Disney Plus Triples in One Week

Netflix Subscriptions Increase by 47%

Capital Strength and Exclusive Streaming Make 'Economies of Scale' Hard to Compete

Must Differentiate with Bundled Pricing Competitiveness and Asian/Niche Content

[Asia Economy Reporter Koo Chae-eun] Due to the impact of the novel coronavirus infection (COVID-19), global online video service (OTT) giants such as Disney Plus and Netflix are rapidly expanding their market share. They are quickly growing the market through a volume offensive with solid exclusive content and strong financial power.

Domestic native OTT companies competing with them are at a disadvantage. Experts point out that native OTT companies need to expand their competitiveness through price competitiveness via 'bundled products' and a united front of Hallyu (Korean Wave) content.

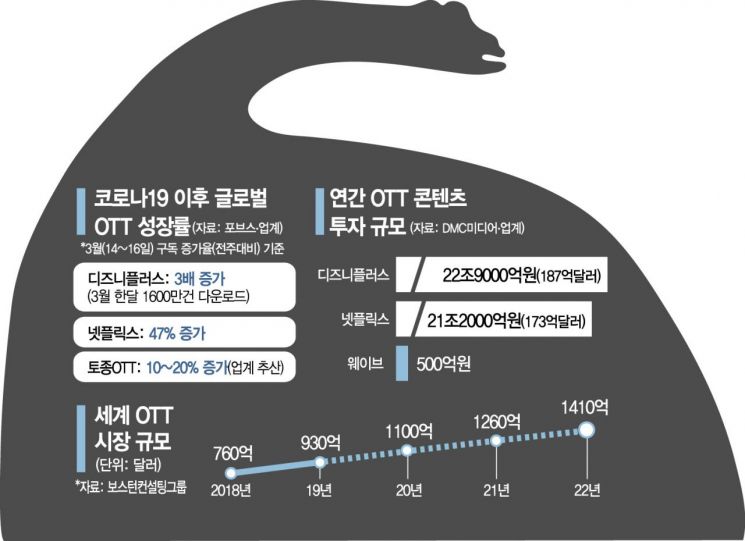

◆ Global OTTs grow up to three times = According to foreign media such as Business Insider on the 8th, the Disney Plus app recorded 16 million downloads in March alone. From the launch day on the 24th to the 31st, downloads in Europe reached 11.3 million. The number of subscribers is also surging. According to Forbes, from the 14th to the 16th of last month, the subscription growth rate for streaming services in North America increased more than threefold for Disney Plus compared to the previous week, and Netflix increased by 47%. This is thanks to reduced outdoor activities due to COVID-19.

On the other hand, native OTT companies have relatively less 'COVID-19 special' benefits. This is because Wave, Season, Tving, and others provide overlapping similar terrestrial broadcasting content. Moreover, domestic demand is mainly formed around paid broadcasting and IPTV bundled subscribers, so the spillover benefits from COVID-19 are limited. Although the industry does not disclose subscriber numbers, it estimates the growth rate of paid subscribers due to COVID-19 to be around 10-20%. An OTT company official said, "The number of subscribers increased in the first quarter, but not to the extent that it can be specifically attributed to COVID-19," adding, "There are quite a few customers who subscribe for just one month and then switch to another OTT."

◆ Mergers and acquisitions, content differentiation needed = Experts point out that as 'OTT subscription' consumption becomes a new trend due to COVID-19, native companies urgently need to change. In other words, they need to pursue price competitiveness, content alliances, and differentiation strategies. An Sang-sang, senior expert at the Democratic Party, said, "If Disney Plus and Netflix have presented portfolios centered on Anglo-American content, our companies could differentiate themselves by absorbing content from Asian regions such as the Islamic world while securing price competitiveness combined with IPTV." He added, "Expanding the content shared by native OTT fronts to create a base where consumers can enjoy content through 'small profits but quick turnover' will also be effective."

There is also a pragmatic view that growing the OTT market pie through 'alliances and mergers' is the priority. Netflix reportedly invested $15 billion (19.1677 trillion KRW) last year solely in creating original content. The industry expects it to spend $17.3 billion (21.2 trillion KRW) this year. This is incomparable to the investment scale of domestic OTT companies (50 billion KRW). A paid broadcasting industry official said, "It is realistic to expand the base of paid subscribers through overseas content and then invest in killer content based on that revenue." An OTT company official said, "It is necessary to actively partner with Disney Plus, Amazon Prime, and others preparing to enter Korea to stimulate competition among global OTTs and strengthen negotiation power for content partnerships."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)