[Asia Economy Reporters Kim Hyunjung (Sejong), Kim Bokyung (Sejong), Jang Sehee] As the government begins full-scale discussions on the phased introduction of the 'Universal Employment Insurance System,' key preliminary tasks include reforming the premium system, addressing legal blind spots, and securing funding. Since the government's 'Durunuri Social Insurance Premium Support Project' in 2012, this marks the first major overhaul of employment-related social insurance systems in over eight years. Experts commonly point out the need to fix longstanding institutional flaws and establish reasonable standards.

According to the government on the 11th, related ministries such as the Ministry of Economy and Finance and the Ministry of Employment and Labor are discussing phased measures to lay the foundation for 'universal employment insurance enrollment.' First, through the Employment Insurance Act amendment bill currently pending in the National Assembly (led by Representative Han Jeong-ae of the Democratic Party), the plan is to enable special employment workers (SEWs), platform workers, and artists to receive employment insurance benefits within this year. Additionally, efforts will be made to promote enrollment of other uninsured workers and establish an income tracking system to support this.

Minister of Employment and Labor Lee Jae-gap announced at the Employment and Labor Crisis Response Task Force (TF) meeting that as the first step toward the 'Universal Employment Insurance System,' from next year, employment insurance will be applied to SEWs such as private tutors and artists. Minister Lee said, "To lay the foundation for an era where all employed persons receive employment insurance benefits, the government will promptly apply employment insurance to SEWs and artists, who have been socially discussed so far."

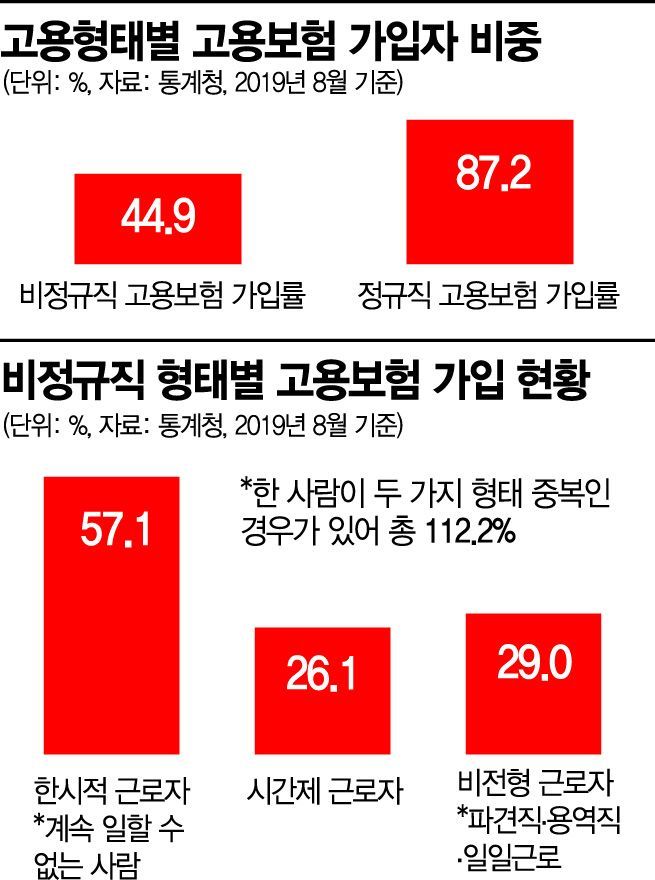

The biggest issue in this process is the shift in the method of imposing employment insurance premiums. Currently, premiums are calculated based on 'wages' centered on employers, which inevitably leads to a large number of uninsured workers depending on employment type. According to Statistics Korea, as of August last year, the employment insurance enrollment rate was 44.9% for non-regular workers and 87.2% for regular workers. Among non-regular workers, part-time workers had only a 26.1% enrollment rate. Professor Ha Jun-kyung of Hanyang University’s Department of Economics said, "Premiums should be recalculated considering employment type and income level," adding, "Moreover, how much social inclusiveness for vulnerable groups is incorporated is also crucial."

There are also claims that for workers like SEWs and platform workers who earn income from multiple companies, premiums should be imposed on employers based on income amounts, or the premium level should be determined based on sales or profits generated through their employment. Researcher Choi Hyun-soo of the Korea Institute for Health and Social Affairs emphasized, "By utilizing the National Tax Service’s Hometax system for tax collection, a system can be quickly established to impose premiums based on income rather than wage relationships," adding, "For platform workers whose employment relationships are difficult to define, premiums should be calculated based on paid income, and employers should bear the minimum social cost based on sales or profits generated by employing them."

Imija, Chair of the Employment and Labor Subcommittee of the National Assembly Environment and Labor Committee, is attending the Employment and Labor Subcommittee meeting held at the National Assembly on the 11th and greeting Democratic Party lawmaker Han Jeong-ae. On this day, the subcommittee reviews the "Employment Insurance Act Amendment" aimed at expanding the scope of employment insurance coverage and the "Job Seeker Employment Promotion and Livelihood Stabilization Support Act" for the introduction of the National Employment Support System. Photo by Yoon Dong-ju doso7@

Imija, Chair of the Employment and Labor Subcommittee of the National Assembly Environment and Labor Committee, is attending the Employment and Labor Subcommittee meeting held at the National Assembly on the 11th and greeting Democratic Party lawmaker Han Jeong-ae. On this day, the subcommittee reviews the "Employment Insurance Act Amendment" aimed at expanding the scope of employment insurance coverage and the "Job Seeker Employment Promotion and Livelihood Stabilization Support Act" for the introduction of the National Employment Support System. Photo by Yoon Dong-ju doso7@

There have also been calls to abolish the exclusion clause for workers under the Labor Standards Act to fundamentally resolve the issue. Researcher Choi said, "The existing wage-centered social insurance system borrows the legal condition of 'worker,' but due to the exclusion clause, employers can legally avoid social insurance enrollment," emphasizing, "Legal clarification on this should be completed early in the 21st National Assembly to begin detailed discussions on universal employment insurance."

As the public nature of employment insurance strengthens, government fiscal expenditure is expected to be inevitable. With concerns about the depletion of the employment insurance fund, securing additional financial capacity is a government task. The employment insurance fund has been in surplus since 2012 but recorded a deficit of 810 billion KRW in 2018. Due to a sharp increase in unemployment benefit payments, last year's deficit exceeded 2 trillion KRW. However, the Ministry of Economy and Finance, responsible for fiscal matters, maintains that funding for employment insurance should fundamentally come from employers and workers. A government official stated, "Unemployment benefits from employment insurance have never been transferred to the general account," and "In principle, it is appropriate for the employment insurance fund to be financed by money paid by workers and employers."

Meanwhile, the current Employment Insurance Act amendment bill, led by Representative Han Jeong-ae, covers only SEWs, artists, and platform workers, so additional discussions on self-employed persons are necessary. A government official said, "Currently, one-person self-employed individuals who join employment insurance receive a 50% premium subsidy for three years," but added, "If protection for vulnerable groups is needed, it should be separately reviewed." There are also talks that if self-employed persons are included, the government might partially support the 'Employment Stability and Vocational Competency Development Project' costs borne by companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.