[Asia Economy Reporter Park So-yeon] SK Innovation recorded an operating loss of over 1.7 trillion KRW in the first quarter. This is the largest loss since the company's founding in 1962. The loss was due to decreased demand caused by the spread of the novel coronavirus infection (COVID-19) and a sharp drop in oil prices. Including non-operating losses such as foreign exchange losses from a strong won, the total deficit reached the 2 trillion KRW range.

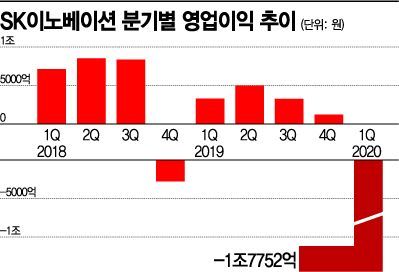

SK Innovation announced on the 6th that its consolidated operating profit for the first quarter turned to a loss of -1.7752 trillion KRW, a decrease of 2.1033 trillion KRW compared to the same period last year. Sales decreased by 1.6144 trillion KRW (12.6%) year-on-year to 11.163 trillion KRW. Compared to the previous quarter, sales fell by 625.5 billion KRW (5.3%), and operating profit decreased by 1.8977 trillion KRW. Notably, the scale of the operating loss was an 'earnings shock,' falling short of the market's initial forecast of 1.0039 trillion KRW. This astronomical loss surpasses the operating profit of 1.2693 trillion KRW earned by the company throughout last year. It is also more than four times the previous worst-ever operating loss of 421.7 billion KRW recorded in Q4 2014. ▶Related article on page 3

Most of the losses occurred in the petroleum business division, which recorded an operating loss of 1.636 trillion KRW. Inventory-related losses due to the sharp drop in oil prices alone amounted to 941.8 billion KRW. The remainder was caused by negative margins, where product prices such as jet fuel and gasoline fell below crude oil prices.

The chemical business division also turned to a loss, recording an operating loss of 89.8 billion KRW. Despite a slight increase in the spread (price difference between products and raw materials) of major products, the impact of demand deterioration due to COVID-19 and inventory losses caused by falling naphtha prices were significant. This is the first quarterly loss in the chemical business since Q4 2015.

The lubricants business maintained profitability but recorded 28.9 billion KRW, down about 5.8 billion KRW from the previous quarter. The petroleum development business saw an increase of about 4 billion KRW compared to the previous quarter, totaling 45 billion KRW, due to reduced field operating costs. The battery division, which began mass production this first half of the year at plants completed last year in China and Hungary, reduced losses by more than 7 billion KRW through operational efficiencies, recording an operating loss of 100 billion KRW. The materials division recorded an operating profit of 27 billion KRW due to increased sales of lithium-ion battery separators for electric vehicles.

Following S-Oil (operating loss of 1.0073 trillion KRW) and Hyundai Oilbank (operating loss of 563.2 billion KRW), SK Innovation also posted an astronomical operating loss, making it likely that the combined operating losses of the four major domestic refiners will exceed 4 trillion KRW in the first quarter. The losses of the three refiners that have announced results so far amount to nearly 3.3 trillion KRW. GS Caltex, which is expected to announce its results soon, is also forecasted to post an operating loss exceeding the initially expected 500 billion KRW range, reaching a level similar to S-Oil.

Kim Jun, CEO of SK Innovation, said, "Although we are facing the worst-ever business environment due to the impact of COVID-19, we are overcoming the crisis by improving our business structure and innovating our business model."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.