Food and Beverage Index at 3788.21 on the 13th... Up 9.75% Since the Beginning of the Year

[Asia Economy Reporter Geum Bo-ryeong] Food stocks showed strong performance in the first quarter, and analysis suggests this trend will continue through the second half of the year. This is expected due to the continuous growth in the Home Meal Replacement (HMR) sector, government policy support, and the popularity of Korean food (K-Food) overseas. The impact of the novel coronavirus disease (COVID-19) is also expected to improve the performance of health functional foods.

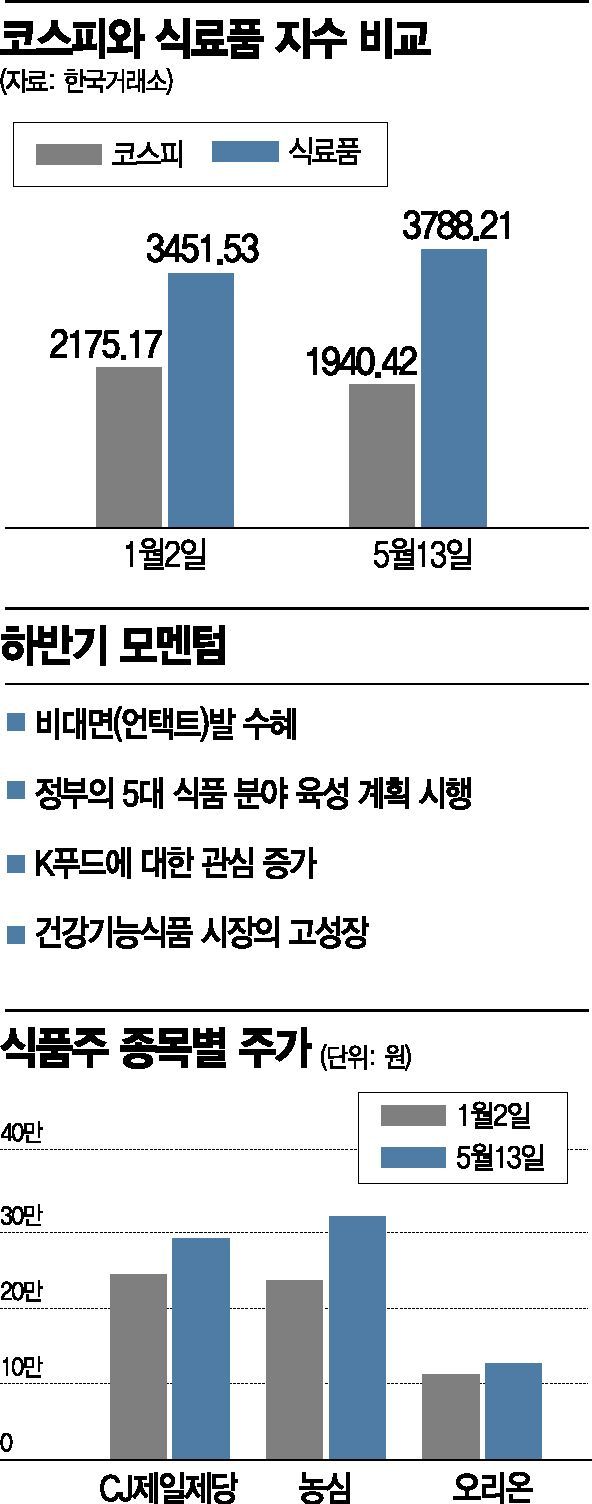

According to the Korea Exchange on the 14th, the food and beverage index recorded 3,788.21 as of the previous day. This is a 9.75% increase compared to 3,451.53 on January 2. In contrast, during the same period, the KOSPI index fell 10.79%, from 2,175.17 to 1,940.42.

Despite concerns about corporate earnings in the first quarter due to the COVID-19 crisis, food stocks posted good results. Orion achieved consolidated sales and operating profit of 539.8 billion KRW and 97 billion KRW respectively, up 8.5% and 25.5% year-on-year. Dongwon F&B also saw sales and operating profit increase by 4.7% and 4.5% to 781.6 billion KRW and 36.5 billion KRW respectively. CJ CheilJedang, Nongshim, and Lotte Foods are also expected to see profit growth.

Food stocks are expected to maintain strong performance in the second half as well. First, the untact (non-face-to-face) culture that began due to COVID-19 is expected to upgrade profitability this year. The HMR sector is anticipated to grow significantly. According to CJ CheilJedang Research, 84.7% responded that dining out decreased after COVID-19, while 75.7% said they maintained or increased HMR purchases. If COVID-19 prolongs, 98.6% said they would reduce dining out, and 94.1% said they would maintain or increase HMR consumption.

The government’s five major food sector development plan will also be fully implemented. At the end of last year, the government announced it would select and focus on five promising food sectors aligned with food consumption trends. These five sectors are customized special foods (medifood, senior-friendly foods, pet food, etc.), functional foods, convenience foods, eco-friendly foods, and export foods, which are considered to have high growth potential and social and economic importance. The government plans to increase the domestic industry size of these five sectors from 12.44 trillion KRW in 2018 to 16.96 trillion KRW in 2022 and 24.85 trillion KRW by 2030. Shim Eun-joo, a researcher at Hana Financial Investment, explained, "The five major food sectors are expected to grow at an average annual rate of 8.1% over the next four years due to government policies. Companies related to functional, convenience, and export foods are already showing visible results, so this policy is expected to trigger a leap forward."

Growing interest in K-Food is also good news for food stocks. According to Hana Financial Investment and the Korea Customs Service, processed food exports last year increased by 4.9% year-on-year to approximately 5.78 trillion KRW. In the first quarter of this year, processed food exports rose 12.4% year-on-year, thanks to interest in K-Food. CJ CheilJedang’s U.S. sales are expected to reach 600 billion KRW this year, led by "Bibigo Dumplings," and Nongshim’s ramen export volume is also expected to increase significantly. Orion’s market share of pies, snacks, and biscuits in China is growing, with estimated sales in China reaching 1.0932 trillion KRW this year.

Related stocks have already been on the rise. Despite COVID-19, CJ CheilJedang’s stock price rose 19.18% from 245,000 KRW on January 2 to 292,000 KRW the previous day. During the same period, Nongshim rose 35.65% from 237,000 KRW to 321,500 KRW, and Orion increased 22.75% from 105,500 KRW to 129,500 KRW.

The high growth of the health functional food market is also noteworthy. Han Kyung-rae, a researcher at Daishin Securities, said, "The domestic health functional food market size was estimated at about 4.6 trillion KRW last year, recording a high average annual growth rate of 11.7% from 2.9 trillion KRW in 2015. Due to the spread of COVID-19, demand for health functional foods to improve immunity is additionally increasing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.