April BSI Forecast Hits Lowest in 135 Months... Decline Faster Than During Global Financial Crisis

"Companies at Survival Crossroads Due to Earnings Deterioration and Credit Squeeze... Need for Liquidity Supply and Active Support Measures"

[Asia Economy Reporter Ki-min Lee] Following the COVID-19 pandemic and ongoing production disruptions, corporate sentiment has contracted to levels comparable to those during the global financial crisis.

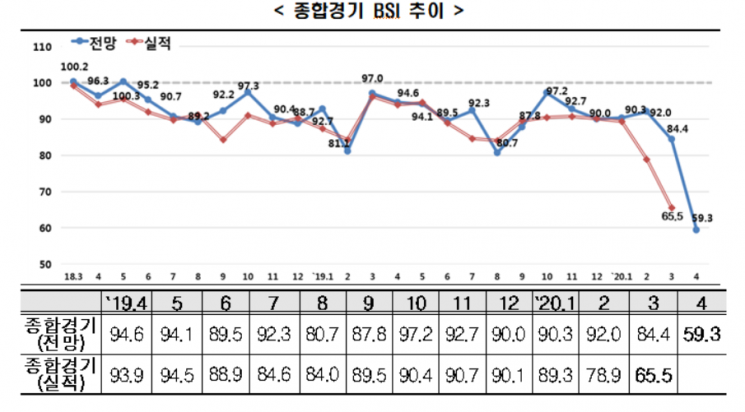

According to a survey conducted by the Korea Economic Research Institute under the Federation of Korean Industries targeting the top 600 companies by sales, the Business Survey Index (BSI) outlook for April this year was recorded at 59.3, announced on the 30th. This is the lowest point in 135 months since January 2009, when the BSI was 52.0 during the global financial crisis.

The BSI is an index derived from surveying business owners about future economic trends, directly reflecting the perceived business climate. A value above 100 indicates that more companies expect economic improvement.

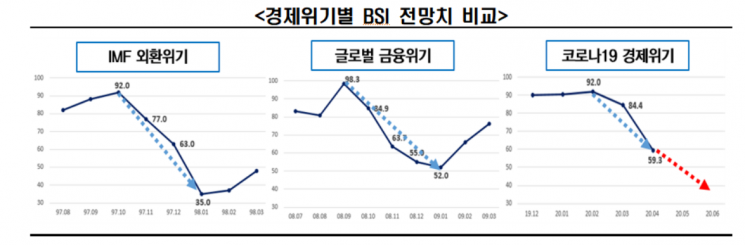

According to the survey results, the April BSI outlook dropped by 25.1 points from the previous month’s outlook (84.4), marking the largest decline since the 1997 Asian financial crisis. The BSI outlook was 63 in December 1997 when the International Monetary Fund (IMF) bailout negotiations were underway, but it fell 28 points to 35 in January 1998. During the global financial crisis from September 2008 to January 2009, the BSI dropped 46.3 points over five months, whereas in the current economic crisis, it fell 32.7 points in just two months, indicating a faster rate of decline.

By sector, all areas except inventory recorded below the baseline: domestic demand (64.3), exports (69.3), investment (74.8), financing (77.0), inventory (95.5), employment (79.0), and profitability (68.8). By industry, the lowest outlooks were in the following order: automobile (44.2), publishing and recorded media (46.2), travel and entertainment services (50.0), apparel and footwear manufacturing (50.0), wholesale and retail trade (52.2), and land and air transportation (52.4).

The actual BSI for March also hit a 133-month low at 65.5. All sectors recorded below baseline levels: domestic demand (71.5), exports (76.5), investment (77.3), financing (81.0), inventory (96.5), employment (81.3), and profitability (76.0).

The Korea Economic Research Institute stated that the contraction in consumption due to movement restrictions combined with supply shocks from global production disruptions has led to corporate sentiment being more severe than during the global financial crisis. They pointed out that since this economic crisis stems from a non-economic cause?the pandemic?its end point is uncertain, making it difficult to predict how much further sentiment will decline.

Choo Kwang-ho, Director of Economic Policy at the Korea Economic Research Institute, said, “Companies are facing an unprecedented economic crisis caused by the COVID-19 pandemic, suffering from deteriorating performance and credit crunch due to tightening financial markets, standing at a crossroads for survival.” He added, “It is urgent to prepare sufficient liquidity supply and actively support affected industries to prepare for the worst-case scenario.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)