KB Life, Heungkuk, and Others Raised Rates by up to 0.72%P Last Month

Contrary to Base Rate Cut... "Increased Burden on Low-Income Households" Criticism

[Asia Economy Reporter Oh Hyung-gil] Since the outbreak of the novel coronavirus disease (COVID-19), the interest rates on insurance policy loans, which tend to increase as the economy worsens, have been rising consecutively.

Small and medium-sized insurers, whose business conditions have deteriorated to the worst due to the ultra-low interest rate environment, are adjusting loan interest rates to secure profitability. Despite criticism that applying high interest rates of 7-9% per annum increases the burden on ordinary citizens, these insurers say they have no choice but to do so for survival.

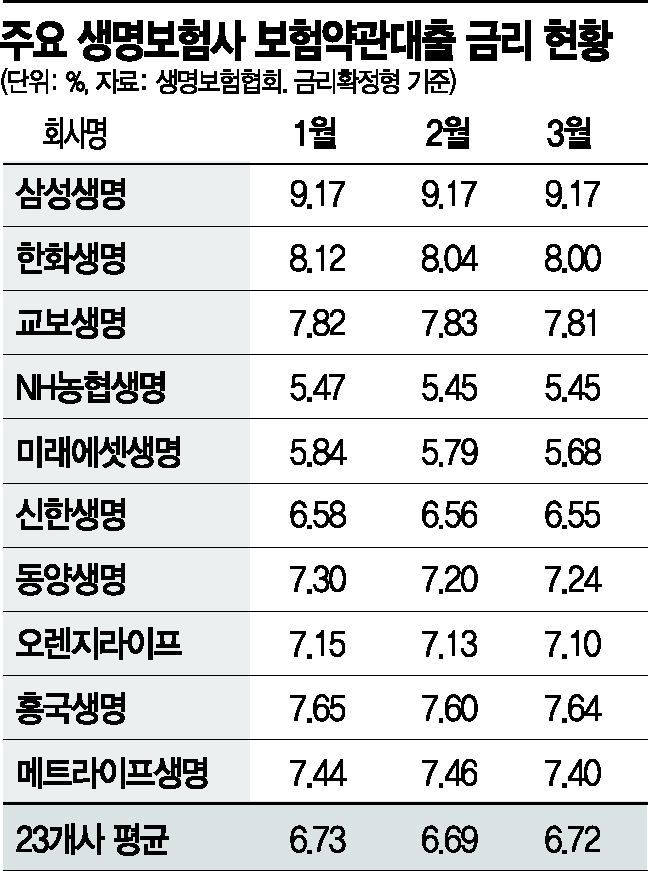

According to the insurance industry on the 16th, the average interest rate on insurance policy loans of 23 domestic life insurers last month recorded 6.72% for fixed-rate loans, up 0.03 percentage points from the previous month's average rate of 6.69%. Although this is similar to January's rate (6.73%), raising rates last month despite the Bank of Korea's significant 0.50 percentage point cut in the base rate has been criticized as problematic.

In fact, while large life insurers lowered their rates, some small and medium-sized companies raised theirs. Companies such as KB Life, LINA, Fubon Hyundai, Heungkuk, KDB, Dongyang, and Prudential Life increased their rates by up to 0.72 percentage points compared to the previous month. Among the top 10 life insurers by assets, six lowered their rates.

Hanwha Life lowered its rate from 8.04% in February to 8.00%, a 0.04 percentage point decrease, and Kyobo Life also reduced its rate from 7.83% to 7.81%, a 0.02 percentage point drop. Mirae Asset, Shinhan, and Orange Life also lowered their rates by between 0.01 and 0.11 percentage points compared to the previous month. Samsung Life was the only company to maintain its rate at 9.17% without any changes for three months since January.

Policy loans are considered "recession-type loans" mainly used by ordinary citizens who urgently need funds during economic hardships. The interest rates on policy loans are divided into fixed-rate and rate-linked types depending on the product. The fixed-rate type calculates interest by adding the guaranteed interest rate (fixed) and a margin rate, while the rate-linked type adds the announced interest rate (variable) and a margin rate.

The fixed-rate type structure means that the higher the guaranteed interest rate of the product a policyholder subscribes to, the higher the loan interest rate. The insurance industry explains that the reason why interest rates on policy loans differ among insurers is that companies selling more products with higher guaranteed interest rates inevitably set higher loan rates.

However, there have been continuous criticisms that despite the low risk of default since the surrender value is used as collateral, the interest rates charged are excessively high.

In particular, customers who took out policy loans with fixed rates are still suffering from high interest rates. Among customers who took out fixed-rate insurance policy loans from Samsung Life, 63.1% bear interest rates of 9.5% or higher. Hanwha Life and Kyobo Life also have loan proportions with interest rates above 8.0% approaching 46.2% and 38.1%, respectively.

The financial authorities requested detailed data from life insurers last November on the scale of policy loans, margin rates, and the basis for interest rate calculations to conduct a reality check on the method of calculating policy loan interest rates. The Korea Consumer Agency also argued through a survey on insurance policy loans last year that insurers' loan interest rates should be corrected.

The Insurance Business Supervision Enforcement Rules stipulate that "costs already reflected in premiums, costs unrelated to insurance policy loans, costs that cannot be reasonably explained as a basis for calculation, and accounting costs incurred for the accrual of income and expenses shall not be reflected in the margin rate."

A representative from a life insurer said, "The margin rate is maintained at a minimum level," adding, "The rise in policy loan interest rates is largely influenced by high-interest products sold in the past."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.