[Asia Economy Reporter Eunmo Koo] It has been diagnosed that if liquidity problems arise in the commercial paper (CP) and electronic short-term bond markets, the financial sector could suffer the greatest impact.

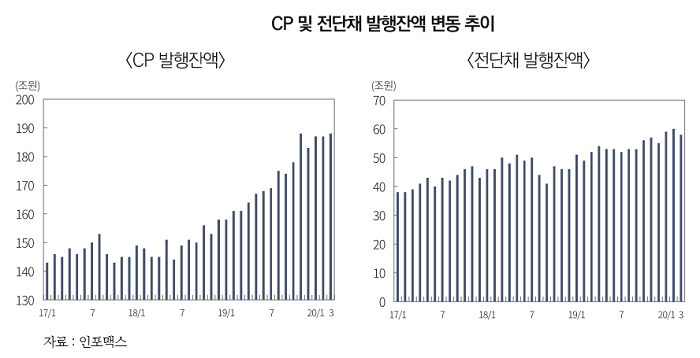

In the latest issue of 'Capital Market Focus' published by the Korea Capital Market Institute on the 7th, Hwang Se-woon, a research fellow at the institute, analyzed this in his article titled "Concerns over Liquidity Squeeze in CP and Short-Term Bond Markets Due to COVID-19." According to the article, the total outstanding CP issuance in Korea was 187 trillion won, 187 trillion won, and 188 trillion won at the end of January, February, and March this year, respectively, while the outstanding short-term bond issuance was 59 trillion won, 60 trillion won, and 58 trillion won during the same periods.

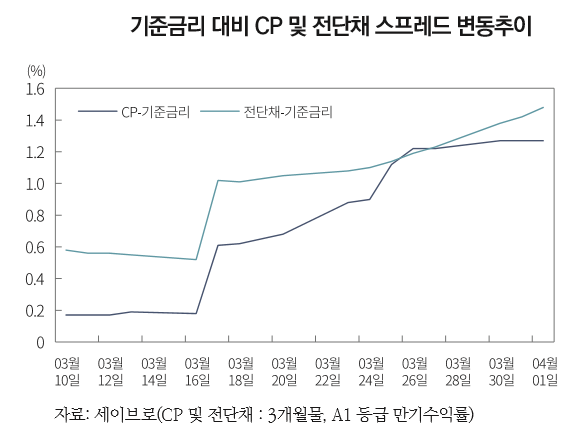

Researcher Hwang stated, "Looking at the outstanding issuance in the CP and short-term bond markets, it is difficult to conclude that liquidity contraction has intensified due to the COVID-19 crisis," but he added, "However, from the perspective of price indicators such as yields, a clear reduction in market liquidity is observed." He further explained, "As of April 1, the yields on A1-rated 3-month CP and short-term bonds were formed at 127 basis points (1bp=0.01 percentage point) and 148 basis points higher than the base interest rate, respectively, raising concerns about corporate short-term funding."

He pointed out, "What is particularly concerning is that a significant portion of CP and short-term bonds are issued by companies in the financial and insurance sectors," explaining, "63.5% of general CP outstanding, 59.3% of general short-term bond outstanding, and most of the asset-backed commercial paper (ABCP) and asset-backed (AB) short-term bond issuance are issued by financial and insurance companies." He added, "This means that if liquidity evaporates in the CP and short-term bond markets, the financial sector is the area that could be hit the hardest."

Researcher Hwang explained, "Due to their short maturities, the CP and short-term bond markets sometimes allow funding even after it becomes difficult to raise funds in the corporate bond market." He added, "Typically, defaults tend to occur first in the CP and short-term bond markets before defaults happen in the corporate bond market, and the crisis caused by defaults then rapidly spreads to the corporate bond market."

He emphasized, "Considering these characteristics, it is necessary to carefully observe changes in prices and cash flows in the CP and short-term bond markets during crisis situations. If risk factors increase rapidly, policymakers need to promptly supply liquidity to stabilize the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.