[Asia Economy Reporter Choi Saeng-hye] The retail market sectors experienced significant disparities in March due to the spread of the novel coronavirus infection (COVID-19). While payment amounts for delivery apps and supermarkets increased significantly, those for large discount stores and franchise coffee shops noticeably decreased.

App and retail analysis services WiseApp and WiseRetail conducted a survey on the rise and fall of consumer payment amounts by retail sector due to COVID-19 last month and announced the results on the 15th.

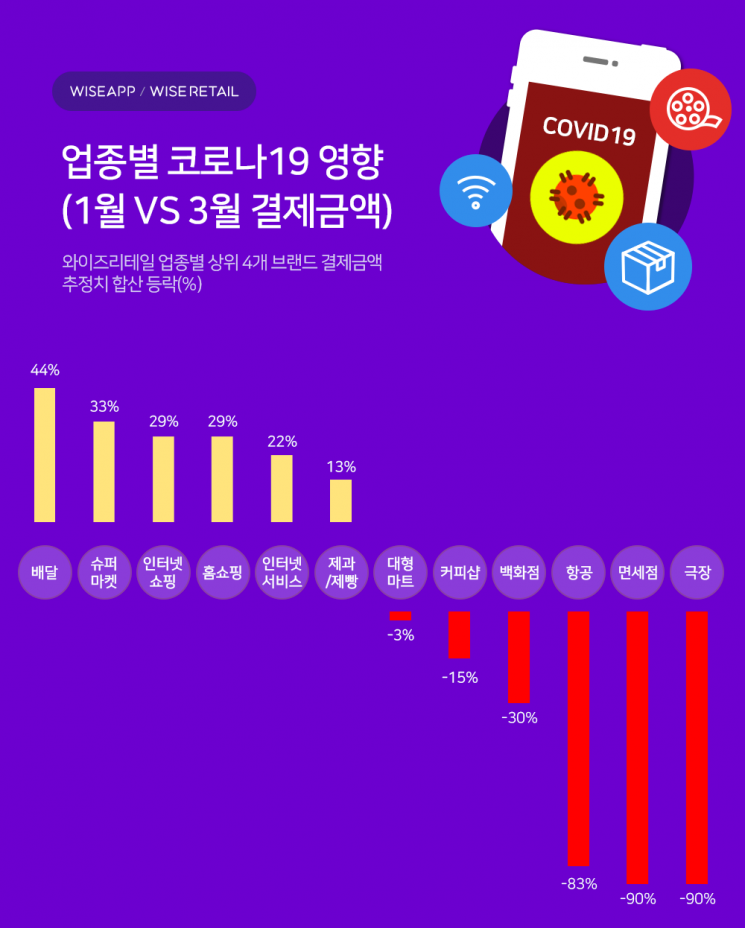

By sampling payment amounts made by Koreans from January to March using credit cards, debit cards, account transfers, and mobile micropayments, and comparing the consumer payment amounts of representative retail sectors in January before COVID-19 became widespread with those of last month when it was in full swing, the sector with the largest increase in payment amount was ‘Delivery.’ The combined estimated payment amount for delivery apps Baedal Minjok and Yogiyo in March increased by 44% compared to January.

The second highest payment amount growth was in the ‘Supermarket’ sector. The combined estimated consumer payment amount for the top four supermarkets, including GS Supermarket and Lotte Supermarket, increased by 33% in March compared to January.

Additionally, the ‘Internet Shopping’ sector, combining estimated payments from Naver, Coupang, eBay Korea, and 11st, increased by 29%; ‘Home Shopping,’ combining GS Home Shopping, Lotte Home Shopping, Home&Shopping, and NS Home Shopping, also rose by 29%; ‘Internet Services,’ combining Google, Today’s House, Nexon, and NETFLIX, increased by 22%; ‘Bakery and Confectionery,’ combining Paris Baguette, Tous Les Jours, Baskin Robbins, and Dunkin’ Donuts, rose by 13%; and ‘Convenience Stores,’ combining GS25, CU, 7-Eleven, and Emart24, increased by 7%.

Many sectors saw a noticeable decrease in payment amounts due to the impact of COVID-19. The ‘Large Discount Stores’ sector, combining estimated payments from Emart, Homeplus, Lotte Mart, and Nonghyup Hanaro Mart, decreased by 3%; ‘Coffee Shops,’ including Starbucks, Twosome Place, Ediya Coffee, and Hollys Coffee, fell by 15%; ‘Department Stores,’ including Lotte Department Store, Shinsegae Department Store, Hyundai Department Store, and NC Department Store, dropped by 30%; ‘Airlines,’ including Korean Air, Asiana Airlines, Jeju Air, and Jin Air, declined by 83%; duty-free shops, including Lotte Duty Free, Shinsegae Duty Free, Shilla Duty Free, and JDC Duty Free, decreased by 90%; and ‘Theaters,’ including CGV, Lotte Cinema, and Megabox, also fell by 90% in estimated payment amounts.

Furthermore, with longer home-stay times due to COVID-19, the online interior goods purchase service ‘Today’s House’ increased by 118%, the online fresh food ordering service ‘Market Kurly’ rose by 100%, and ‘Nestl? Korea’ saw an 87% increase due to increased home coffee purchases.

These survey results were estimated by WiseApp and WiseRetail based on payment amounts made by Koreans aged 20 and over using credit cards, debit cards, account transfers, and mobile micropayments at the respective retailers. Payments made by corporate cards, corporate account transfers, inter-company transactions, cash transactions, and gift certificates are not included.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.