Concerns Over Argentina's Ninth Default

India's Growth Rate Plummets to 1% Range

[Asia Economy Reporter Jeong Hyunjin] Concerns are growing that the economic impact on Brazil and Argentina, key countries in Latin America, and India in South Asia will exceed expectations. Unlike the United States and Europe, where economic slowdowns occurred due to lockdown measures following the spread of the novel coronavirus infection (COVID-19), these countries were already facing issues such as decreased demand and financial market instability before the current crisis, and the pandemic has struck them like "adding insult to injury."

There is increasing weight to the forecast that global economic recovery will be slow even if the US and Europe resume economic activities. The Group of Twenty (G20) is considering a debt repayment moratorium for low-income countries to secure fiscal capacity to respond to the COVID-19 crisis.

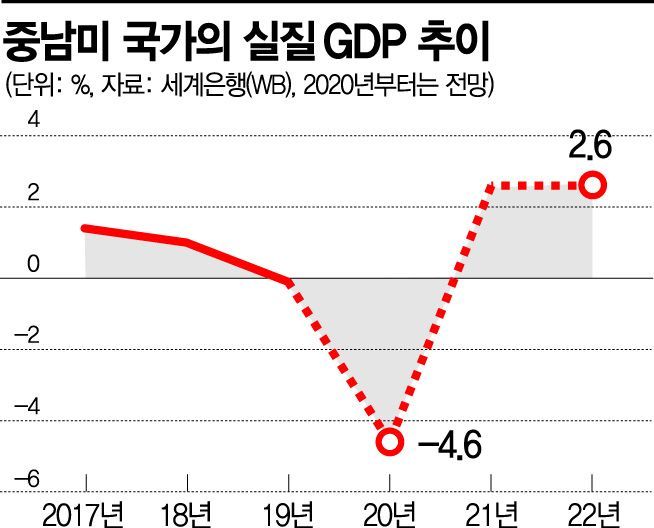

On the 12th (local time), the World Bank (WB) downgraded its forecast for the real gross domestic product (GDP) growth rate in Latin America this year to -4.6% in its report on Latin American countries. This is lower than the -2.1% during the 2009 global financial crisis and the -2.4% during the 1983 Latin American debt crisis, and also lower than Goldman Sachs' forecast of -3.8% for Latin America's GDP growth rate released at the end of last month.

The WB also projected Brazil, the largest country in Latin America, to have a GDP growth rate of -5.0% this year, which is lower than the regional average. This is due to Brazil's characteristics of having developed service and agricultural sectors, where external demand is expected to sharply decline due to COVID-19, and the inevitable impact of falling oil prices. The Brazilian Institute of Economics (Ibre) at the Getulio Vargas Foundation, a private research institute in Brazil, recently forecasted that if the government maintains employment levels without reducing the income loss of workers, up to 12.6 million new unemployed people could emerge. The institute predicted that in the worst case, the growth rate this year could be -7%, and the unemployment rate could reach 23.8%. As of that day, Brazil had 22,192 confirmed COVID-19 cases, ranking 14th worldwide.

In Argentina, another pillar of Latin America alongside Brazil, the possibility of a ninth default is being raised. The self-designated debt restructuring period ended at the end of last month, and some bond repayments amounting to $10 billion were postponed last week. Discussions on this matter are scheduled for this week, but experts expect the Argentine government to present terms unacceptable to creditors.

Latin American countries were already facing significant internal and external difficulties before the spread of COVID-19, including large-scale anti-government protests due to growing social unrest last year and the recent collapse of commodity prices, including international oil prices. COVID-19 rapidly spread across the continent starting last month, prompting belated lockdown measures and factory shutdowns. The lack of sufficient fiscal capacity makes it particularly difficult to urgently establish social safety nets to protect employment through large-scale stimulus measures like those taken in the US or Europe. The complacent responses of some Latin American leaders, such as Brazilian President Jair Bolsonaro, are also cited as factors contributing to economic instability.

South Asian countries, including India, are facing similarly difficult economic situations. The WB significantly lowered its forecast for South Asia's GDP growth rate this year to 1.8?2.8% in its report released that day. Six months ago, it had projected a 6.3% increase. The WB described this as "the worst crisis in 40 years," expecting a sharp economic downturn due to halted economic activities, trade collapse, and increased financial sector pressures. India, the largest economy in South Asia, is expected to have an economic growth rate of 1.5?2.8% for the fiscal year 2020 (April 2020 to March 2021). The Indian government plans to extend the nationwide lockdown order, initially issued until the 14th, by two more weeks until the 30th of this month. COVID-19 confirmed cases in India are increasing by more than 800 per day.

As COVID-19 spreads to economically vulnerable countries including Latin America, South Asia, and Africa, discussions on international institutional support for these countries are ongoing. G20 countries are reportedly discussing whether to introduce debt repayment moratorium measures for low-income countries as part of efforts to prevent a debt crisis in emerging markets. This is at the request of the International Monetary Fund (IMF) and the WB, with options under consideration to postpone sovereign bond repayments by 6 to 9 months or until 2021. A decision is expected at this week's finance ministers' meeting. A G20 official told a foreign media outlet, "Although it will take time for joint work such as actual debt restructuring to be carried out, it is necessary to provide capacity now so that there are no concerns about cash flow or debt repayments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)