[Asia Economy Reporter Lee Chun-hee] The government is taking steps to ensure housing stability throughout the life cycle through various financial supports.

On the 5th, the Ministry of Land, Infrastructure and Transport announced that it will actively expand housing support for life stages such as youth and newlyweds through the 'Housing Welfare Roadmap 2.0' announced on the 20th of last month. In particular, this roadmap includes measures to strengthen benefits and expand support targets for various financial products provided by life cycle using the Housing and Urban Fund.

For youth aged 34 and under?

Products available for unmarried youth aged 19 to 34 include ▲Jeonse loans for youth working in small and medium enterprises ▲Youth-exclusive Butimok loans ▲Youth-exclusive guaranteed monthly rent loans. These groups mainly need housing independence but often face difficulties in preparing Jeonse deposits.

The Jeonse loan for youth working in small and medium enterprises targets youth with an annual income of 35 million KRW or less (combined 50 million KRW or less for dual-income couples) working in small and medium-sized enterprises or mid-sized companies. Loans for rental deposits up to 100 million KRW at a fixed annual interest rate of 1.2% are available for houses under 85㎡ with a deposit of 200 million KRW or less. Considering that the current market interest rates for Jeonse loans are around 2.5~2.6% annually, this can save up to 1.3 to 1.4 million KRW in interest costs annually. Another major advantage is that loans can cover the entire Jeonse deposit.

Since its launch in the second half of 2018, this product has become a representative product of the Housing and Urban Fund, supporting a total of 7.27 trillion KRW for 96,504 people last year. It is evaluated to have greatly contributed to housing stability for workers in small and medium enterprises, thereby stabilizing jobs and improving working conditions.

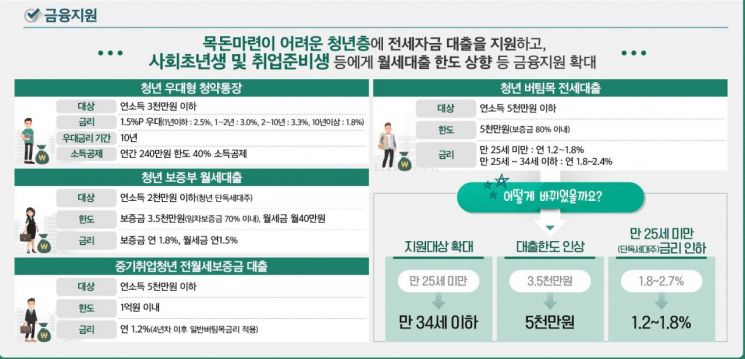

College students or young workers not employed by small and medium enterprises can apply for the youth-exclusive Butimok Jeonse loan. The Ministry of Land plans to raise the age limit of this product from 24 years or younger to 34 years starting in August. For youth under 24 years old who are single household heads with an annual income of 20 million KRW or less, such as college students, the interest rate floor will be lowered from 1.8% to 1.2%, a 0.6 percentage point reduction.

Accordingly, youth with an annual income of 50 million KRW or less can borrow up to 50 million KRW at a low interest rate of 1.8~2.4% annually when renting a house with a deposit of 70 million KRW or less. Single household heads under 24 years old can borrow up to 35 million KRW at a low interest rate of 1.2~1.8% annually when renting a house under 60㎡ with a deposit of 50 million KRW or less.

There is also a monthly rent loan product. If living in a house under 60㎡ with a deposit of 50 million KRW and monthly rent of 600,000 KRW or less, youth-exclusive guaranteed monthly rent loans are available. Both deposit and monthly rent can be loaned, and for those with an income of 20 million KRW or less, loans up to 35 million KRW for deposits (1.8% annually) and up to 400,000 KRW for monthly rent (1.5%) are possible.

A Ministry of Land official said, "In addition to these loan products, we strongly recommend immediate enrollment in the 'Youth Preferential Subscription Savings Account'." This subscription account offers an interest rate of 3.3% for youth with an income of 30 million KRW or less who have been enrolled for more than two years. It also provides additional benefits such as tax exemption on interest income up to 5 million KRW and income deduction on annual payments up to 2.4 million KRW.

For (prospective) newlyweds?

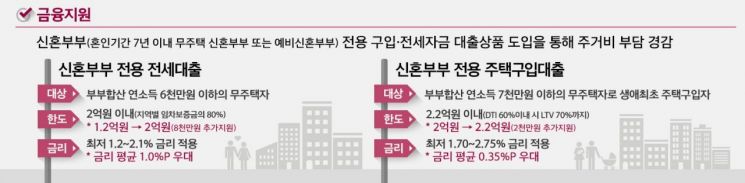

For newlyweds married less than seven years or prospective newlyweds planning to marry within three months, there are ▲newlywed-exclusive Butimok loans ▲newlywed-exclusive Didimdol loans.

The newlywed-exclusive Butimok loan is available to newlyweds with a combined annual income of 60 million KRW or less. For Jeonse deposits of 300 million KRW or less in the metropolitan area and 200 million KRW or less in other regions, loans up to 200 million KRW within 80% of the rental deposit are possible. Interest rates range from 1.2% to 2.1% annually depending on income and deposit levels. Even at the highest rate of 2.1%, it is much lower than the market Jeonse loan rates of 2.5~2.6% annually.

Newlyweds wishing to purchase a home can use the newlywed-exclusive Didimdol loan. This loan targets newlyweds with a combined annual income of 70 million KRW or less purchasing a home priced at 500 million KRW or less for the first time in their life. Loans up to 220 million KRW are available at interest rates of 1.7~2.75% annually.

The product offering the greatest benefits to newlyweds is the Shared Revenue Mortgage for Newly Hope Town. This product is for newlyweds purchasing homes supplied by the Korea Land and Housing Corporation (LH) in Newly Hope Town. Loans up to 400 million KRW at a fixed interest rate of 1.3% annually are available within 70% of the home price. If the sale price exceeds 250 million KRW, applicants must apply compulsorily for 30~70% of the sale price.

However, while the interest rate and loan limit are more favorable, it should be noted that a certain percentage of the profit generated upon disposal of the home must be shared with the fund depending on the loan period and number of children.

For households with children?

Additional benefits are provided for households with children. For households with two or more children, the loan limit for purchase funds is expanded to 260 million KRW. Jeonse loan limits are increased to 220 million KRW in the metropolitan area and 180 million KRW in other regions, and the loan period is extended by two years per child.

Preferential interest rates are also applied: 0.3 percentage points for one-child households, 0.5 percentage points for two children, and 0.7 percentage points for three or more children. Newlyweds with two children can use Jeonse loans at 1.0~1.6% and purchase loans at 1.2~2.25% interest rates.

A Ministry of Land official said, "If children are born during the loan period, preferential interest rates can be applied immediately to the existing interest rate," and advised, "Applicants should apply immediately to the entrusted banks or the Housing and Urban Guarantee Corporation (HUG)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)