Sellers or Investors Involved in Design and Operation... Ambiguity Between 'Consultation' and 'Instruction'

Joint Venture of License-Free Sellers and Track Record-Less Operators

Issues Include Sellers Pursuing Self-Interest and Insufficient Verification of Operators' Capabilities... Potential Consumer Harm

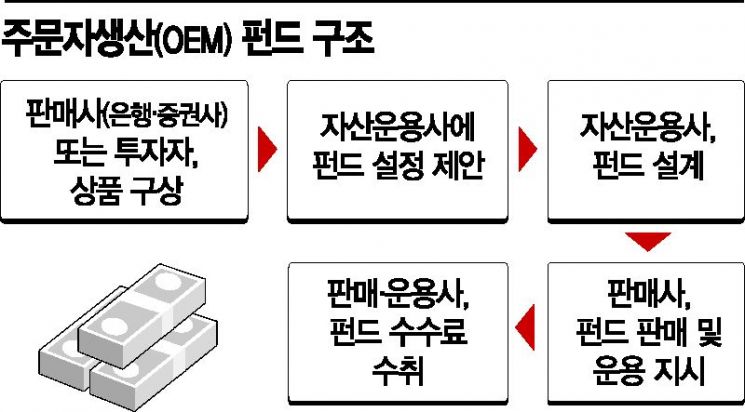

[Asia Economy Reporter Haeyoung Kwon] The 'Original Equipment Manufacturer (OEM) Fund' is considered a blind spot in private equity fund regulations. As the private equity fund market grows, suspicious cases of OEM funds are also increasing, but the criteria for judgment, such as the distinction between 'consultation' and 'instruction,' are ambiguous and difficult to prove, placing them in a 'gray zone' between legality and illegality.

OEM funds stem from the structural power imbalance between distributors and manufacturers. Banks and securities firms (distributors) often exploit their superior position to covertly intervene deeply in the authority of asset management companies (manufacturers), from product design to operational instructions. Asset managers find it difficult to refuse the demands of banks and securities firms that sell their funds, and distributors are not penalized even if the fund is revealed as an OEM fund, creating a structure that pressures asset managers. Some corporate investors also create OEM funds by involving small asset managers to receive tax benefits. They give practical operational instructions, such as specifying stocks and bonds to be included in the fund, while only giving the asset managers a fee.

A distributor official stated, "Distributors need to satisfy various investment demands, and small asset managers with low market recognition need to build a track record," adding, "While some asset managers are pushed into creating OEM funds, in most cases, the needs of distributors and manufacturers align."

The problem is that beyond unauthorized securities business by distributors and distributor bullying, OEM funds can also lead to expanded consumer harm.

For example, distributors can design fund structures to favor their commission profits, thereby pursuing self-interest. In the case of overseas interest rate-linked derivative-linked funds (DLFs), which financial authorities effectively consider OEM funds, banks were suspected of pressuring asset managers to set short fund maturities to earn commission revenue. Many DLFs had expected returns of 3-4% per year, maturities of 4 months, and sales commissions of 1-1.5% of the investment amount. If investors reinvest at the product maturity, distributors can earn sales commissions of 3-4.5% annually, which is comparable to the DLF's expected annual return.

Another issue is when the asset manager's capability is unverified. Most OEM fund orders are placed with small to medium-sized asset managers. Although asset managers design and operate funds according to distributors' plans, there are many cases where their fund management skills, such as risk management, are significantly lacking, resulting in failure to respond to changing market conditions and expanded losses. Some overseas real estate funds that recently caused losses to individual investors fall into this category, according to industry sources.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)