Illegal Private Loan Damage Consultations Surge from January to March

Nearly 36,000 Financial Debt Defaulters

Amid the deepening struggles of self-employed workers due to the impact of COVID-19, Seoul Hwanghak-dong Kitchen Street showed a quiet scene on the 30th of last month. / Photo by Moon Honam munonam@

Amid the deepening struggles of self-employed workers due to the impact of COVID-19, Seoul Hwanghak-dong Kitchen Street showed a quiet scene on the 30th of last month. / Photo by Moon Honam munonam@

[Asia Economy Reporters Hyojin Kim and Minyoung Kim] As the impact of the novel coronavirus infection (COVID-19) spreads, low-credit ordinary citizens are being pushed into a 'financial blind spot.'

With illegal private loans targeting ordinary citizens who find it difficult to secure funds through formal channels showing signs of resurgence, it has been revealed that nearly 36,000 self-employed individuals are in a state of financial delinquency (credit default) due to inability to repay borrowed money.

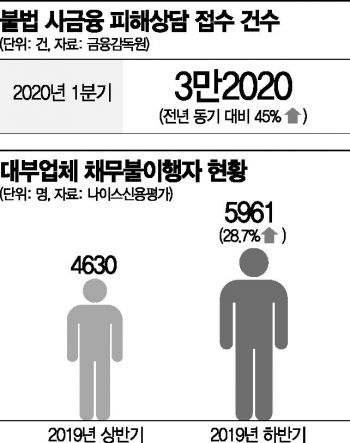

According to financial authorities and the financial sector on the 6th, the Illegal Private Loan Reporting Center operated by the Financial Supervisory Service received 32,020 consultations related to illegal private loans such as loan sharking through the end of last month this year, marking an approximately 45% increase compared to the same period last year.

There were 29,227 cases up to the 24th of last month, but about 2,800 cases increased within just one week after that. The Financial Supervisory Service has identified that illegal private loans exploiting anxieties caused by COVID-19 are particularly rampant. Since the COVID-19-induced liquidity crunch began in earnest in March, the general consensus is that this phenomenon will intensify further.

Many of those exposed to illegal private loans are considered to be small-scale self-employed individuals with credit ratings below grade 7 who have exhausted their ability to secure funds from formal financial institutions. They are even unable to access the ultra-low interest (annual 1.5%) secondary guarantee loans related to COVID-19 damage implemented by the government and commercial banks.

According to data on personal business loans (self-employed loans) submitted by NICE Credit Rating to the office of Kim Jong-seok, a member of the National Assembly’s Political Affairs Committee from the Future Korea Party, as of the end of last year, the number of self-employed individuals in financial delinquency was counted at 35,806. Among them, the vast majority, 34,009, had credit ratings below grade 7.

The number of self-employed individuals in financial delinquency increased from 33,292 in the second quarter of last year to 35,567 in the third quarter and 35,806 in the fourth quarter. This contrasts with the number of household loan delinquents, which decreased from 793,963 in the second quarter to 775,692 in the third quarter and 750,714 in the fourth quarter.

Savings banks, which handle a significant portion of microfinance in the secondary financial sector, have raised lending thresholds due to the total debt service ratio (DSR) regulations applied since the second half of last year. The loan approval rate for credit grades 6 to 7 at savings banks is already below 10%, making it difficult for low-credit ordinary citizens crushed by the unprecedented COVID-19 crisis to find support.

With the situation worsening even in the lending industry, which is the 'lowest tier' of formal finance, it is expected that the reach of illegal private loans will extend even deeper. According to the Korea Financial Services Association, 10 out of the top 29 companies in the industry have currently suspended new loan operations.

The legal maximum interest rate was lowered to 24% in February 2018, weakening business capabilities, and with the outbreak of COVID-19, many companies have effectively shut down. Meanwhile, the loan approval rate in the lending industry fell by 4.3 percentage points over two years to 11.8% last year.

A survey conducted by the Korea Microfinance Institute from October to December last year targeting about 22,179 low-credit individuals and 570 lending companies found that 70% of respondents had applied for loans from lending companies in the past three years but were rejected.

Cho Sung-mok, president of the Korea Microfinance Institute, said, "Policy financial products cannot replace market functions," adding, "Ultimately, a foundation must be established to revitalize the private microfinance market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.