Global Economic Growth Expected to Remain in 0% Range This Year

Moody's Economist: "Curve Likely to Show Sharp Decline Followed by Gradual Recovery"

Professor Stiglitz: "Improvement Difficult Even After This Summer"

S&P Downgrades Growth Forecast from 1.5% to 0.4%

[Asia Economy New York=Correspondent Baek Jong-min] There are consecutive forecasts that the global economy will grow at a rate in the 0% range due to the novel coronavirus disease (COVID-19). Concerns have also been raised that the U.S. economy, after experiencing the COVID-19 crisis, will show a gradual recovery resembling the "Nike" logo rather than a clear V-shaped or U-shaped rebound.

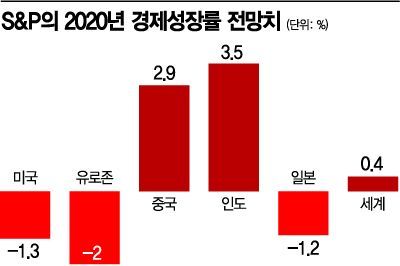

International credit rating agency Standard & Poor's (S&P) significantly downgraded its global economic growth forecast for this year from the previous 1.0?1.5% to 0.4% in a special COVID-19 report released on March 31 (local time). Earlier, U.S. investment bank JP Morgan had announced a growth forecast in the 0% range, but among the three major credit rating agencies, S&P is the first to project growth in the 0% range.

CNBC referenced 1982, right after the second oil shock, reporting on S&P's forecast as "a number never seen since then." At that time, the global economic growth rate was 0.43%, marking the worst since the Great Depression of the 1930s. S&P's forecast implies that the current situation is worse than back then.

S&P issued a strong warning to advanced countries such as the U.S. and Europe, where COVID-19 control is deemed impossible. S&P estimated that the U.S. and Europe will contract by 1.3% and 2%, respectively, this year. For the U.S., the second quarter is projected to shrink by 12%.

Paul Gruenwald, S&P's Chief Economist, explained the reason for the sharp downgrade in growth forecasts, saying, "The COVID-19 pandemic is delivering an unprecedented shock to economic activity and financial markets." He expressed concern that "the U.S. unemployment rate will reach 10% in the second quarter and peak at 13% in May," warning of a crisis unlike anything experienced even during the 2008 global financial crisis.

On the same day, investment bank Goldman Sachs also forecast that the U.S. Gross Domestic Product (GDP) will decline by 9% in the first quarter and 34% in the second quarter. The 34% contraction is considered the lowest growth rate since World War II.

As global economic forecasts are consecutively downgraded to the 0% range, expectations for a rebound are also diminishing. Mark Zandi, Chief Economist at Moody's, said in an interview with Bloomberg News that "the U.S. economy will grow about 15% in the third quarter after a sharp decline in the second quarter, but will then follow a Nike-shaped growth pattern." This means growth will continue at a slower pace rather than a sharp U-shaped or V-shaped recovery. This is completely different from U.S. President Donald Trump's expectation of a rapid rebound after a record plunge. Zandi also added, "The U.S. economy is likely to remain in a prolonged recession starting from the fourth quarter." This points out that the sharp growth in the third quarter is a temporary surge in demand that was halted by COVID-19 and cannot be sustained long-term.

Joseph Stiglitz, Nobel laureate and Columbia University professor, also said, "It cannot be assumed that COVID-19 will disappear within the second quarter," adding, "The COVID-19 situation will continue beyond summer, making economic recovery difficult." He expressed concern that the real economy crisis could spread to a financial crisis amid rapidly rising corporate and household debt in the U.S.

The situation is no different for emerging markets, which need to compensate for the sluggishness of advanced markets. China, which was the first to be affected by COVID-19, is expected to grow by only 3%, half of the government's 6% growth target. This would be the lowest growth rate for China in 30 years. India, which recently announced nationwide movement restrictions, is expected to experience a -3.5% contraction.

In revising its growth forecast, S&P projected that the COVID-19 pandemic will continue until mid-year. If the pandemic does not subside by then, it is possible that the economic impact could be even more severe.

Economist Gruenwald said, "It is not easy to reflect the health crisis in economic variables," leaving room for further downward revisions depending on future developments.

▶What is a 'Nike-shaped rebound'?

The Nike-shaped curve is a term that emerged after the 2008 global financial crisis. At that time, as the economy sharply declined, there was debate over whether the recovery would be V-shaped or U-shaped. Since neither a rapid V-shaped recovery nor a slower but clear U-shaped growth was expected, attention was drawn to a trend line that gradually rises at the tail end. This curve was named because it resembles the logo of the sportswear company Nike.

New York=Correspondent Baek Jong-min cinqange@asiae.co.kr

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.