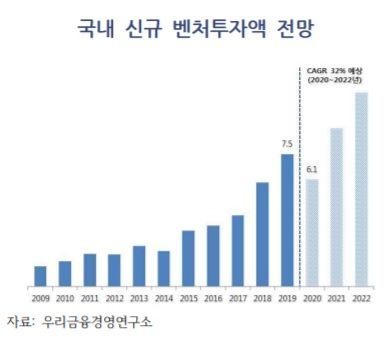

New Venture Investment Expected Around 6 Trillion Won This Year

Annual Average Growth of 32% Projected for the Next 3 Years from 2020 to 2022

[Asia Economy Reporter Kwon Haeyoung] Due to the impact of the novel coronavirus infection (COVID-19), it is forecasted that the scale of new domestic venture investments this year will decrease by 20% compared to last year.

According to Woori Financial Management Research Institute on the 29th, the scale of new venture investments in 2020 is expected to be around 6 trillion won. This is a 19% decrease from last year (7.5 trillion won), similar to the 22.4% decline during the 2008 financial crisis.

Woori Financial Management Research Institute predicted that due to the COVID-19 impact, contributions from private liquidity providers (LPs) will decrease, and general partners (GPs) will postpone investments to secure liquidity.

However, even if venture investments temporarily shrink this year, new venture investments over the next three years from 2020 to 2022 are expected to increase by an average of 32% annually, surpassing the 29.7% level from 2017 to 2019. Last year, the ratio of new domestic venture investments to gross domestic product (GDP) was 0.6%, lower than China (1.8%) but comparable to the United States (0.6%).

Woori Financial Management Research Institute stated, "With low returns on safe assets such as government bonds and deposits, pension funds and high-net-worth investors will steadily increase the proportion of alternative investments, including venture investments, in their mid- to long-term portfolios," and added, "The government also plans to actively support the spread of innovative finance."

The Financial Services Commission plans to ease soundness regulations to activate venture loans by securities firms, so that venture loans within 50% of their own capital will not be deducted from operating net capital when calculating the net capital ratio (NCR). It will also promote easing investment regulations on innovative startup companies by banks and insurance companies.

Woori Financial Management Research Institute analyzed, "Due to the impact of the COVID-19 situation, venture investments in 2020 will temporarily decrease," but "there is abundant potential investment demand for the 4th

industry, where many startups are concentrated, and with government support for innovative finance, the mid- to long-term outlook after 2021 is very positive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)