[Asia Economy Reporters Haeyoung Kwon, Minyoung Kim] The Discovery Asset Management fund has defaulted, causing backlash for the distributors. Discovery Asset Management is led by Jang Ha-won, former head of Hana Financial Economic Research Institute and younger brother of Ambassador Jang Ha-sung to China. As market conditions worsened, fund redemptions have been repeatedly suspended since last year. Due to market instability caused by the spread of the novel coronavirus (COVID-19), defaults on funds may increase, and with the label "Jang Ha-sung's brother's fund" drawing heightened attention, distributors have collectively begun assessing the situation and formulating countermeasures.

According to the Korea Financial Investment Association on the 10th, as of the end of February, IBK Industrial Bank of Korea held the largest amount of Discovery Asset Management fund assets under management at 94.163 billion KRW among distributors.

Following were Shinhan Bank with 86.131 billion KRW, Daishin Securities with 65.448 billion KRW, Yuanta Securities with 62.946 billion KRW, Shinhan Financial Investment with 51.533 billion KRW, IBK Investment & Securities with 42.85 billion KRW, Hana Financial Investment with 30.776 billion KRW, and Hana Bank with 22.059 billion KRW.

By financial group, Shinhan Financial Group sold Discovery Asset Management funds worth 137.664 billion KRW, the highest sales amount. IBK Industrial Bank of Korea group followed with 137.013 billion KRW, Hana Financial Group with 52.835 billion KRW, and NH Nonghyup Financial Group with 7.171 billion KRW.

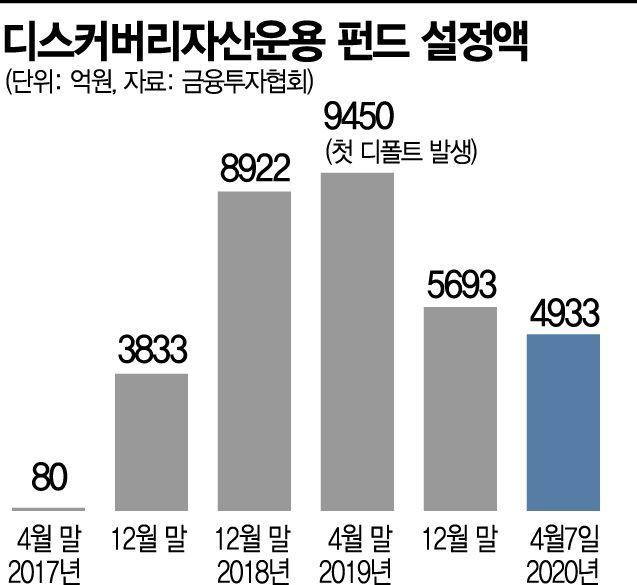

Discovery Asset Management was established in November 2016 and began setting up funds from April the following year. By the end of May, a month after Jang Ha-sung was appointed Chief of the Blue House Policy Office, the fund's assets under management increased to 46.5 billion KRW, expanding to 383.3 billion KRW by the end of 2017 and 892.2 billion KRW by the end of 2018. However, after the first default occurred at the end of April 2019 with 945 billion KRW, the assets gradually decreased to 569.3 billion KRW by the end of December the same year and shrank further to 481.2 billion KRW as of the end of February this year.

Distributors are anxious as Discovery Asset Management funds have repeatedly suspended redemptions this year following last year. The management company postponed redemptions of fintech loan funds worth 180 billion KRW last year and notified an additional postponement of about 100 billion KRW in real estate loan fund redemptions last month.

For the fintech loan fund 'Discovery US Fintech Global Bond Fund,' IBK Industrial Bank of Korea has been unable to return 69.5 billion KRW and Hana Bank 24 billion KRW to investors. This fund invested in private bonds issued by Direct Lending Global (DLG), but problems arose as DLG failed to repay principal and interest on its private bonds.

Separately, the real estate loan fund 'Discovery US Real Estate Senior Secured Bond Fund' is also unable to repay approximately 65.1 billion KRW from Shinhan Bank, 21.9 billion KRW from IBK Industrial Bank of Korea, and about 10 billion KRW from securities firms including Yuanta Securities. This fund, which invested in real estate loan receivables and regularly generated interest income, was popular but repayment has been delayed due to disruptions in local US funding and sales caused by the spread of COVID-19.

The problem is that the market conditions could worsen further as the global real economy and financial markets cool down due to the impact of COVID-19.

An IBK Industrial Bank of Korea official said, "We have formed a dedicated task force (TF) for Discovery Asset Management funds and are establishing countermeasures," adding, "We are reviewing ways to minimize investor losses." Hana Bank stated, "We are urging the management company to finalize the repayment schedule and are monitoring market conditions," while Shinhan Bank said, "The issue arose because real estate sales are difficult due to COVID-19, and we will devise measures to minimize investor damage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.