Global Stock Markets Plunge, Operating Profit Forecast Down 41%... Major IB Transition Slows Down

[Asia Economy Reporter Song Hwajeong] Due to the novel coronavirus infection (COVID-19), the global stock markets plummeted last month, leading securities firms to forecast poor performance for the first quarter of this year. In particular, it is expected that the earnings of major securities firms have significantly declined due to sluggish corporate finance (IB) and trading divisions.

According to financial information provider FnGuide, the consensus operating profit for the KOSPI securities sector in the first quarter of this year is 537.3 billion KRW, down 41.38% compared to the same period last year. This figure was revised downward by 33.34% compared to a month ago.

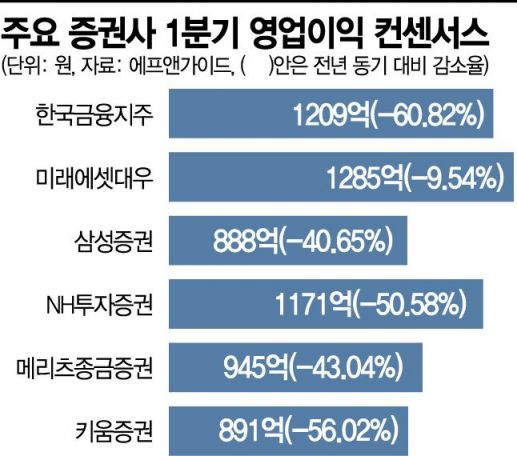

By securities firm, Korea Financial Group is expected to report an operating profit of 120.9 billion KRW in Q1, a decrease of 60.82% year-on-year. NH Investment & Securities is estimated to decline by 50.58% to 117.1 billion KRW, Meritz Securities by 43.04% to 94.5 billion KRW, and Kiwoom Securities by 56.02% to 89.1 billion KRW. Samsung Securities is expected to decrease by 40.65% to 88.8 billion KRW, while Mirae Asset Daewoo is forecasted to fall by 9.54% to 128.5 billion KRW.

The main cause of these securities firms’ poor performance is the expansion of operational losses. Jang Hyoseon, a researcher at Samsung Securities, analyzed, "In March, as major global stock markets simultaneously plunged, large operational losses occurred in the hedge positions of equity-linked securities (ELS). Especially, during the liquidity securing process for ELS margin payments and project financing (PF) securitized debt underwriting, volatility in commercial paper (CP) interest rates and exchange rates increased, raising transaction costs." Jang added, "Evaluation losses on proprietary investment (PI) equity assets exposure and trading losses on bonds due to rising interest rates were also inevitable."

A slowdown in the IB division is also unavoidable. Hi Investment & Securities forecasts that IB and other profits in Q1 will decrease by 31.1% quarter-on-quarter to 228.8 billion KRW. Kang Seunggeon, a researcher at Hi Investment & Securities, analyzed, "Normal business activities proceeded until February, but in March, due to the spread of COVID-19, most deal processes such as asset due diligence and contract signing were halted. Uncertainty over asset prices and short-term credit tightening burdens expanded, leading to a decrease in deal demand."

While IB and trading, which had driven securities firms’ earnings growth, have slowed, stock trading has become active, so the brokerage division is estimated to be relatively favorable. According to Korea Investment & Securities, the average daily trading volume in Q1 was 15 trillion KRW, surpassing the previous record of 13.9 trillion KRW in Q2 2018. Particularly, due to increased low-price buying sentiment among individuals, the number of active stock trading accounts increased by more than 820,000 in March alone, marking the second-highest record since April 2009, when 2.48 million accounts were added. Baek Doosan, a researcher at Korea Investment & Securities, said, "Brokerage commission income for securities firms likely increased by 53% compared to the previous quarter. Considering the prolonged COVID-19 situation, the possibility of a double dip or highly volatile market remains high, and customer deposits, which are stock market standby funds, increased by 52% quarter-on-quarter to 43 trillion KRW, so trading volume is likely to remain at a high level for the time being."

With a slowdown in the IB division expected for the time being, major securities firms that had been accelerating their efforts to become mega investment banks (IBs) will likely need to adjust their pace. In particular, liquidity shortages and price declines in PF and alternative investment assets are cited as concerns. As risk aversion expands, issuing and rolling over asset-backed commercial paper (ABCP) has become difficult, increasing pressure to execute purchase commitments and guarantees. Jeong Taejun, a researcher at Yuanta Securities, explained, "ABCP is issued as a funding method when structuring PF contracts, and if ABCP issuance is insufficient, securities firms have to purchase and absorb it themselves. In situations like mid-to-late March, when risk aversion increased and the CP market was paralyzed, securities firms had to exhaust their liquidity held for ABCP underwriting, increasing liquidity burdens." Price declines in alternative investment assets are also a concern. Jeong said, "Prices reflect the inability to travel and move normally, so hotels, department stores, shopping malls, and aircraft will inevitably be hit. This means delays in sale timing and even the possibility that senior-position investors among creditors may file for auctions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.