Coupang Surpasses 7 Trillion Won in Sales Last Year, 'Record High'... Loss Growth Also Slows Down

Coupang achieved a record-breaking sales figure exceeding 7 trillion won last year, marking a growth of over 60% compared to the previous year. Although it continued its aggressive deficit management, resulting in significant operating losses as in previous years, the scale of losses was greatly reduced from the prior year. Notably, the upward trend in operating losses, which had been continuously expanding since the launch of Rocket Delivery in 2014, has been halted. There is also analysis suggesting that the 'Amazon strategy'?prioritizing economies of scale and ecosystem building despite accepting losses?has begun to yield results.

In this year’s e-commerce market, which has entered a new phase due to increased non-face-to-face (untact) consumption caused by the spread of COVID-19, strategies from Coupang, which continues the 'Amazon strategy,' as well as WEMAKEPRICE and TMON, which have shifted towards profit improvement, are expected to engage in a fierce competition.

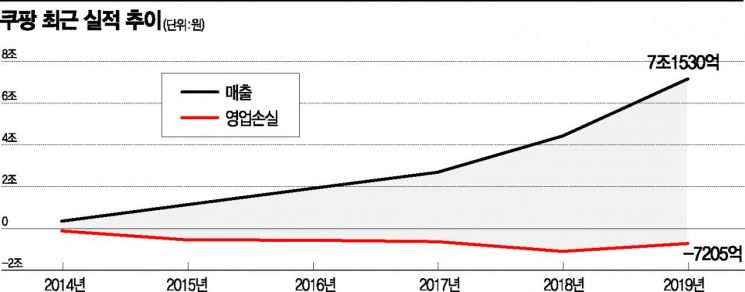

On the 14th, Coupang announced that it achieved sales of 7.153 trillion won last year, representing a 64% increase from the previous year. In particular, operating losses were significantly reduced to 720.5 billion won. Coupang’s operating losses, which were 121.5 billion won in 2014, increased to 1.1279 trillion won in 2018, exceeding 1 trillion won and raising concerns inside and outside the market. The question was whether Coupang could endure by consuming investment funds in a structure where deficits continuously accumulated until achieving the targeted economies of scale. However, with the achievement of the largest sales scale and the halt in loss growth this time, Coupang has gained momentum to push forward its existing strategy despite concerns.

◆Investment for Sales Growth and Job Creation = Coupang’s sales growth was driven by 'Rocket Delivery,' launched in 2014. This is Coupang’s unique service guaranteeing next-day delivery based on direct product purchases. Additionally, 'Dawn Delivery,' which completes delivery before 7 a.m. the next day if ordered by midnight, was introduced consecutively, and now millions of products, including fresh food, are delivered to customers within just a few hours, 365 days a year.

While such services have boosted Coupang’s sales, they have also required massive investments in logistics. Coupang has built logistics infrastructure equivalent to the size of 193 soccer fields nationwide and directly or indirectly employed about 30,000 developers, delivery, and logistics personnel last year. The number of employees increased by about 5,000 compared to the previous year. Labor costs reached 1.4 trillion won last year. Considering it was 100 billion won in 2014, this represents a 14-fold increase in five years, indicating significant contributions to job creation.

Kim Beom-seok, CEO of Coupang, said, "The exceptional speed of Rocket Delivery is thanks to the technology and infrastructure that predict the products customers want and prepare them in advance at Rocket Delivery centers close to customers." He added, "We will continue to aggressively invest in technology and infrastructure to accelerate a world where customers ask, 'How did we live without Coupang?' by providing unprecedented services such as same-day Rocket Fresh delivery beyond dawn delivery."

◆The 'Amazon Strategy' Shines = Coupang has steadily navigated the market with the 'double-edged sword' of simultaneous sales growth and expanding losses. This approach resembles Amazon’s strategy of prioritizing growth to build a differentiated ecosystem first and eventually reducing costs through economies of scale, even if profits come later. Coupang’s performance last year is interpreted as evidence that this Amazon strategy is beginning to be effective in the domestic market as well.

Especially this year, the transaction volume on Coupang is growing even larger. According to WiseApp, an application data analysis service, Coupang’s payment amount increased from 1.44 trillion won in January to 1.63 trillion won in February. An industry insider said, "With the surge in orders due to COVID-19 and the shift in consumption culture to untact, the time for Coupang’s strategy to settle in the market will be accelerated."

◆Diverging E-commerce Strategies = WEMAKEPRICE is also adopting a similar Amazon strategy to Coupang. Last year, WEMAKEPRICE recorded sales of 465.3 billion won and an operating loss of 75.7 billion won. While sales increased by 8.4% compared to the previous year, operating losses expanded by 94%. However, based on a 370 billion won investment raised at the end of last year, WEMAKEPRICE is focusing on strengthening platform competitiveness by recruiting excellent talent and increasing new partners to lay the foundation for sustainable growth.

Based on this, WEMAKEPRICE plans to continue expanding its scale this year with a goal of double-digit growth in transaction volume. Its strategy is to further strengthen market influence through aggressive investments such as attracting a large number of new partners, hiring 1,000 merchandisers (MDs), and upgrading the platform. Park Eun-sang, CEO of WEMAKEPRICE, said, "We will not hesitate to make aggressive investments to create a virtuous cycle structure where more small and medium partners can succeed together with WEMAKEPRICE."

On the other hand, TMON has stepped back from the competition to expand scale last year and shifted its goal to improving profitability. Since the fourth quarter of last year, losses have rapidly improved, and in March this year, TMON achieved a monthly profit of 160 million won for the first time. TMON expects to sustain this trend to surpass profits in the second and third quarters and achieve annual profitability. It has also started preparing for an initial public offering (IPO) aiming for listing in 2021. Lee Jin-won, CEO of TMON, said, "We will continue to strengthen the structure so that profits are not just one-time but can expand quarterly or annually."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)