Difficult with Solus Sale Alone

Focus on Possibility of Securing Liquidity

Preparation of Self-Help Plan for Governance Change

On the 27th, the Doosan Tower building in Dongdaemun-gu, Seoul, is visible as the government decided to inject 1.6 trillion won into Doosan Heavy Industries, which is experiencing financial difficulties, through the Korea Development Bank and the Export-Import Bank of Korea. Photo by Kang Jin-hyung aymsdream@

On the 27th, the Doosan Tower building in Dongdaemun-gu, Seoul, is visible as the government decided to inject 1.6 trillion won into Doosan Heavy Industries, which is experiencing financial difficulties, through the Korea Development Bank and the Export-Import Bank of Korea. Photo by Kang Jin-hyung aymsdream@

[Asia Economy Reporters Jeongsoo Lim, Gimin Lee] Doosan Group, which is promoting the sale of Doosan Solus as part of its financial structure improvement plan, is drawing attention as to whether it will also sell Doosan Fuel Cell, another key new growth engine.

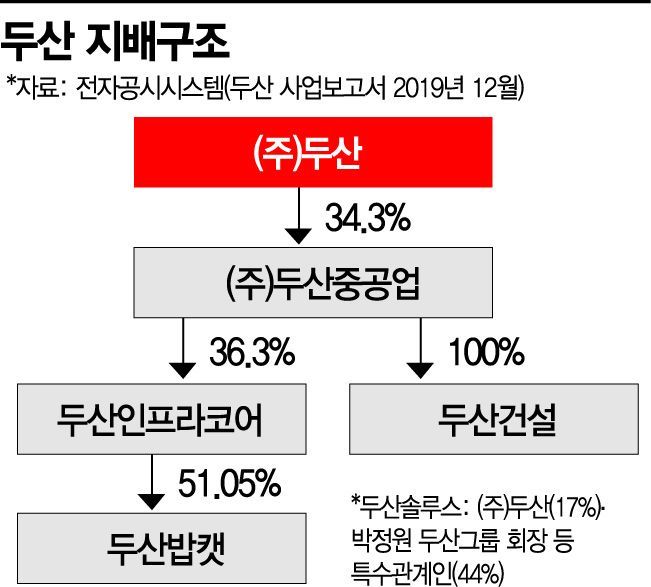

According to industry sources on the 10th, Doosan Corporation is seeking to prepare a self-rescue plan through the sale of affiliates and business divisions, including Doosan Solus, which is called a new growth engine, and changes in the ownership structure.

The most rapidly advancing restructuring is the sale of Doosan Solus. According to the investment banking (IB) industry, negotiations for the sale of Doosan Solus between Doosan Group and private equity fund (PEF) operator Skylake Investment have reached the final stage. It is known that the management rights shares held by Doosan, Doosan Group Chairman Park Jeong-won and his family, the Yeongang Foundation, and the Dongdaemun Future Foundation are the target of the sale.

Doosan Solus is a company spun off from Doosan, with Doosan and Chairman Park's special relations holding 50.48% of common stock and 11.04% of preferred stock. The common stock is the subject of the sale, and the two sides are negotiating the sale price of the shares including management rights at around 600 billion to 800 billion KRW. An industry insider said, "It is understood that final negotiations are underway regarding the handling of preferred stock shares held by Doosan and Chairman Park and the sale price," adding, "Doosan, cornered, is in a somewhat disadvantageous position in negotiation power, resulting in the sale."

If the share sale is completed, Doosan will receive 160 billion to 200 billion KRW, and Chairman Park and his special relations will secure 440 billion to 600 billion KRW in funds. It is expected that Doosan will immediately inject the sale proceeds into Doosan Heavy Industries & Construction, and Chairman Park and his special relations will also support Doosan Heavy Industries & Construction through private fund contributions.

However, there is concern among some creditors that the sale of Doosan Solus alone will not be enough to cover about 2 trillion KRW of non-bank borrowings (such as corporate bonds) maturing this year out of the total 4.9 trillion KRW in borrowings. This is why speculation is growing that Doosan may take another step by selling Fuel Cell. Doosan Fuel Cell is an affiliate focusing on the fuel cell business, which Chairman Park promoted as a new growth engine during his tenure as chairman of Doosan's holding division in 2014. This year, its annual order amount is 1.2 trillion KRW, making it Doosan's cash cow affiliate that has achieved over 1 trillion KRW for two consecutive years. Fuel Cell shares are held by Doosan (18.05% common stock, 12.47% preferred stock) and special relations with 65.08% of common stock and 48.34% of preferred stock.

Meanwhile, creditors are reportedly demanding that Doosan Heavy Industries & Construction itself restructure the ownership of its subsidiary InfraCore and its sub-subsidiary Bobcat to reorganize the structure under Doosan's control as part of its self-rescue plan. A securities firm researcher said, "The market expects that the restructuring of Doosan Heavy Industries & Construction's affiliate structure and the sale of business divisions will be included in the self-rescue plan." This means that due to Doosan Heavy Industries & Construction's management difficulties, the performance of InfraCore and Bobcat flows directly to Doosan Heavy Industries & Construction, which must be prevented to avoid cash flow tightening. It is also expected that this will strengthen creditworthiness and secure liquidity through corporate bond issuance and other means.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.