[Asia Economy Reporter Changhwan Lee] Due to the spread of the novel coronavirus infection (COVID-19), it is forecasted that exports of South Korea's 15 major export items, including machinery, ships, and automobiles, will significantly decrease compared to the previous year.

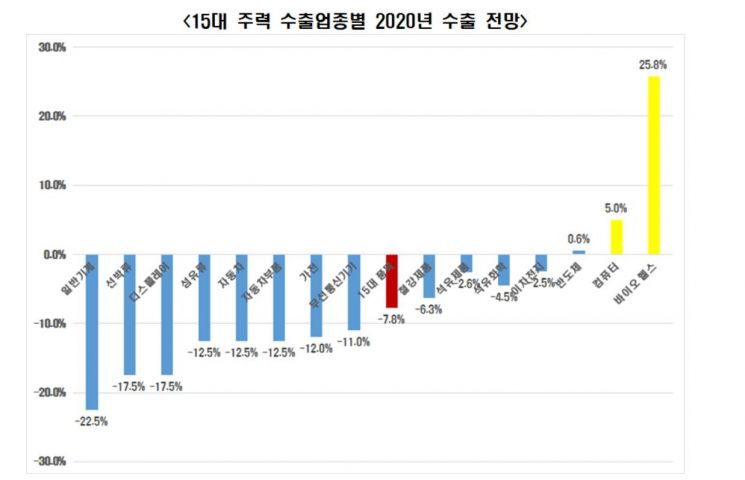

The Federation of Korean Industries (FKI) announced on the 5th that according to surveys of member companies and related industry organizations, exports of South Korea's 15 major export items are expected to decrease by 7.8% compared to the previous year. This result is explained as being more than 10 percentage points lower than the forecasts made by the Korea International Trade Association and the Korea Economic Research Institute in November last year and February this year, respectively, before COVID-19 became widespread.

By industry, it is expected that exports in general machinery (-22.5%), display (-17.5%), shipbuilding (-17.5%), automobile (-12.5%), and textiles (-12.5%) will suffer the greatest damage due to COVID-19. Exports of home appliances (-12.0%) and wireless communication devices (-11.0%) are also expected to decline.

On the other hand, semiconductors (0.6%) and computers (5.0%) are expected to see some export growth due to increased IT demand from the rise in non-face-to-face contact. In particular, biohealth (25.8%) is expected to experience a sharp increase in exports compared to the previous year due to increased demand for medical and health-related products amid the spread of COVID-19.

The FKI announced that it will urgently propose 10 major policy tasks to the government on the 6th to overcome the export decline crisis.

First, it argued that entry bans and restrictions on Korean businesspeople by major countries should be promptly lifted. Since individual companies are currently chartering planes to dispatch engineers to operate production bases in China and Vietnam, it is claimed that exception measures allowing entry through government-level issuance of health certificates should be completed within this month.

It also explained that aggressive multilateral and bilateral Free Trade Agreements (FTAs) should be pursued. Since the Korea-China FTA came into effect in December 2015, exports utilizing FTAs have stagnated. The utilization rate of FTAs by Korean companies for China and ASEAN is only about 50-70%. In contrast, competitor Japan has surpassed Korea in FTA utilization rates as of 2019 through aggressive FTAs, including leading the launch of the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership).

It was pointed out that the number of countries with which currency swap agreements are concluded should also be increased. Korea has extinguished urgent fires by concluding a 6-month, $60 billion currency swap with the United States, but to respond to the surge in dollar demand due to COVID-19, it emphasized the need to conclude currency swaps with key currency countries and expand currency swaps to the level of Japan in the long term.

Other major policy tasks presented include expanding the scope of items subject to tariff quotas, extending visas for foreign workers residing in Korea, easing entry and exit restrictions on Japanese service engineers, and leading the freezing (Stand Still) of protectionist measures through multilateral cooperation systems.

Kim Bongman, head of the FKI International Cooperation Office, said, "Since March, COVID-19 has severely impacted the financial and real economies of China, the United States, and the Eurozone, which are Korea's largest export regions," adding, "I hope the government will actively resolve corporate difficulties and issues in trade and commerce by leveraging Korea's elevated national status through COVID-19 diagnosis, quarantine, and response processes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.