Korean Air Initiates Rotational Leave for All Employees... All Airlines Enter Workforce Adjustment Phase

Cases of Layoff Promotion Also Call for "Bold Support"

[Asia Economy Reporter Yoo Je-hoon] As the novel coronavirus infection (COVID-19) pandemic enters a prolonged phase, the downsizing scenario in the aviation industry is becoming a reality. The short-term leave atmosphere, which started mainly with low-cost carriers (LCCs), has expanded to six-month long-term leaves and even layoffs. Industry insiders agree that without active government support, extreme cases like layoffs could spread further, emphasizing the need for swift and bold financial assistance.

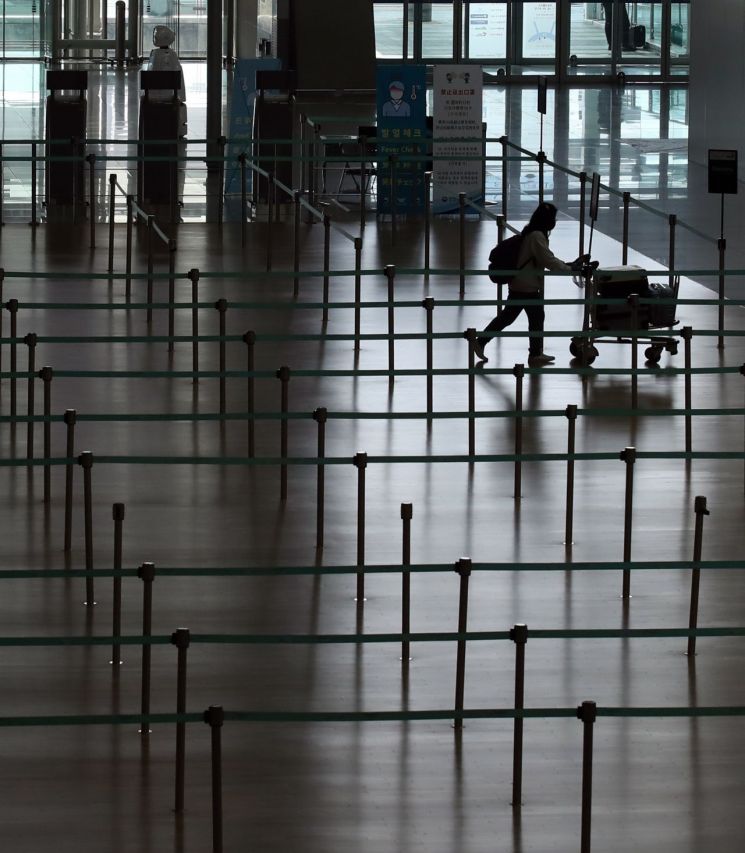

According to the aviation industry on the 8th, Korean Air has decided to implement a rotating paid leave for about 19,000 employees working domestically from the 16th of this month until October 15th, a period of six months. Even Korean Air, which had been deliberating until the last moment, has joined the leave ranks, meaning all national airlines are now participating in workforce restructuring.

◆ Rush of Restructuring in Airlines = Since last month, airlines have been actively implementing paid and unpaid leaves due to the impact of COVID-19. Asiana Airlines is currently enforcing unpaid leave of 10 days in March and 15 days in April for all employees. This means 50% of all employees have entered leave. Among low-cost carriers (LCCs), many have chosen paid leave. The leave rates by company are reported to be 95% for Air Seoul, 70% for Air Busan, 65% for T'way Air, and around 50% for Jeju Air and Jin Air.

As airlines, the backbone of the aviation industry, fall into financial difficulties, the distress of ground handling companies, in-flight meal manufacturers, and partner companies is also increasing. For example, at Korean Air's in-flight meal center at Incheon Airport, 1,000 out of 1,300 partner company workers are unable to come to work. Among ground handling partner companies, unpaid leave or voluntary retirement cases are also occurring frequently.

Recently, cases of layoffs beyond leave have also appeared. This is the case with Eastar Jet, which suspended all routes due to management crisis. Eastar Jet initially considered restructuring about 750 employees, about 40% of its workforce, but through pain-sharing between labor and management, the number of regular employee layoffs was reduced to around 350. This is significant as the first case of layoffs due to the impact of COVID-19.

◆ COVID-19 Shows No End... Job Impact Grows = The problem is that it is difficult to predict the end of the COVID-19 pandemic. Recently, COVID-19 has spread significantly mainly in the Americas and Europe, and countries are rather strengthening restrictions on air routes. According to the Ministry of Foreign Affairs, as of the afternoon of the previous day, a total of 181 countries have strengthened entry restrictions on passengers from Korea.

However, support for the aviation industry remains at a standstill. The government has previously announced measures such as reduction or deferment of airport facility usage fees (parking and landing fees), deferment of transportation rights and slot recovery, and financial support for LCCs (worth 300 billion KRW), but these are evaluated as being at the level of 'freezing feet while urinating' (meaning ineffective).

In the case of reduction or deferment of airport facility usage fees, it is not a practical help as the operation rate of all airlines remains around 10%. The scale of financial support for LCCs is also about 30 to 40 billion KRW per company, which only covers immediate operating funds. The fixed costs accumulating monthly across the industry amount to 900 billion KRW, and the debt of 5.3 trillion KRW maturing within the year is insufficient to repay or refinance. Kim Yoo-hyuk, a researcher at Hanwha Investment & Securities, pointed out in a report that "(The current financial support for LCCs) is only enough to sustain airlines for one to two more months considering their minimum operating funds."

As this situation continues, there are concerns that a downsizing storm like the previous layoffs could become a reality. The International Air Transport Association (IATA) warned that if travel restrictions by countries due to COVID-19 continue for the next three months, 25 million jobs related to the aviation industry and tourism worldwide could disappear. In particular, airlines are expected to consume $61 billion (about 74 trillion KRW) in cash in the second quarter alone due to a 70% drop in passenger demand this year.

Industry experts and insiders are concerned that without prompt financial support for airlines, a large-scale unemployment crisis in the domestic aviation industry could occur. Professor Heo Hee-young of Korea Aerospace University said, "The current situation is a temporary liquidity crisis caused by COVID-19, and performance will improve rapidly once the business conditions improve. Therefore, the government must move away from a passive attitude," adding, "A two-track strategy is needed: providing necessary bailout funds to LCCs and unlimited payment guarantees to major airlines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.