From now on, all will be unified as household use.

A beer industry official said, "Even when household stock was insufficient and large mart stock was excessive, different labels forced us to produce new household products, causing unnecessary costs and time," adding, "The abolition of usage labels will save costs in production, logistics, and inventory management, which is positive and will be especially beneficial for the craft beer industry that produces small quantities of many varieties."

Expectations are also high for the emergence of a 'Korean Guinness.' Under current law, nitrogen gas cannot be used as an additive in beer, but the revision now allows nitrogen addition. Using nitrogen creates smaller bubbles, resulting in a smoother taste. Both large manufacturers and craft beer companies will be able to try more diverse products, increasing the variety of flavors consumers can enjoy. Companies that lacked equipment to can beer and had to sell only draft beer can now outsource packaging to produce canned products. This means consumers will have more opportunities to drink distinctive craft beers in cans.

Sales-related regulations have also improved. When ordering food, if the liquor price is lower than the food price, online sales are allowed. This enables ordering chicken with beer, jokbal (pig's trotters) with soju or traditional liquor, which is expected to increase consumption of beer, soju, and traditional liquor at home.

The traditional liquor industry is smiling broadly as tax relief earlier this year is followed by permissions for contract production, delivery logistics, and tasting events. Support for expanding the base of traditional liquor has been strengthened, including allowing tasting events at promotional centers, raising industry expectations.

The wine and whiskey industries expressed regret as there was no change despite their desire to switch from ad valorem tax to specific tax, as was done for beer and takju (unfiltered rice wine). They are raising their voices to sequentially implement specific tax for wine and whiskey, considering fairness among liquor types.

Some liquor wholesalers are also concerned. They worry about the use of general courier vehicles for liquor transportation. While large manufacturers with well-established logistics systems can handle sudden demand, small breweries find it difficult to respond. Although positive overall, wholesalers find the situation awkward. A wholesaler said, "Allowing courier services instead of dedicated liquor logistics will inevitably reduce the influence of about 1,100 comprehensive liquor wholesalers nationwide," expressing concern.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)