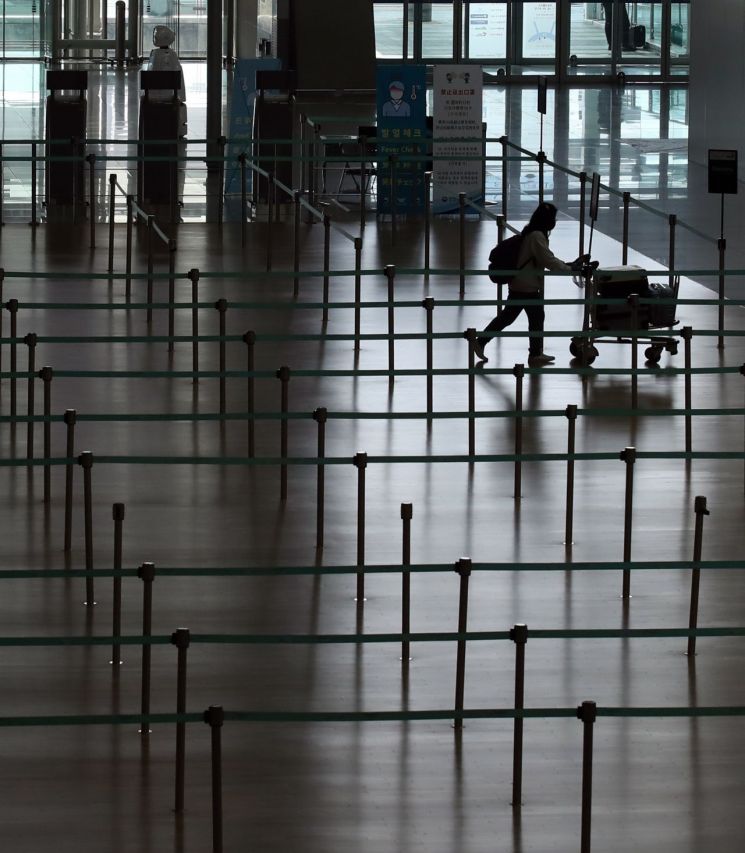

[Asia Economy Reporter Yoo Je-hoon] As the skies have shut down due to the novel coronavirus infection (COVID-19), national airlines on the brink of collapse are desperately trying to secure cash. They are introducing related systems to induce flight ticket refund requests to be changed to rescheduling, while attempts to monetize idle assets located in various places are also ongoing.

According to the aviation industry on the 11th, Korean Air has recently been encouraging customers eligible for flight ticket refunds due to COVID-19 to issue 'Credit Vouchers.' Previously, Korean Air had implemented a one-time waiver of the reissuance fee for tickets for customers unable to travel due to COVID-19, but this was limited to changes within the ticket validity period.

In contrast, the new system allows customers to apply for voucher issuance instead of receiving a refund, making the voucher usable for one year from the date of issuance, and also offers a 10% discount when purchasing new tickets. Given that ticket prices may surge after the COVID-19 situation settles, this is considered a significant incentive depending on the circumstances.

The voucher system is already commonly found in foreign airlines that have also suspended many flights due to COVID-19, similar to domestic airlines. For example, Middle Eastern Etihad Airways operates the 'Etihad Credit' system.

Other national airlines are doing the same. Jeju Air is running a 'Safe Guarantee Campaign' that waives cancellation penalties and change fees for all tickets departing until October 25 this year. Other airlines are also implementing various penalty and fee waiver measures.

The industry views these attempts as desperate efforts by airlines, whose cash inflows have stopped due to the suspension of most flight routes, to secure cash. Woo Ki-hong, CEO of Korean Air, expressed difficulties at the first anniversary memorial service of the late Chairman Cho Yang-ho held on the 8th in Yongin, Gyeonggi Province, stating, "Available Seat Kilometers (ASK: seats available per aircraft × flight distance) have decreased by 92%," and "Passenger revenue is disappearing by 600 billion KRW per month."

Efforts to secure cash are underway in various places. Monetizing idle assets through sales is a representative example. Korean Air is known to be continuously conducting and reviewing small-scale asset sales, including real estate scattered in various locations besides the Jongno Songhyeon-dong site, where it is currently selecting a sales agent. Although not large in scale, the sales process is considered relatively smooth.

Borrowing is also expanding. Following Korean Air's successful issuance of 622.8 billion KRW in asset-backed securities (ABS) last month, Asiana Airlines recently decided to take out a short-term loan of 300 billion KRW. The 300 billion KRW loan by Asiana Airlines is a conversion of a standby letter of credit (LC) guarantee credit line provided by the Korea Development Bank and others last year into a credit limit loan. An Asiana Airlines official explained, "The 300 billion KRW short-term loan is just a change in the purpose from a letter of credit to a credit limit loan," adding, "The timing of use is undecided."

The industry expects this situation to continue for the time being. A representative from a national airline said, "With cash inflows stopped and no clear sign of when the business environment will improve, everyone is experiencing a liquidity crisis," and added, "This kind of trimming will continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.