[Asia Economy Reporter Jo Gang-wook] Financial public institutions will supply 427.5 billion KRW to social economy enterprises this year. In particular, to help social economy enterprises cope with the difficult business conditions caused by the novel coronavirus disease (COVID-19) pandemic, they plan to execute 60% of the scheduled funds within the first half of the year.

The Financial Services Commission announced this plan on the 31st during the first Social Finance Council meeting of the year. The meeting was held in writing with the participation of 17 organizations, including the Ministry of Economy and Finance, the Ministry of SMEs and Startups, the Financial Supervisory Service, and the Korea Inclusive Finance Agency.

Social finance refers to financial activities that support social economy enterprises such as social enterprises, cooperatives, self-sufficiency enterprises, and village enterprises through investments, loans, and guarantees based on recovery, rather than subsidies or donations.

At the meeting, the current status of social finance execution for social economy enterprises struggling due to the COVID-19 pandemic was reviewed, and it was examined whether COVID-19 response policy funds are being provided to these enterprises without discrimination.

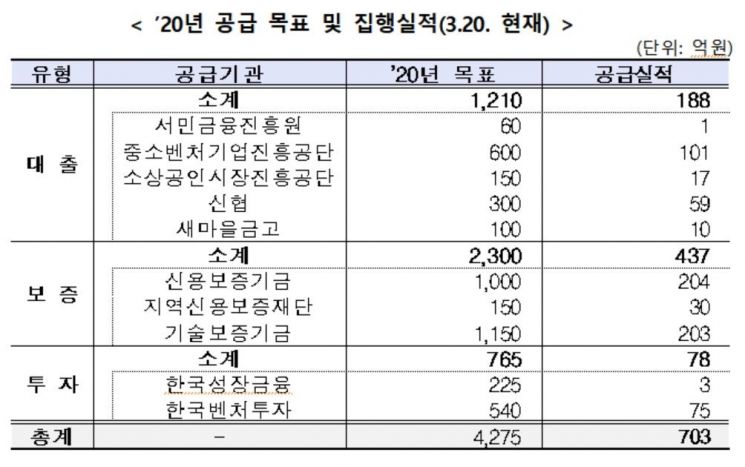

The funding supply target for social economy enterprises this year is 472.5 billion KRW, a 32.4% increase from last year’s 323 billion KRW. By type, loans amount to 121 billion KRW, guarantees 230 billion KRW, and investments 76.5 billion KRW.

The outstanding loan balance to social economy enterprises by banks last year was 849.8 billion KRW, a 58.1% increase from 537.4 billion KRW at the end of 2018. Most of the loans were to social enterprises at 629.5 billion KRW (74.1%), followed by cooperatives at 202 billion KRW (23.8%), village enterprises at 14.5 billion KRW (1.7%), and self-sufficiency enterprises at 3.8 billion KRW (0.4%).

By bank, KEB Hana Bank (246 billion KRW, 28.9%), Shinhan Bank (163.1 billion KRW, 19.2%), and NongHyup Bank (140.9 billion KRW, 16.6%) accounted for more than half of the total performance (550 billion KRW, 64.7%). Regional banks ranked Daegu (26.8 billion KRW, 3.2%), Gyeongnam (11.7 billion KRW, 1.4%), and Busan (10.8 billion KRW, 1.3%) in order.

Outside of loans, donations and sponsorships accounted for most of the support at 14.5 billion KRW (74.5%), followed by product purchases at 4.4 billion KRW (22.4%) and equity investments at 0.5 billion KRW (2.3%).

From the beginning of this year until the 20th of this month, 70.3 billion KRW (loans 18.8 billion KRW, guarantees 43.7 billion KRW, investments 7.8 billion KRW), which is 16.4% of the total target, has been supplied. The Financial Services Commission explained that the execution rate is usually lower in the first quarter due to corporate settlements and investor general meetings compared to other quarters.

The Financial Services Commission plans to execute funds as early as possible so that social economy enterprises can cope with the impact of COVID-19.

A Financial Services Commission official said, "We will continue to actively promote fund supply and infrastructure establishment through the operation of the Social Finance Council," adding, "In particular, we will continuously cooperate with social finance-related institutions to ensure that social finance policy funds are smoothly supplied to social economy enterprises facing difficulties due to COVID-19 and other factors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)