[Asia Economy Reporter Kim Hyo-jin] Special caution is required in managing the emergency disaster relief funds related to the novel coronavirus infection (COVID-19) provided by the government or local governments.

According to financial authorities on the 2nd, the emergency disaster relief funds are provided through methods such as credit cards or anonymous prepaid cards. Among these, anonymous prepaid cards, due to their anonymous nature, may become unusable for the remaining balance if lost or stolen.

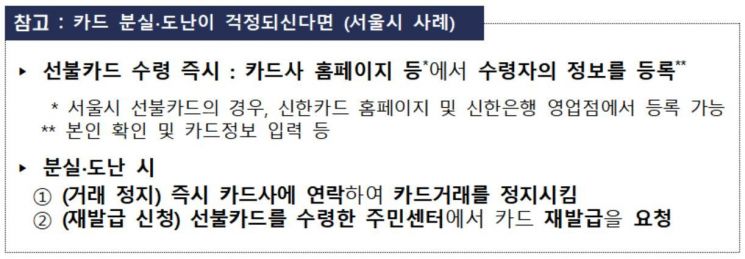

The Financial Supervisory Service recommends registering the recipient's information immediately upon receiving an anonymous prepaid card. By registering the recipient's information on the card company's website, reissuance is possible even if the card is lost or stolen during use, and the remaining balance can be used within the unused amount.

When registering holder information, services such as mobile phone balance notification and card loss registration via the card company's ARS are also available.

Upon receiving an anonymous prepaid card, one should check the usage period and restricted business sectors. For example, support funds provided by Seoul City and Gyeonggi Province can be used at credit card merchants within the city and province but cannot be used at entertainment establishments, gambling businesses, department stores, etc.

Be cautious of voice phishing and smishing related to COVID-19 disaster relief funds. If you are asked for personal information or account numbers over the phone, or encouraged to apply for low-interest loans related to COVID-19 or install smartphone applications, suspect voice phishing. If you receive text messages containing internet addresses about emergency disaster relief fund applications or gift certificate arrivals, suspect smishing, the Financial Supervisory Service explained.

The Financial Supervisory Service urged, "Immediately delete messages from unknown sources and refrain from clicking suspicious internet addresses."

If you suspect voice phishing or smishing fraud, report it to the National Police Agency (112), Financial Supervisory Service (1332), Illegal Spam Reporting Center (118), or the relevant financial institution. You can receive damage counseling and be assisted through fund payment suspension or refunds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.