[Asia Economy Reporter Jeong Hyunjin] "Italy has long been Europe's wildcard. The novel coronavirus disease (COVID-19) has ultimately increased the risk." - The Washington Post (WP)

Italy, which has been suffering from chronic fiscal instability, has once again become a flashpoint for the European economy due to COVID-19. Since the 2012 European debt crisis, the country has not shaken off the label of having weak economic fundamentals such as high debt levels and unemployment rates. Instead, concerns are growing that the 'black swan' event of COVID-19 will lead to the worst economic growth rate. The country's credit rating has been pushed to just above speculative grade.

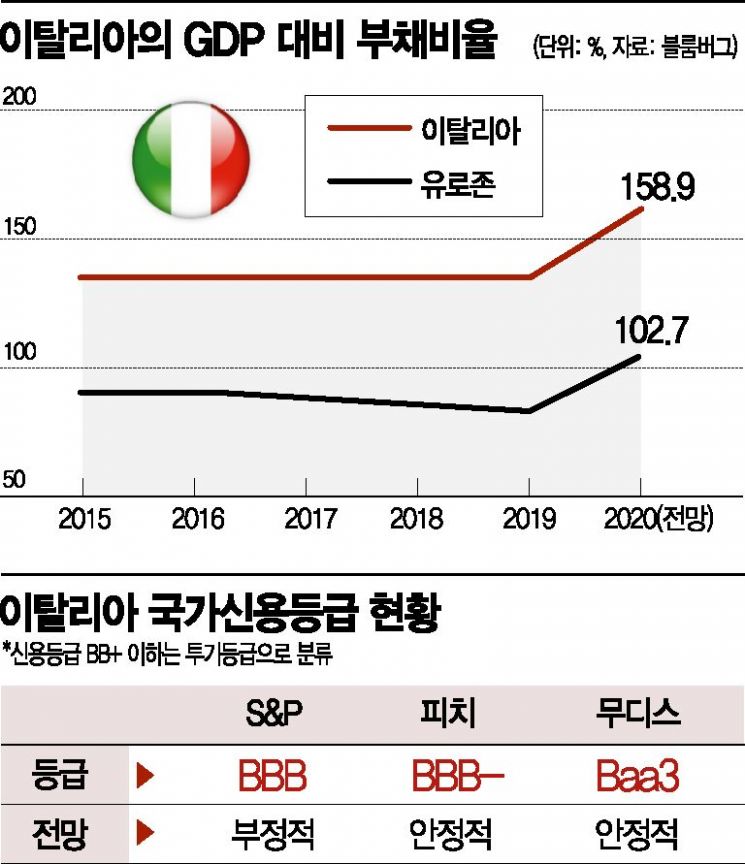

According to Bloomberg and others on the 11th (local time), the three major credit rating agencies S&P, Moody's, and Fitch have assessed Italy's sovereign credit rating at just above speculative grade (BB+ or below). Moody's decided on the 8th to maintain Italy's credit rating at Baa3 and keep the outlook 'stable' for now, but Fitch downgraded the rating from BBB to BBB-, and S&P changed the outlook from 'stable' to 'negative.' Canadian credit rating agency DBRS also revised Italy's credit rating outlook from 'stable' to 'negative' on the 8th.

The market's focus on Italy is due to its high likelihood of becoming a weak link in the global economy. In particular, if Italy, often regarded as the 'sick man' of Europe, is not rescued in time, the rift between Southern and Northern Europe could deepen, raising concerns that Italexit (Italy's exit from the EU) could become a reality following Brexit (the UK's exit from the European Union).

Concerns about Italy are also reflected in government bond yields. Italy's 10-year government bond yield closed at 1.876% that day. The 10-year bond yield, which was below 1% in mid-February, peaked at 2.4% on March 18 as COVID-19 spread, and has since fluctuated in the high 1% range. The credit default swap (CDS) premium, which reflects default risk, has more than doubled.

The most worrisome factor is fiscal debt. Italy's debt-to-GDP ratio is expected to rise to 158.9% this year. At the end of last year, it already reached 135%, far exceeding the Eurozone average debt ratio of 84% (among the 19 countries using the euro). It is the second highest debt ratio in the Eurozone after Greece. The fiscal deficit ratio is also expected to increase from 1.6% of GDP at the end of last year to 10.4% this year.

Additionally, COVID-19 has hit Italy's key economic sectors, further heightening market concerns. Italy relies on tourism, which has been severely impacted by COVID-19, for 13% of its GDP. The country also has a higher proportion of small businesses compared to other nations. It is noteworthy that the northern region, which has the highest number of COVID-19 cases, is home to major economic drivers such as automobile factories.

The Italian government forecasts a GDP growth rate of -9.5% this year. The unemployment rate, which fell from 13% in 2014 to 10% last year, is expected to rise again. WP reported that Italy is "one of the countries hardest hit economically as a single nation" in the world.

The market is paying close attention to Italy's economic reopening and European-level support measures going forward. The reason Italy has so far maintained investment grade despite the risk of falling to speculative grade is due to expectations of support from the EU and the European Central Bank (ECB). Since Italy's collapse would inevitably lead to the collapse of the Eurozone economy, it implies that the EU will not stand by and watch its member Italy fail.

However, the rift between Italy and the EU runs quite deep emotionally. In June 2018, the populist parties Five Star Movement and the Northern League formed the first populist coalition government in Western Europe, and since then, the Italian government has clashed with the EU annually over budget plans. According to EU fiscal rules, member states must keep fiscal deficits and public debt within 3% and 60% of GDP, respectively. But Italy has openly clashed, saying it is "ready to break the rules." The EU expresses dissatisfaction, claiming Italy's populist policies exacerbate the crisis. Policies promoted by the populist coalition government include basic income, easing pension reforms, and providing social security benefits.

Giuseppe Conte, the Italian Prime Minister leading the Five Star Movement, has pressured the EU during the COVID-19 crisis, demanding active support for member states. The Italian government is determined to lift lockdown measures and return to normalcy to revive the economy by summer. In a recent interview, he said they plan to lift lockdown measures earlier than initially planned and emphasized that the EU must provide economic recovery funds in the second half of the year. He also advocated issuing European joint bonds, so-called 'corona bonds,' to help economically struggling member states during the COVID-19 crisis. Germany and the Netherlands oppose this.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.