AhnLab Stock Surges on COVID-19 Medical Volunteer News

People's Party Stock Falls Due to Poor Election Results

Leading Security Firm's Sales Steadily Increase

[Asia Economy Reporter Park Hyungsoo] Ahn Cheol-soo, leader of the People’s Party, was considered a major presidential candidate ahead of the 2012 '18th Presidential Election.' Ahn began his political activities by announcing his candidacy for the Seoul mayoral by-election in 2011, receiving overwhelming support from the younger generation. From that time, AhnLab’s (formerly AhnLab, Inc.) stock price began to fluctuate more based on Ahn’s approval ratings than on the company’s actual performance.

◆Stock Price Fluctuations Follow Ahn Cheol-soo’s Approval Ratings= Since its listing in September 2001, AhnLab’s stock price reached an all-time high on January 3, 2012. At one point during the trading session, it was traded at 167,200 KRW (adjusted for rights issue). Within five months of Ahn gaining attention as a political newcomer from a well-known entrepreneur and scholar, AhnLab’s stock price surged about sixfold. Trading trends at the time showed individual investors were heavily net buying AhnLab. AhnLab was among the top 10 stocks in net purchases by individual investors on the KOSDAQ market. Among individual investors, a so-called “super individual investor” who acquired a 10.8% stake in AhnLab saw the value of their shares approach 170 billion KRW at one point. Public disclosures revealed that this super individual investor made capital gains worth hundreds of billions of KRW.

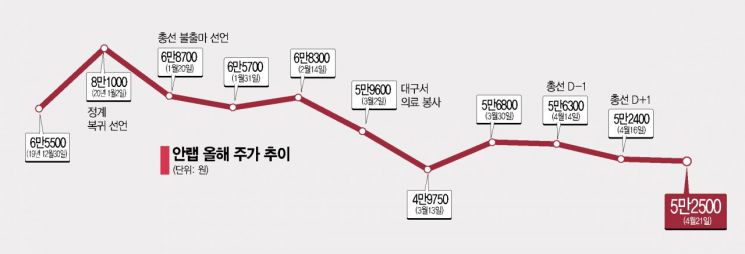

Despite no reasons for a surge in corporate value, AhnLab’s stock price rose continuously, prompting the company to issue a query disclosure response cautioning that “investing based on criteria other than corporate performance and value may cause damage to shareholders.” AhnLab’s stock price plummeted when Ahn, who had maintained high approval ratings, decided not to run in the 18th presidential election. Stocks that traded between 120,000 and 140,000 KRW dropped sharply to around 30,000 KRW within two months. Since then, AhnLab’s stock price has fluctuated in response to various political events.

This year as well, AhnLab’s stock price has been volatile depending on Ahn’s activities. On the 2nd of last month, AhnLab’s stock price jumped more than 10%. The news that Ahn volunteered for medical service in Daegu, where COVID-19 cases surged, influenced the stock price. On the 16th, news of the People’s Party’s poor performance in the general election led to a drop of more than 10% in AhnLab’s stock price during the trading session.

◆Leading Domestic Security Company with Steady Sales Growth= AhnLab is a leading domestic security company developing products such as V3, endpoint security, network security, and mobile security. It also provides related services including security monitoring, security consulting, and security system integration (SI) business. The company is growing by selling security products in Japan and China. AhnLab launched Korea’s first antivirus solution in 1995. Since then, it has continued to focus on research and development, keeping pace with global computer virus vaccine developers. In 2019, AhnLab became the first in Korea to receive the 'Advanced Threat Defense (ATD)' certification from ICSA Labs, a world-renowned security solution certification body, recognizing its world-class technological capabilities.

AhnLab invests nearly 30% of its annual sales revenue in research and development. Last year, it invested 46.7 billion KRW in R&D, accounting for 28.7% of total sales. In 2017 and 2018, the R&D investment ratio to sales was 25.5% and 29.2%, respectively.

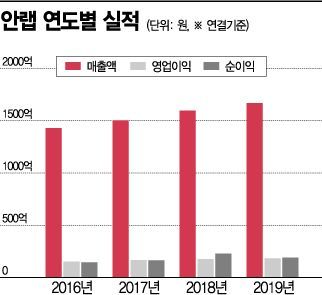

With high recognition in the domestic security market and steady R&D investment, AhnLab’s sales have steadily increased. Sales rose 32% from 126.8 billion KRW in 2012 to 167 billion KRW in 2019. Exports account for only 5% of total sales. If exports increase, the sales growth rate could accelerate. AhnLab is strengthening technology integration and certification with IT companies by participating in security ecosystem programs of global IT companies such as HP and IBM, laying the groundwork to target overseas markets.

Regarding shareholder composition, Ahn Cheol-soo, leader of the People’s Party, is the largest shareholder of AhnLab with an 18.6% stake (1.86 million shares). The Donggurami Foundation, established by Ahn with his private funds, also holds 9.99% (1 million shares) of AhnLab. About 47% excluding 13.3% treasury stock belongs to small shareholders. Last year, AhnLab paid a cash dividend of 900 KRW per share. The dividend yield at the time was 1.4%, similar to interest rates on bank deposits.

Based on last year’s performance, the current stock price is trading at a price-earnings ratio (PER) of about 24 times. Last year, AhnLab achieved an operating profit of 18.4 billion KRW and a net profit of 19.1 billion KRW. Operating profit increased by 4% compared to the previous year, but net profit decreased by 16%. The decline in net profit was due to a 3.6 billion KRW decrease in financial income compared to 2018.

◆Political Theme Stocks Continue to Prevail= Experts expressed concerns that as the March 2022 '20th Presidential Election' approaches, the volatility of theme stocks including AhnLab will increase. The period when theme stocks dominate ahead of presidential elections is becoming shorter. Ahead of the 2007 presidential election, the stock price of Ewha Gongyeong surged about 26 times in five months. Since then, attempts to catch political theme stocks at low points have increased, and ahead of the 2012 presidential election, stocks related to low birthrate policies attracted attention from May 2011.

Nam Gil-nam, senior researcher at the Korea Capital Market Institute, analyzed 70 political theme stocks during the 16th to 19th presidential elections and found that theme stocks related to both losing and winning candidates experienced relative price declines immediately after election day. He added, “No matter how much investors, listed companies, and regulatory authorities emphasize active responses, the limitations of the domestic stock market remain,” and “It is not easy to eradicate the political theme stock phenomenon, which can be described as a backward practice.”

Nam believes that to minimize damage from investing in political theme stocks, the fundamental change needed is the disappearance of the practice of collusion between politics and business, and a market led by investors capable of evaluating the intrinsic value of companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)