ETN Sanctions Lead to Surge in ETF Buying

Net Purchases Exceed Combined Amount of Hyundai Motor, SK Hynix, and Samsung Electronics

[Asia Economy Reporter Minwoo Lee] As historically low oil prices continue, individual investors are rapidly purchasing products such as oil-related exchange-traded funds (ETFs) and exchange-traded notes (ETNs). Despite regulatory measures like single-price trading and trading suspensions to cool overheated investment sentiment, investors remain confident that prices are at historic lows, and their enthusiasm has not diminished.

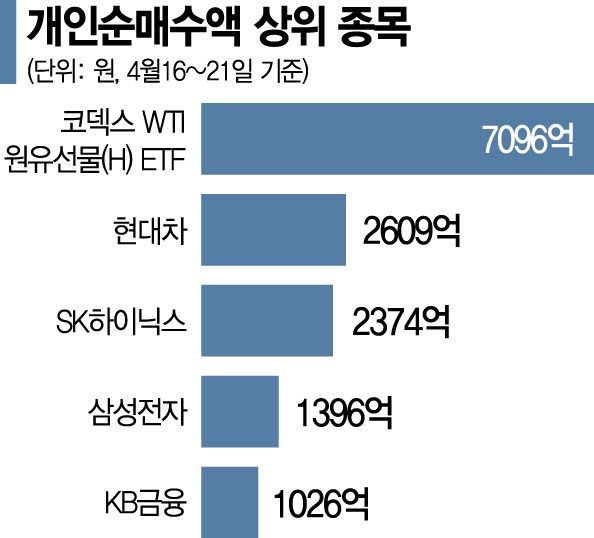

According to the Korea Exchange and NH Investment & Securities on the 22nd, individual investors net bought 709.6 billion KRW worth of 'KODEX WTI Crude Oil Futures (H)', an ETF tracking West Texas Intermediate (WTI) crude oil, over four trading days from the 16th to the 21st. It was the most purchased stock across both KOSPI and KOSDAQ during this period. The net purchase amount is nearly equivalent to the combined net purchases of Hyundai Motor (260.9 billion KRW), SK Hynix (237.4 billion KRW), Samsung Electronics (139.6 billion KRW), and KB Financial Group (102.6 billion KRW), which ranked 2nd to 5th respectively, totaling 740.5 billion KRW.

As investment in oil-related products overheated, regulatory authorities imposed sanctions on leveraged ETN products related to oil, leading investment sentiment to shift toward ETF products that avoided such restrictions. Earlier, on the 7th, the Korea Exchange announced a trading suspension for ETNs related to WTI crude oil futures with excessive premium/discount rates (the difference between indicative value and market price). However, as the premium/discount rates did not decrease, from the 16th, trading was suspended for three products: 'Samsung Leverage WTI Crude Oil Futures ETN', 'Shinhan Leverage WTI Crude Oil Futures ETN (H)', and 'QV Leverage WTI Crude Oil Futures ETN (H)'. Purchasing stocks with large premium/discount rates at market price can result in investment losses equivalent to the premium/discount during the adjustment of market price to indicative value. Shinhan Financial Investment resumed trading on the 21st by issuing an additional 200 million shares, but the premium/discount rate still remained in the 60% range.

In contrast, the premium/discount rate of 'KODEX WTI Crude Oil Futures (H)' remained between 2% and 5% despite the investment fervor. To reduce premium/discount rates, ETNs require liquidity providers (LPs) to pre-notify financial authorities and secure shares before additional issuance to place sell orders in response to investor purchases. However, ETFs can apply for additional creation and sell shares even if LPs have no inventory, theoretically allowing unlimited sell orders. Therefore, compared to ETNs, which experienced disturbances due to trading suspensions and single-price trading measures, relatively stable ETFs attracted more buying interest.

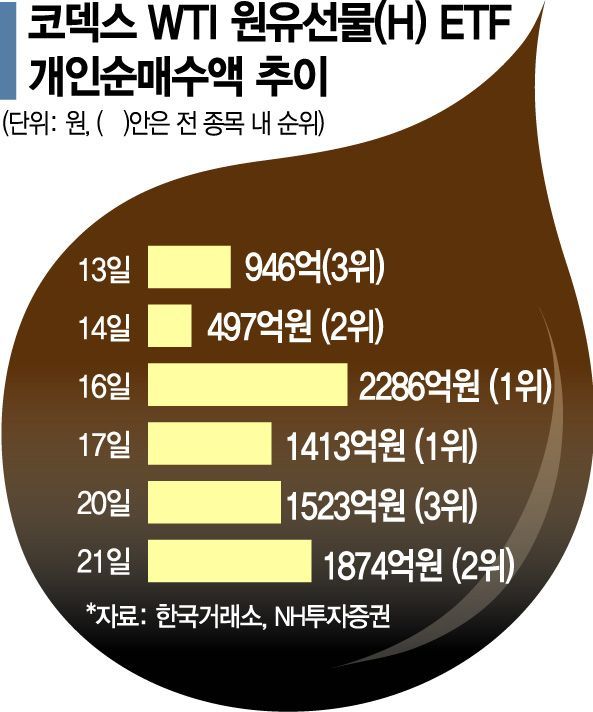

Since the Korea Exchange's measures began, 'KODEX WTI Crude Oil Futures (H)' has consistently ranked high in net purchases by individuals. Until the 6th, Samsung Leverage WTI Crude Oil Futures ETN had the highest net purchases among oil-related products. After the exchange's measures were announced, net purchases of 'KODEX WTI Crude Oil Futures (H)' increased, making it the top net purchased product among related items. On the 16th, it even recorded the highest net purchase amount across the entire KOSPI and KOSDAQ markets at 228.6 billion KRW.

However, experts caution that even ETFs with low premium/discount rates require careful investment due to the high volatility of the underlying assets. A Korea Exchange official stated, "Although these are not leveraged products, ETF investments still carry risks," adding, "Given the recent increased volatility of the underlying asset, crude oil, investors should be cautious about investing based solely on expectations of an oil price rebound."

Meanwhile, on the 21st (local time) at the New York Mercantile Exchange (NYMEX), June delivery WTI closed at $11.57 per barrel, down 43.4% ($8.86) from the previous day. During the session, prices fell as low as $6.50 per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)