Up 25.11% from Yearly Low... KOSDAQ Rises 41.86%

Return to Pre-Crisis Levels... Credit Crunch, Economic Recession, and COVID Issues Remain

Valuation Concerns Persist, High Chance of Adjustment During Q1 Earnings Announcements

Oil Prices Also a Concern... Production Cut Agreement Challenges, US Withdrawal Could Limit Gains

[Asia Economy Reporter Song Hwajeong] As the domestic stock market has risen for four consecutive days recently, with the KOSPI recovering the 1800 level, attention is focused on whether the rebound trend will continue. Experts pointed out that valuation burdens due to recent stock price increases and oil price conditions need to be cautiously monitored during the rebound phase.

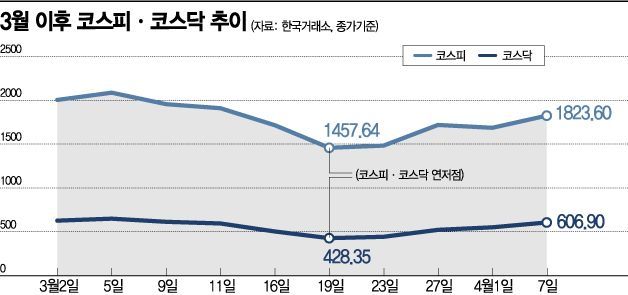

As of 10:51 a.m. on the 8th, the KOSPI recorded 1815.15, down 0.46% (8.45 points) from the previous day. The KOSDAQ rose 0.14% (0.83 points) to 607.73. After starting weak, the KOSDAQ reversed to an increase, but the KOSPI showed fluctuating movements. Having risen for four consecutive days recently, the KOSPI recovered the 1800 level, and the KOSDAQ recovered the 600 level. Since the beginning of this month until the previous day, the KOSPI rose 3.93%, and the KOSDAQ rose 6.65%. Compared to the year-to-date low closing price recorded on the 19th of last month, the KOSPI rose 25.11%, and the KOSDAQ rose 41.68%.

Lee Jinwoo, a researcher at Meritz Securities, analyzed, "Currently, the stock market is returning to levels before each crisis," adding, "The domestic COVID-19 outbreak was the reason for the KOSPI falling below 2000, the credit crunch and recession concerns caused by the sharp drop in oil prices were the reasons for falling below 1900, and the worsening liquidity crunch caused the KOSPI to plunge from 1800 to 1400." He further explained, "In the same context, the current recovery of the KOSPI to 1800 means the market is escaping liquidity crunch concerns," adding, "The remaining issues are credit crunch, recession, and COVID-19."

As the rapid increase in confirmed cases in the U.S. and Europe slowed down, the rebound gained momentum, but the economic impact must be continuously monitored. Jo Ikjae, a researcher at Hi Investment & Securities, said, "There will likely be aftershocks centered on U.S. employment and credit risk," analyzing, "Considering that the average decline in U.S. stock prices was -39% when the U.S. unemployment rate rose in the past, the recent stock price drop reflected this, but the period is judged to still remain."

Valuation burdens due to the short-term rebound are also factors to be cautious about during the rebound phase. The KOSPI’s 12-month forward price-to-earnings ratio (PER) approached 10 times. Roh Nokil, a researcher at NH Investment & Securities, said, "Rapid PER increase without fully adjusting earnings per share (EPS) can hinder further stock price rebounds," adding, "The expected EPS growth rate for the KOSPI in 2020 was 63.2%, but the earnings forecast for this year is likely to be adjusted during the first-quarter earnings announcements." According to financial information provider FnGuide, the consensus operating profit for the first quarter this year is 25.7779 trillion won, down 19.83% compared to the same period last year, and revised downward by 17.16% compared to a month ago. The second quarter is expected to decrease by 0.96% to 29.3772 trillion won, which is 13.25% lower than a month ago.

Oil price movements are also a factor to watch. International oil prices plunged for two consecutive days. On the 7th (local time), West Texas Intermediate (WTI) crude oil for May delivery on the New York Mercantile Exchange (NYMEX) closed at $23.63 per barrel, down 9.4% ($2.45). The Organization of the Petroleum Exporting Countries (OPEC) and non-member countries, collectively known as 'OPEC+,' plan to hold an emergency video conference on the 9th, but reaching an agreement is expected to be difficult. Roh said, "The U.S. administration and shale oil companies are known to oppose production cuts, and even if OPEC+ agrees to reduce output, if the U.S. is excluded, the rise in oil prices may be limited," explaining, "U.S. credit spreads remain high, and if oil prices do not rebound quickly, the possibility of bankruptcies among marginal companies remains."

Recent stock price increases are seen as technical rebounds, and fundamental recovery will take time. Kim Ilgu, a researcher at Hanwha Investment & Securities, said, "The recent stock price rise, appearing as the virus spread slows, is a technical rebound rather than a fundamental uptrend," adding, "As the virus spread slows, many cities will normalize again, but it will take a long time for the economy to normalize and corporate profits to recover to previous levels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.