KCCI and 5 Industry Associations Including Automobile, Steel, Petrochemical, Machinery, and Shipbuilding Discuss Joint COVID-19 Response on the 16th

Participants Unite in Calling for Government Rescue Amid Demand Cliff and Bold Liquidity Support

[Asia Economy Reporter Kim Hyewon] The domestic equipment industry, hit hard by the novel coronavirus infection (COVID-19), has unanimously called for the government to step in as a savior to support the recovery of domestic demand in preparation for a full-scale 'demand cliff' in the second quarter. There were also calls for bold government support as companies face liquidity problems due to decreased demand.

The Korea Chamber of Commerce and Industry held an industrial countermeasure meeting on the 16th in collaboration with five industry associations including automobile, steel, petrochemical, machinery, and shipbuilding to discuss solutions to difficulties caused by COVID-19.

Kim Jin-woo, an analyst at Korea Investment & Securities who presented at the meeting, said, "The economic impact of COVID-19 partially appeared in the first quarter, but it will become full-scale from the second quarter," adding, "Once negative figures combining supply disruptions and a demand cliff start to appear in the second quarter, economic agents' anxiety will inevitably intensify."

Kim identified the automobile industry as one of the sectors severely affected by COVID-19. He said, "The automobile industry is intricately linked to the global supply chain and is sensitive to demand," forecasting that "with production disruptions and sales impacts becoming full-scale in the second quarter, global automobile industry demand will decrease by more than 7.7%." He continued, "The slump in the automobile industry will directly affect the downstream steel industry, causing simultaneous decreases in steel sales volume and profitability deterioration in the second quarter," and pointed out, "Petrochemicals will also inevitably face negative impacts as demand for related products such as automobiles, home appliances, and textiles sharply declines in the second quarter."

According to investigations by the Korea Customs Service and associations, industry damage has increased since the beginning of this month. From April 1 to 10, steel product exports decreased by 15%, and domestic automobile production is projected to decline by 360,000 units in the first half of this year.

The second presenter, Lee Jae-jin, head of the Trade Cooperation Office at the Korea Iron & Steel Association, expressed concern that the economic crisis triggered by COVID-19 and low oil prices could lead to the spread of protectionist measures and urged the government to respond actively. He also emphasized the urgent need to improve steel trade and distribution systems to prevent anticipated trade disputes by ensuring the accuracy of steel import declarations and expanding distribution history management systems.

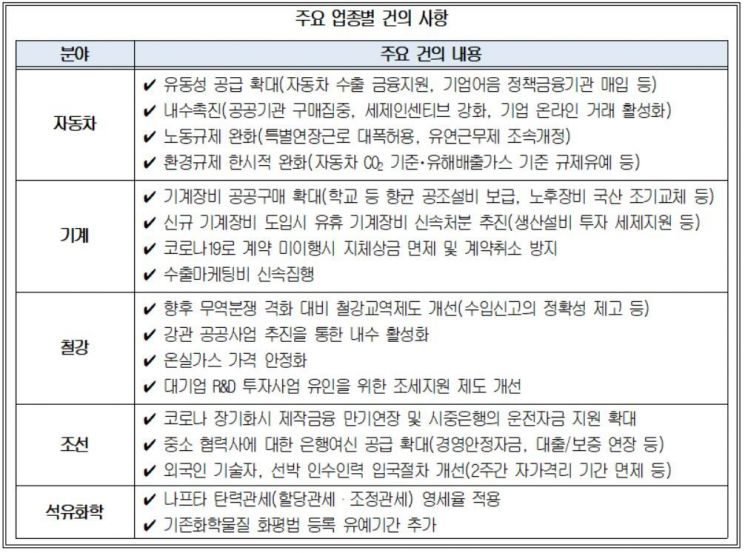

Participants called for proactive government support to address the demand cliff and liquidity crisis in the second quarter.

Kim Tae-nyeon, Executive Director and Operating Committee Chairman of the Korea Automobile Manufacturers Association, said, "Due to the spread of infectious diseases in overseas markets such as the U.S. and Europe, a shock of global supply chain collapse and demand plunge is expected from April," adding, "Policy support is urgently needed to revive domestic demand through measures such as expanding public institution vehicle purchases, strengthening subsidies for eco-friendly vehicles, reducing acquisition tax and individual consumption tax, and promoting online transactions."

Choi Hyung-gi, full-time vice president of the Korea Machinery Industry Promotion Association, also emphasized, "Due to the machinery industry's characteristic of taking 3 to 12 months from production to order, responding after damage becomes visible means missing the timing," urging, "The government should proactively respond to the demand cliff by expanding public orders, such as early replacement of outdated equipment owned by public institutions, universities, and national research institutes, and institutionalizing the priority purchase of domestic equipment when procuring machinery and equipment."

Lee Min-chul, full-time vice president of the Korea Iron & Steel Association, said, "Unlike the 2008 financial crisis when China made large-scale infrastructure investments, the steel industry now faces a situation with no support as demand has evaporated due to global factory shutdowns," requesting, "The government should expedite planned public projects and newly add replacement projects for water and heat pipes over 20 years old."

Lee Byung-chul, full-time vice president of the Korea Shipbuilding & Offshore Plant Association, said, "Due to increased uncertainty from COVID-19 and the sharp drop in oil prices, global ship orders in the first quarter decreased by 71.3% compared to the same period last year, and LNG ship orders, the main type for domestic shipbuilders, were only two vessels," warning, "If the situation prolongs, liquidity problems may arise due to delays in ship delivery and difficulties in fund recovery, so financial support such as extension of shipbuilding finance maturity and supply of working capital is urgently needed."

Kim Pyeong-jung, head of research and investigation at the Korea Petrochemical Industry Association, said, "Recently, the petrochemical industry is suffering from the double hardship of global oversupply and demand slump caused by COVID-19," proposing as an urgent task the "application of a zero tariff rate for naphtha flexible tariffs." Naphtha is a key raw material for the petrochemical industry, and tariff costs alone amounted to 95 billion KRW last year. Since competing countries like Japan and China continue to apply zero tariff rates, urgent application of zero tariffs for naphtha is necessary.

In addition, participants discussed difficulties related to environmental regulations such as ▲significant expansion of special extended working hours ▲prompt revision of flexible work systems to ease labor regulations ▲stabilization of carbon emission permit prices ▲extension of registration grace periods for existing chemical substances.

Woo Tae-hee, full-time vice chairman of the Korea Chamber of Commerce and Industry, said, "The reason our economy could barely withstand past crises was because key manufacturing and core industries supported it," emphasizing, "We must prepare for the worst-case scenario such as prolonged COVID-19 pandemic so that the competitiveness of key industries is not damaged." He added, "This COVID-19 crisis is more difficult for companies as domestic demand and exports decline simultaneously," and stated, "Government support is inevitable to prevent the collapse of Korea's industrial ecosystem due to this crisis."

The meeting was attended by full-time vice chairmen and executives from major industry associations including the Korea Chamber of Commerce and Industry, Korea Iron & Steel Association, Korea Machinery Industry Promotion Association, Korea Shipbuilding & Offshore Plant Association, Korea Automobile Manufacturers Association, and Korea Petrochemical Industry Association.

The Korea Chamber of Commerce and Industry plans to hold subsequent countermeasure meetings with the IT industry including semiconductors and displays on the 21st, followed by consumer goods industries such as pharmaceuticals, bio, cosmetics, and apparel fashion on the 23rd.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.