Dallas Fed Business Activity Index -70

Manufacturing Production Index Also 'Negative'

Manufacturing Production Expected to Decline by 5.3%

Corporate Hiring Index Hits Lowest in 3 Years

[Asia Economy New York=Correspondent Baek Jong-min, Beijing=Correspondent Park Sun-mi, Reporter Kwon Jae-hee] Due to the spread of the novel coronavirus infection (COVID-19), industrial indicators of the world's first and third largest economies, the United States and Japan, showed weakness. In contrast, China, where COVID-19 has come under control, showed a clear recovery trend driven by efforts to normalize the economy such as factory restarts. However, since the recovery of the global supply chain remains uncertain, it is difficult to predict how long it will take for a full normalization.

On the 30th (local time), the Dallas Federal Reserve Bank announced that its Business Activity Index plummeted from 1.2 in February to -70 in March. The Business Activity Index is an indicator that gauges expansion or contraction based on zero (0). The -70 is the lowest since data collection began in 2004. Considering the market expectation was -6.0, this index result was completely unexpected. Along with this, the Manufacturing Production Index, March New Orders Index, Capacity Utilization Rate, and Shipments Index all turned negative, indicating that the economic recession is progressing.

This survey was conducted from the 17th to the 25th targeting over 110 companies located in Texas. The Texas region, including Dallas, boasts the second-largest economic power in the United States after California. Its share of the U.S. Gross Domestic Product (GDP) also reaches 10%. Considering that Texas had a relatively low spread of COVID-19 and did not impose stay-at-home orders compared to other states, it can be inferred that the economic damage in states like New York is even more severe.

The St. Louis Fed predicted that 47 million jobs in the U.S. would disappear and the unemployment rate would soar to 32.1%, analyzing this as "a shock of a different magnitude than anything the U.S. economy has experienced in the past 100 years."

Japan, where COVID-19 cases have been increasing following the decision to postpone the Tokyo Summer Olympics, also faces dark clouds over its manufacturing outlook. On the 31st, Japan's Ministry of Economy, Trade and Industry announced that industrial production in February rose 0.4% month-on-month, and the Industrial Production Index stood at 100.2, marking a third consecutive month of increase. However, the manufacturing production forecast survey predicted a 5.3% decline in March. The Ministry stated, "Difficult conditions are expected due to production decreases caused by the spread of COVID-19." Since the forecast survey was based on data as of the 10th, and considering the rapid increase in confirmed cases starting on the 24th, the manufacturing impact in March could be worse than the forecasted figures.

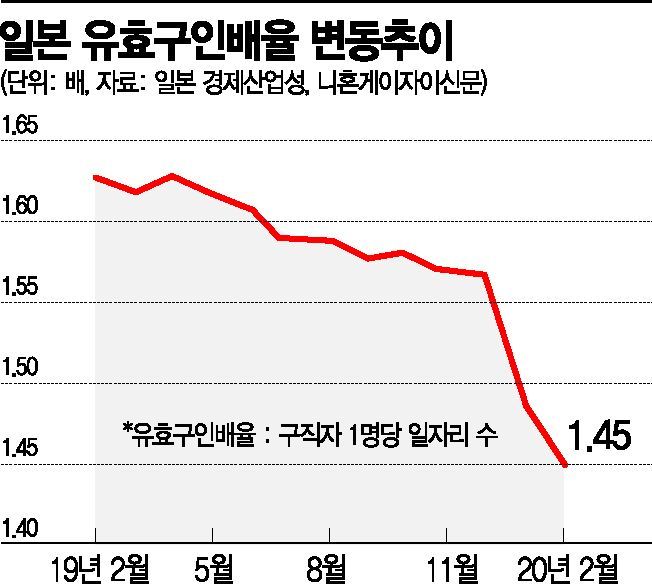

Along with the worsening leading economic indicators, employment indicators are also unfavorable. On the same day, Japan's Ministry of Health, Labour and Welfare announced that the effective job openings-to-applicants ratio for February was 1.45, down 0.04 from the previous month, marking the lowest level in 2 years and 11 months. The effective job openings-to-applicants ratio indicates the number of job openings per job seeker, and this decline suggests that companies' willingness to hire has sharply decreased due to the spread of COVID-19. The number of effective job seekers increased by 0.3% to 1.68 million, but effective job openings decreased by 2.2% to 2.56 million.

On the other hand, China showed a 'surprise' recovery as the spread of COVID-19 slowed. China's National Bureau of Statistics announced that the Manufacturing Purchasing Managers' Index (PMI) for March recorded 52.0. This greatly exceeded experts' forecast of 44.8 and rose 16.3 points from last month's historic low of 35.7. The Non-Manufacturing PMI for March also recorded 52.3, sharply rising 22.7 points from last month's all-time low of 29.6. The PMI has a baseline of 50, with values above indicating economic expansion and below indicating contraction. The Production Index, which reflects production trends, rose 26.3 points month-on-month to 54.1. The New Orders Index also recorded 52, up 22.7 points, revealing the recovery status of the manufacturing market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.